The recent Crypto Market Dip has not stopped Ethereum bulls. They still bet that ETH will be high.

Myriad Forecast Market Trader, Its Market Developed by DecryptionParent company Dastan is confident that Ethereum hits the $5,000 price mark faster and faster, and is hitting a new all-time high in the process.

Ethereum is currently close to $4,500 after a wild ups and down weekend, but Myriad traders will get odds of around 80% in one market and nearly 73% in another over the next four months.

Certainly, these odds have declined slightly over the past few days, peaking at around 90% to 95% when Ethereum mooned to $5,000 in shy $4,950. However, the fact that they did not drop below 70%, even if ETH was heading in the opposite direction, speaks to the bull’s overall sentiment and beliefs at this time.

And the charts tend to agree.

Ethereum (ETH) Price: Where will you go next?

Overall, today’s Crypto Markets is bouncing back after a turbulent weekend. Single Bitcoin Zilla unloaded $2.7 billion worth of BTC on Sunday, and began liquidating the Cascade as its long positions forced shut down and BTC prices plummeted.

Naturally, when market leaders go down, other crypto assets follow. Ethereum is no exception, falling 10% after temporarily hitting an all-time high of over $4,900.

But today, ETH is on the green and the technical setup is one set up that traders interpret as primarily positive. It suggests that the long-term overall bullish trend remains strong despite short-term panic attacks, as ETH is likely to finish the day on the green.

Ethereum price data. Image: TradingView

Among the technical indicators, the average directional index (ADX) for Ethereum is at 39. This shows that the Bulls are still in charge. ADX measures trend intensity on a scale from 0 to 100. Measurements above 25 confirm a strong trend, and above 40 indicate very strong momentum. At 39, yesterday’s dip cooling has dropped from above 41 points just a few days ago.

ETH’s relative strength index (RSI) is currently 58 years old. This would say that traders are sweet spots for ongoing profits. RSI measures momentum on a scale of 0-100, with measurements frequently appearing above 70 and above the excess profitable conditions, indicating overselling levels below 30.

The 58-year-old ETH successfully recovered from its unsold condition without entering dangerous, over-acquired territory. That is, before triggering an algorithm sale from a trader using RSI as an exit signal, there is fuel in the tank for further rise.

And when examining average price support and resistance, Ethereum’s exponential moving average configuration remains decisively bullish. With 50-day EMA well above the 200-day EMA, there is a strong bullish trend in the long run after last month’s golden cross formation. This setup usually shows sustained purchasing pressure across multiple time frames, suggesting that both short-term momentum traders and long-term position holders are bullishly aligned.

The squeeze momentum indicator shows the “on” status. This is especially important after the sale yesterday. This metric identifies when the market moves from integration to trend phase. Fired “on” indicates a breakout from integration is in progress. In combination with today’s recovery candle, this suggests caution. Even in solid bullish trends, short-term traders can still be redirected.

Important levels to see

- Immediate resistance: $4,800 (pre-crash level yesterday)

- Strong resistance: $5,000-$5,200 zones (ATH and Fibonacci Extension Targe)

- Immediate support: $4,000 zone (psychological targets slightly below the previous price bounce and slightly below the EMA 50)

- Strong support: $3,500 level held through recent bull runs.

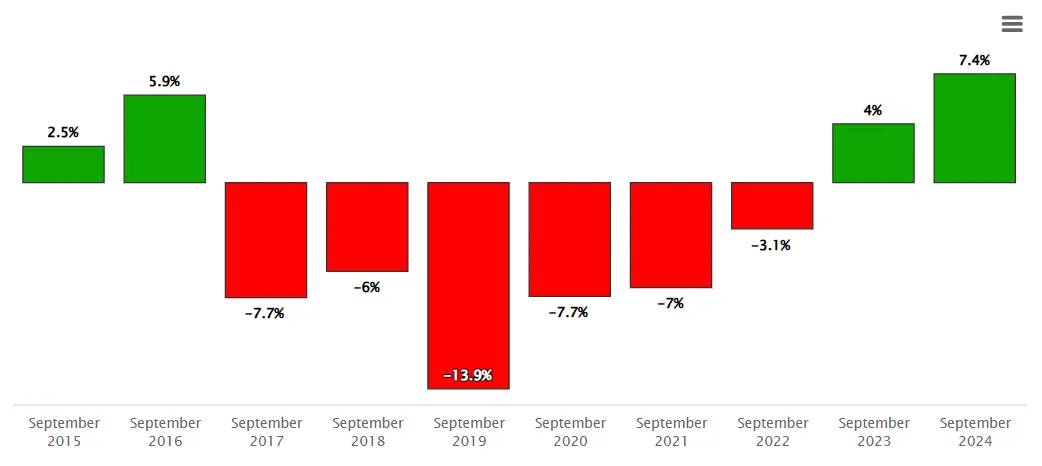

Remember: Red September

But the Bulls may have strong opponents that get closer to the ring: history.

Trading data from 2015 to 2024 usually shows that Bitcoin is insufficient in September, with an average monthly return of -4.89%. During “Red September” we should not confuse it with Uptober (comes right after!) – Bitcoin prices fell on average 4.5%, making it the worst month for Bitcoin holders.

