The competition to build the Cryptocurrency Department is accelerating. Alongside high-profile ventures that source billions, blockchain native protocols themselves are exploring new ways to lock value into ecosystems.

On August 7th, ChainLink Network announced its own reserve designed to accumulate native token chain links (links) for protocols collected from both Onchain service fees and off-chain enterprise revenues, creating a direct link between ChainLink’s business activity and long-term token demand.

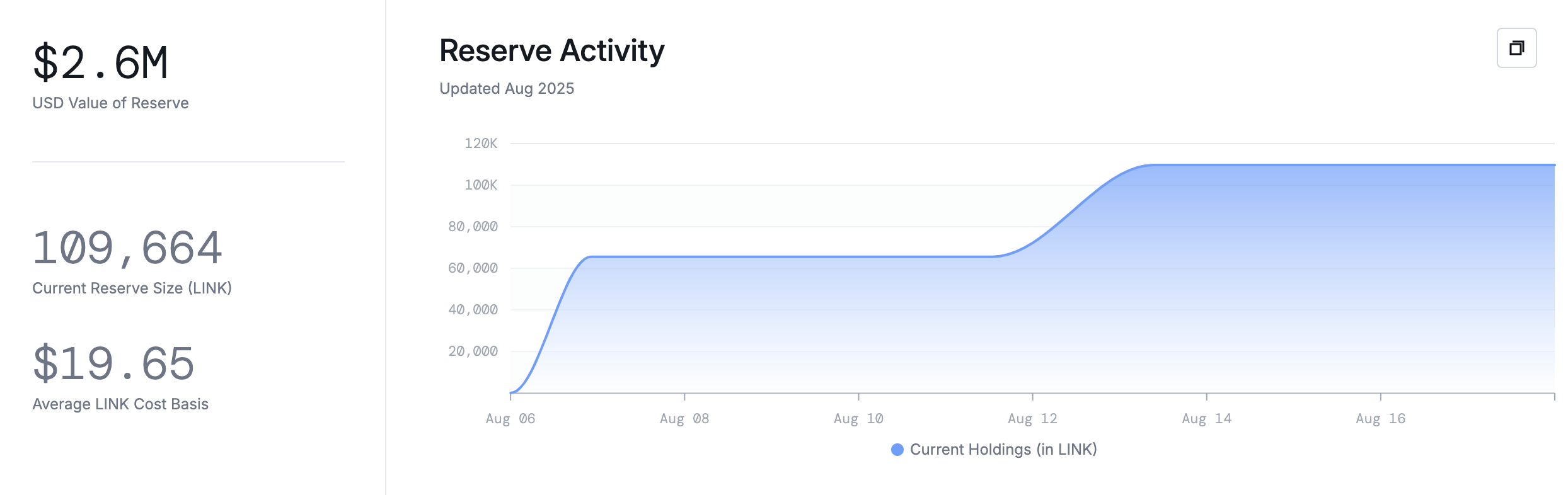

Since then, the protocol has made two deposits with the newly launched On-Chain Treasury Ministry. Etherscan’s Onchain data shows total holdings at 109,661.68 links at the time of this writing, worth around $2.6 million.

ChainLink has not made a statement on how often it will be added to the reserve, but the initiative is part of a broader change in crypto to using finance as an aggressive driver of token demand rather than a passive reserve.

Chain link reserve. sauce: ChainLink

Turning the Ministry of Finance into a permanent demand engine

ChainLink’s reserves are funded with revenue from banks and capital market enterprise clients. These payments, whether stubcoins, gas tokens, or fiats, are collected and automatically converted to links via the Chain Link payment abstraction system before they are deposited in the reserve.

According to ChainLink Labs, the network has already generated hundreds of millions of dollars from these enterprise transactions. He also noted that there will be no withdrawal from the reserve for several years.

Also, it’s Cardano who explores alternatives to Crypto Treasury. In a live stream on June 15th, Cardano founder Charles Hoskinson converted 5% to 10% of Cardano’s $1.2 billion ADA (ADA) Treasury Department into Bitcoin and Stubcoin, then used yields to buy back native tokens from the open market. His estimates resulted in a redistribution of approximately $100 million in ADA, resulting in a permanent demand loop, with annual repurchases of between $5 million and $10 million.

Unlike ChainLink, which introduces external revenue to a link without selling it to a link, Cardano’s plans redistribute existing assets and create short-term selling pressures, but offer greater long-term profit potential when the strategy works.

https://www.youtube.com/watch?v=20zfedqdkl8

Bitwise research analyst Danny Ryan told Cointelegraph that keeping tens of millions of purchases “almost certainly pays long-term dividends to holders” if implemented on a scale.

“These buyback programs should be seen as obvious bullish developments in the market. Projects that believe in their own value should be willing to protect and grow the capital they acquire by investing in tokens. Investors should be careful.”

The move could increase certain token values and add an extra layer of collateral, but Ryan argues it’s too early to measure market impact.

Analysts said it is unclear how the Native Treasury of Cryptody will affect token prices, raising questions about whether these efforts could significantly affect large tokens due to the volume of transactions such as links.

“How much does Chainlink spend on the reserve, how often they buy, the exact amount, the exact amount,” the analyst said, adding that such purchases “will not be able to travel through a market with daily trading volumes exceeding $1 billion.”

Ryan dismissed concerns that pooling links into a single Treasury contract could centralize risk. “(It’s) the relatively very, very $1 million owner of a token worth billions of people by market capitalization.”

Trump’s WLFI $150 Million Crypto Treasury

Another unconventional financial strategy comes from World Liberty Financial (WLFI), which builds a $1.5 billion reserve through vehicles registered with NASDAQ, a Trump family-backed venture.

On August 12, Alt5 Sigma Corporation agreed to sell 200 million shares of common stock, split equally between registered direct offers and private placements at $7.50 per share. Each sale is worth $750 million, with a total increase of $1.5 billion.

Unlike Chain Link’s gradually growing on-chain reserves and Cardano’s proposed yield fund repurchase program, WLFI’s Treasury Department is in full swing.

Half of the funds will be held as WLFI tokens (valued by $750 million) in exchange for a warrant with 1 million shares and 99 million advance funds. The other half will be paid in cash, and Alt5 will be used to grow the WLFI corporate reserve, he said.

By using publicly available companies and holding more than $1 billion in tokens and cash from day one, WLFI is taking a more immediate approach to building the Department of Cryptocurrency.

A recent report from the New Yorker estimated that since 2022, Trump has won around $2.4 billion from his crypto venture.