Ethereum prices It holds past the $4,200 mark after an explosive summer rally, but the next move is more than just a chart. With Federal Reserve Chairman Jerome Powell preparing for a final Jackson Hole speech, political pressure from President Trump and increased tariffs for the US economy, crypto investors are asking for one important question. Will ETH prices crash?

Macro background: Powell, tariffs, interest rates

The best Federal Reserve policymakers have closed their doors to hopes of rate cuts in September, pointing to stubborn inflation and still strong labor markets. Without promoting mitigation, the Fed signal a more severe situation for longer. It is a set-up of cryptographic elements, which usually come together when monetary policy changes slowly. Instead, traders stare at high rates and limited liquidity. This could potentially drag both Bitcoin and altcoin soon.

The Fed is walking the tightrope. Inflation remains rising, tariffs are putting new upward pressure on consumer prices, and Trump is demanding lower fees ahead of the September policy meeting. Investors will be split on whether the Fed will provide interest rate reductions or hold them steady. Powell is unlikely to tilt his hand to Jackson Hole. This means that the market may be inferred until data arrives.

This uncertainty is important for Ethereum. Interest rate reductions tend to fuel risk assets like crypto by increasing liquidity and reducing capital costs. However, if the Fed doubles combat inflation, capital will return to bonds and dollars, and ETH will be under pressure.

Ethereum price forecast: Where is the situation right now?

eth/usd daily charts – TradingView

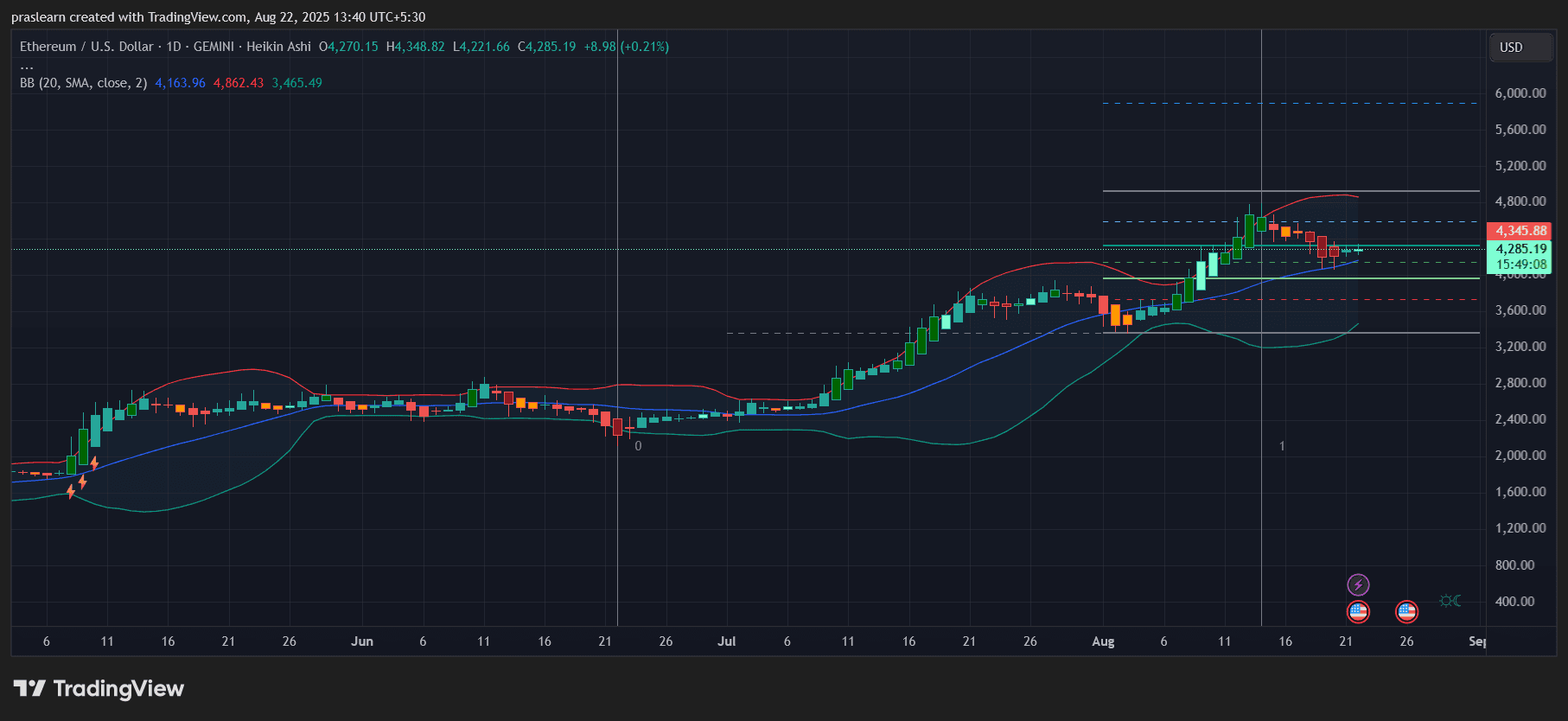

The ETH Daily Chart shows that Ethereum is consolidating a consolidation of under $4,300 after testing a resistance of nearly $4,600 at the beginning of August. The price sits around the midline of the Bollinger band, suggesting a post-race cooling period from the $3,200 level in June.

Important technical levels to look at:

- Immediate resistance is located between $4,350 and $4,400, in line with recent failed breakout candles.

- The upper bollinger band, which is around $4,860, is the next bullish target if momentum reigns.

- Strong support is around $4,100, and deeper protection is $3,650 if the fix is extended.

The fact that ETH holds the breakout zone about $4,000 above indicates that buyers are still in control, but the pace has slowed down.

Will ETH prices crash or stabilize?

The short-term risks are clear. If Powell suggests Hawkish’s stay and inflation data is hot, risky assets could be sold out. That scenario could pull ETH back into the $4,100-$3,650 support zone. However, this still doesn’t look like a crash setup. ETH is still on the upward trend, with no higher lows and higher highs.

A true crash requires both a macro tightening and a technical collapse of under $3,650. That level is a line in the sand of a bull. As long as the ETH remains above it, the pullback looks like a healthy correction within the wider bull cycle.

Ethereum price forecast: Unbalanced actions take place first

The next 30 days of Ethereum will be about activities on the chain, and how the Fed balancing act will work. If Powell suggests future mitigation, ETH could retest $4,800 and aim for $5,200. If he highlights the risk of inflation and avoids reducing signaling, ETH may shatter or drop September sideways.

In any case, ETH is unlikely to crash completely unless the macro impact is alongside the technical breakdown. For now, the market remains cautiously bullish, looking at Jackson Hole for clues.