Image: State Museum

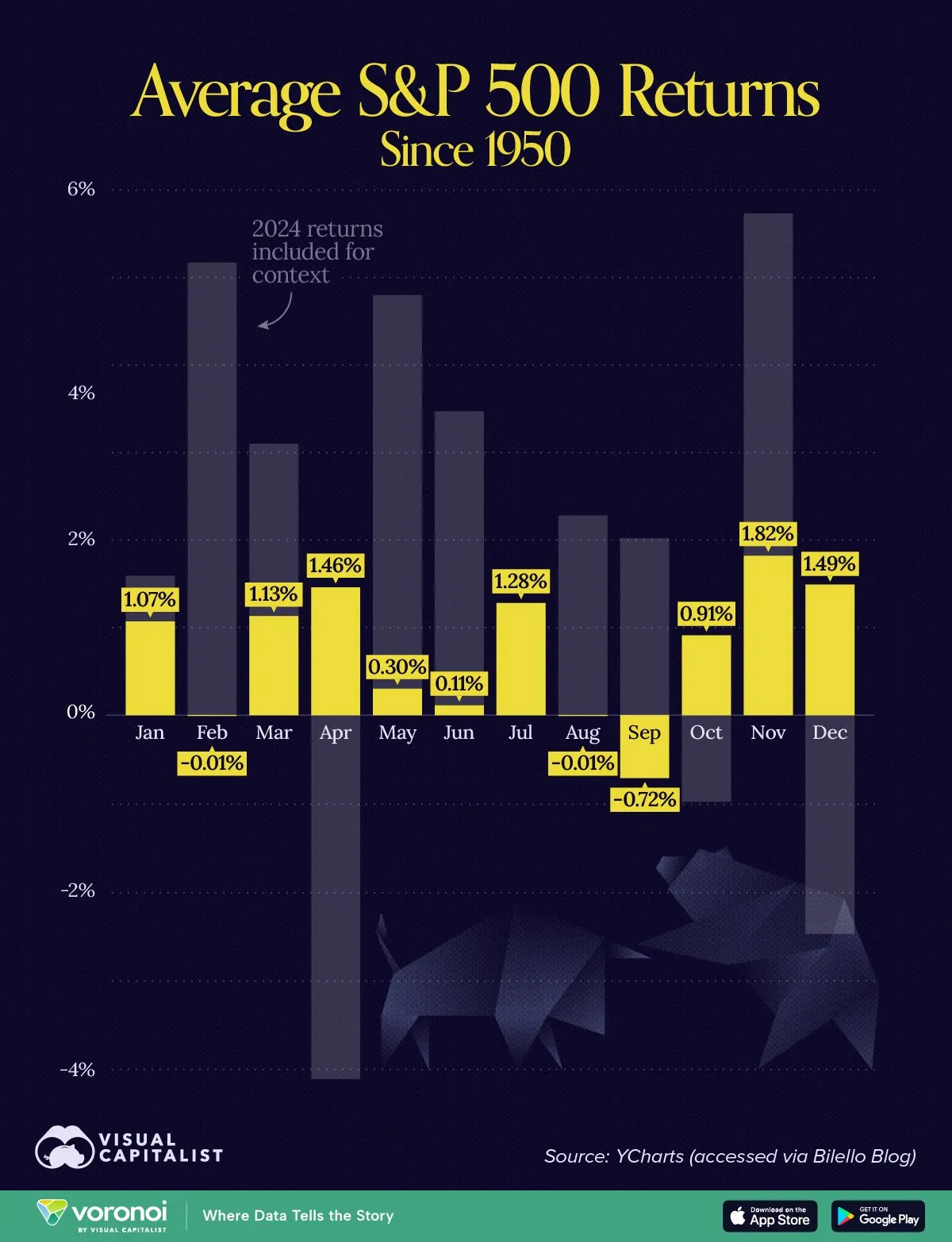

However, this is not cryptography-specific either. Over the past 75 years, the stock market has also experienced a pattern in which September tends to be on average the worst month.

Image: Visual Capitalist

This historic headwind creates some tension. If support between $4,300 and $4,500 is traditionally held throughout Crypto’s worst month, the technical setup suggests that ETH can actually reach the $5,000 target. During “Uptober,” the Crypto market recorded an average profit of 60% and 22%.

If ETH respects the support that sparked the current trend, natural movements will receive it to $5K by October.

At this point, technical data supports a bullish view among countless traders. The odds of 73% in the “month or dip” market ask traders to predict whether ETH will be $5k in 5k per month or immerse in 3.5k. a bit It’s getting higher based on available data, but it’s still lined up.

It’s hard to imagine this not happening in the “ETH in 5K in 2025” market. October has historically brought fireworks, and the current technical setup at the RSI of 58 leaves plenty of space upside down. Even if September becomes rough and ETH repeats 14% DIP in 2019, the drawdown will only test 50 days of EMA support, and ETH will be at the October rally.

Disclaimer

The views and opinions expressed by the authors are for informational purposes only and do not constitute financial, investment, or other advice.