Fidelity Digital Assets’ latest report on Ethereum outlines three different development trajectories for the largest smart contract platform in the market.

It also places Ethereum’s decentralization approach as a midway between Bitcoin’s extreme security and Solana’s speed-centric model.

Three scenarios for Ethereum from Fidelity

In Bull’s scenario, smart contract platforms can reshape the way people work together to build trust, positioning Ethereum as a global coordination infrastructure for its transparency, censorship resistance and security. User costs remain low thanks to dense transaction activity in Layer 2.

In the basic scenario, smart contracts strengthen specific financial and non-financial sectors and act as “check and balance protocols” within traditional systems controlled by governments and large corporations.

Ethereum continues to grow amidst increasing financial constraints and competition, but remains the lead as the dominant platform. Its market share is integrated in sectors that require high security and trust.

In the bear scenario, smart contract platforms are categorized into speculative cycles and struggle to create products that meet mainstream needs. Slowing user growth can weaken the cash flow accumulation of ETH owners and erode market share by competitors who provide cheaper and faster experiences.

Modular scaling and its impact on value: Ethereum vs. Solana

Fidelity highlights that demand for ETH (gas fees, security, staking) is likely to increase as application demand increases. However, Ethereum’s modular scaling strategy (offloading processing to Layer-2 and using “blobs” for data) sacrifices some value capture at Layer-1.

“The ether requirements for using networks are at the heart of its investment paper. In theory, if the demand for using applications on Ethereum networks increases over time, there is a need for tokens, ether,” the report states.

Recent post-upgrade data shows that Layer 2 fees account for only about 1% of the total cost, reflecting the increasingly “staying” of its economic value in the roll-up. At the same time, Ethereum maintains its role as an intentionally open, secure, distributed data layer. This benefits users at a lower fee, but raises concerns for investors about whether layer-2 growth can compensate for the decline in layer-1 value capture.

This value trade-off leads to a significant comparison with Solana, taking a fundamentally different approach. Ethereum prioritizes decentralization and security, while Solana optimizes raw performance (TPS/cost) at Layer-1.

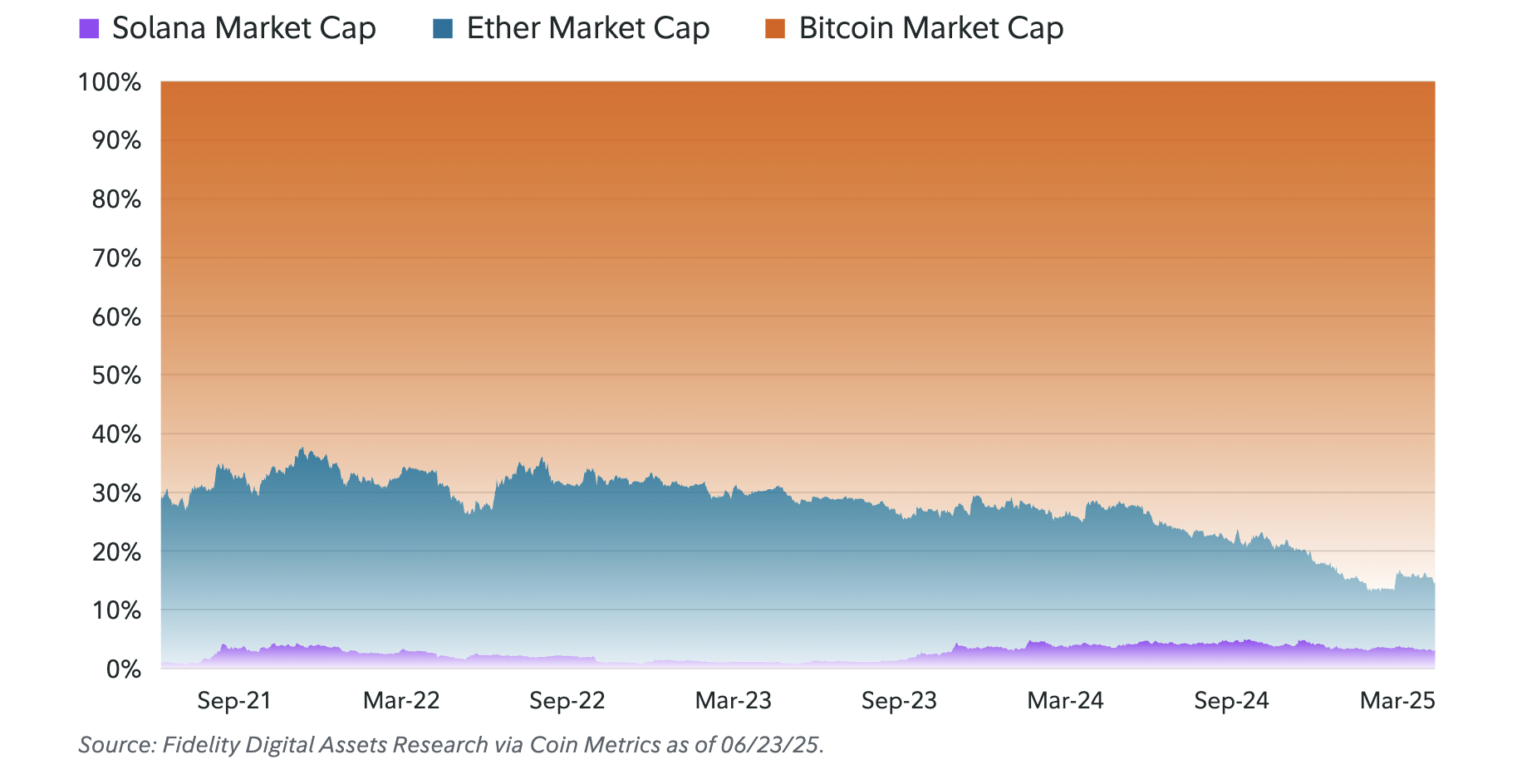

Market capitalizations of Bitcoin, Ethereum and Solana. Source: Fidelity

The cost of this approach is that Ethereum “zeds” the value generation (net fee) that is present in the roll-up layer. Meanwhile, Solana’s raw performance can be translated directly into the value of Sol Holders. This poses a real competitive risk in the short term, as it captures market share with cheaper and faster experiences, even at the expense of decentralization.

In the long run, the key issue is what aspects of the “blockchain tri-rema” the market values most: decentralization, security, or scalability.

Post-Fidelity highlights Ethereum’s unique position between Bitcoin and Solana.