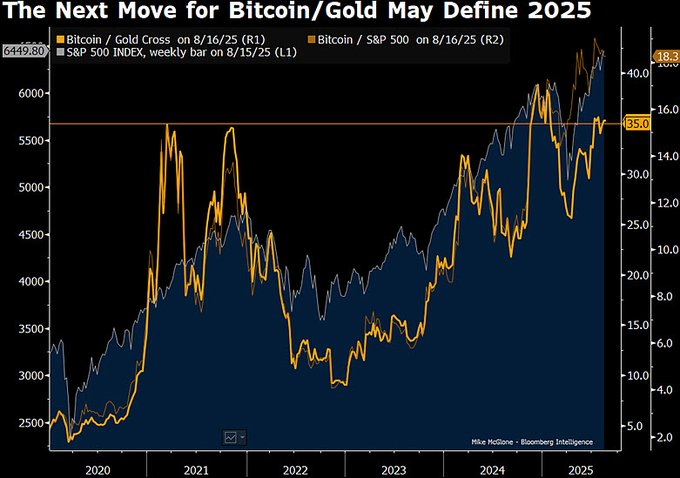

Bloomberg Intelligence Senior commodity strategist Mike McGroen warns that Bitcoin (BTC) is facing a critical test of gold that could shape investors’ flow for the rest of 2025.

He points out an important ratio comparing Bitcoin’s value to gold, showing the world’s largest cryptocurrency hovering around 35 ounces of gold per Bitcoin, the level that marked its peak in 2021.

In an X post on August 16th, McGlone warned that if Bitcoin cannot hold above this threshold it could cause a shift in capital to the US Treasury as “the next big trade.”

“The first code born in 2009 (now with around 19 million minions, and if you go back from the roughly 35oz rock on August 15th, T-bonds could signal as NBT,” he said.

He suggested that Bitcoin’s inability to defend levels could potentially slip into 1.75%, reflecting the trajectory seen in China, allowing existing shelters to slip into 1.75%.

McGlone’s analysis shows that BTC’s performance has skyrocketed in recent years compared to both Gold and S&P 500, but is now at a crossroads.

To this end, he noted that the Bitcoin to P500 ratio is currently around 18.3, highlighting the resilience of cryptocurrency stocks. However, gold thresholds appear to be a critical marker of long-term positioning.

Stopped Bitcoin to Gold Ratio

On August 15, McGlone said it was at a critical time when the stalled Bitcoin to Gold ratio was either at a critical time, poised to catch up with record US stocks or signal a broader risk asset reversion towards the second half of 2025.

Stalled Bitcoin vs. Gold Top Reading Indicator –

Keeping up with record-setting stock markets or signaling’s return in rising risk assets is the main end-of-2025 option for the Bitcoin/Gold ratio.

A full report on Bloomberg is here: https://t.co/hbv24zvji1 {bi…pic.twitter.com/fvzfhylhnl– Mike McGlone (@mikemcglone11) August 15, 2025

In particular, Bitcoin’s deadlock benefits on gold highlight the uncertainty about the resilience of digital assets amid inflation, central bank policy and geopolitical risks. McGlone suggested that the breakout would show new confidence in risky assets, suggesting that stagnation could foresee a pullback in stocks and crypto.

Meanwhile, both Bitcoin and Gold are enjoying an impressive 2025 run. Gold targeted the highest ever $4,000 at one point. At the time of pressing, Bitcoin was trading at $118,266, well above the $100,000 level.

Featured Images via ShutterStock