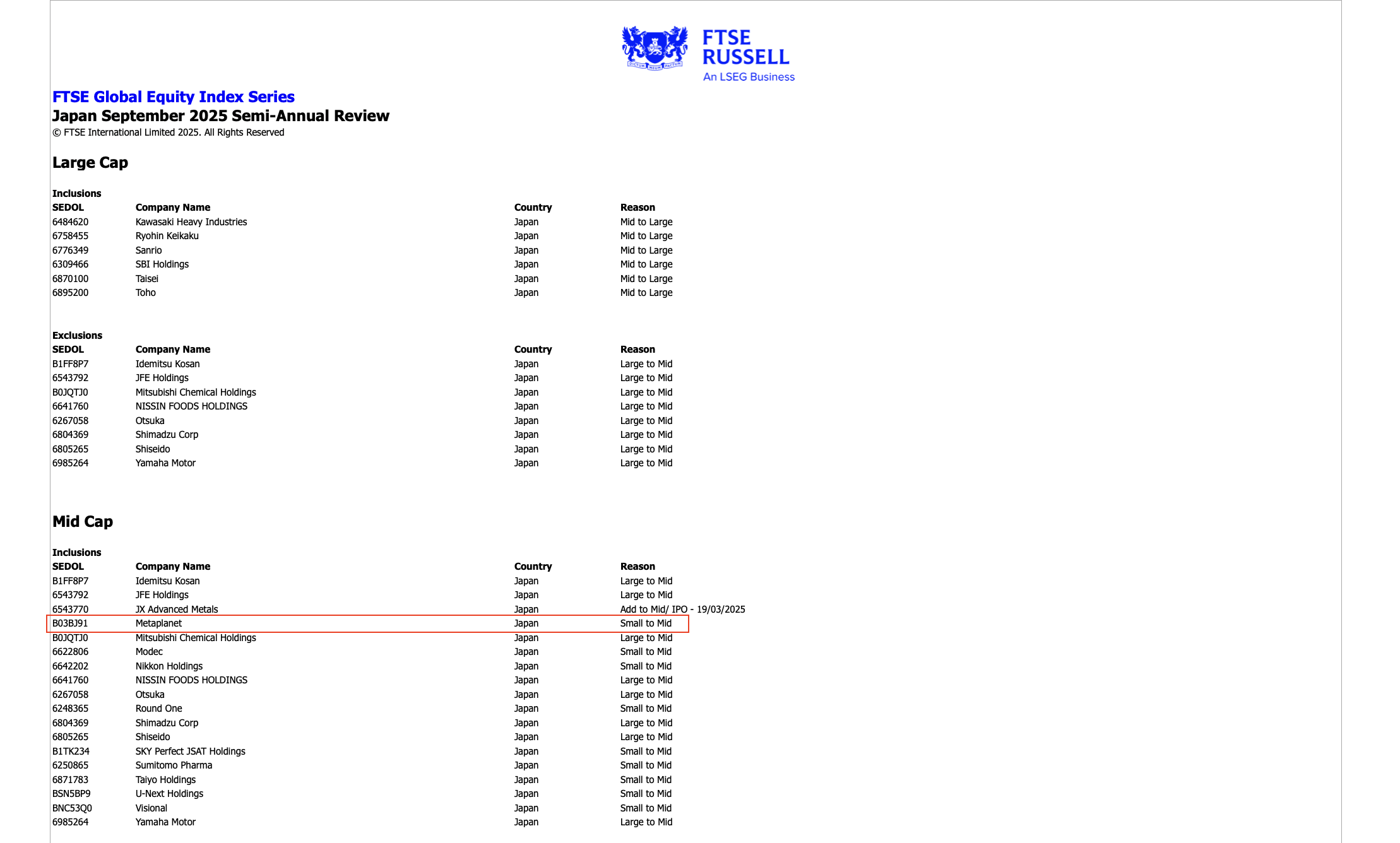

Bitcoin (BTC) finance company Metaplanet has been upgraded from small-caps to intermediate stocks in a semiannual review in September 2025 by index provider FTSE Russell, and increased it to include it in the flagship FTSE Japan Index.

Index providers updated and rebalanced their indexes quarterly, and following Metaplanet’s strong Q2 performance, they were added to the FTSE Japan Index, the stock market index for intermediate and large companies listed on Japanese exchanges.

The inclusion of Metaplanet in the FTSE Japan Index means that market capitalization in each geographical region will automatically be added to the FTSE global index of the largest public companies.

The FTSE Global Equity Index series semi-annual review upgraded Metaplanet from small-caps to mid-caps. sauce: ftse russell

Including Metaplanet in the major globally recognized stock market index means that the company will redirect capital from traditional financial markets to Bitcoin, giving passive stock investors an indirect exposure to the world’s largest cryptocurrency.

Related: Metaplanet and Smartweb add nearly $100 million to Bitcoin to the Treasury

Metaplanet is better than Japanese blue chip stock as the eyes grow larger

Metaplanet surpassed the Tokyo Stock Index (Topix) Core 30, a stock market benchmark index featuring Japanese manufacturing and technology giants Toyota, Sony and Nintendo, according to its second quarter financial report.

Bitcoin Treasury Company announced a profit of approximately 187% per year in August, compared to Topix 30’s 7.2% YTD appreciation.

Metaplanet 1-year inventory performance measured in Japanese yen. sauce: Yahoo Finance

Metaplanet currently owns 18,888 BTC in the Ministry of Corporate Treasuries, and is the seventh largest publicly traded holder of the supply cap coin, according to Bitcointreasuries.

Metaplanet, originally a hotel operator, reformed in 2024 as a Bitcoin finance company. Currently, the company owns more BTC than Coinbase, Tesla and Hat8 mining companies, and is Japan’s largest BTC finance company by BTC Holdings.

In July, Metaplanet CEO Simon Gerovich showed that the company would use a portion of the BTC Stash to purchase a business that generates additional revenue, highlighting the possibility of buying a digital bank or business adjacent to digital assets and money.

The company’s executives have set a target to accumulate 210,000 BTC by 2027. This is 1% of the total supply of currency 21 million.

magazine: We risk being “front run” in Bitcoin reserves by other countries: Samson Mo