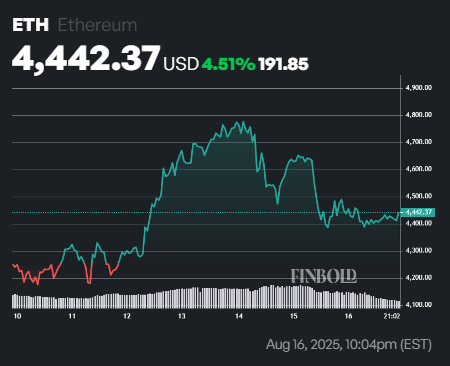

Ethereum’s (ETH) recent gatherings have cooled down, with assets below $4,500.

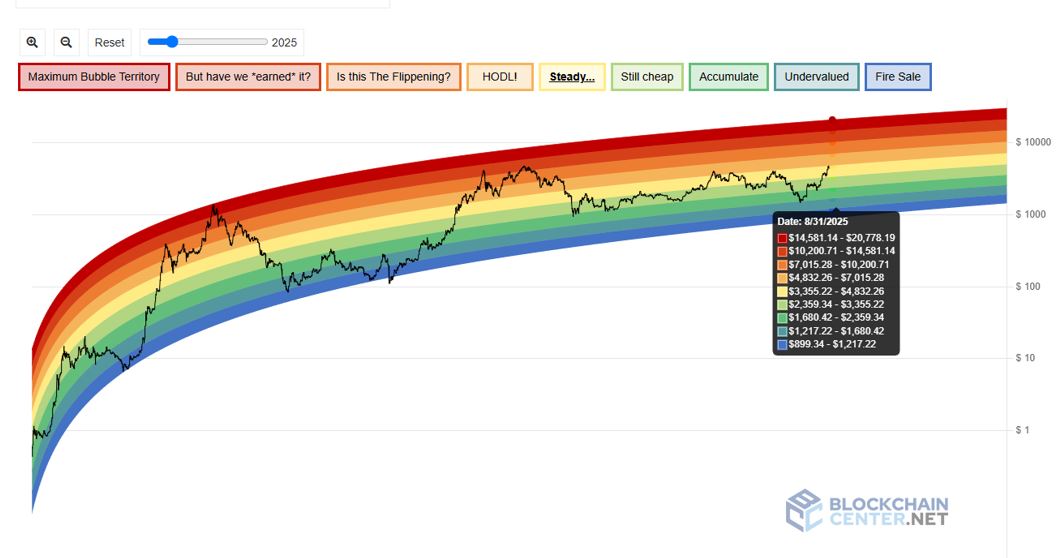

However, the Ethereum Rainbow Chart suggests that high levels of cryptocurrency may still exist by the end of the month.

A chart that applies logarithmic growth curves to long-term evaluation bands classifies Ethereum prices into a range of colours. In particular, this model helps investors measure whether their assets are undervalued or overheated, rather than predicting short-term movements.

On August 31, 2025, the chart outlines nine evaluation zones. At the bottom, the “fire” bands range from $899 to $1,217, followed by “undervaluation” ($1,217–$1,680), “accumulation” ($1,680-$2,359), and “still cheap” ($2,359-$3,355). The “stable” band, often considered fair value, ranges from $3,355 to $4,832, close to Ethereum’s current trading levels.

More than that, “Hodl!” covers $4,832–$7,015. “Is this flipping?” spanning $7,015-10,200, “But did we win it?” Operating between $10,200-$14,581. At the top, the “maximum bubble area” ranges from $14,581 to $20,778.

Ethereum trades for around $4,400 and is within the “stable” zone. If the band is held at the end of August, the model suggests a potential target between $3,355 and $4,832, indicating that the historical standards are valuing the assets quite a bit.

Ethereum price analysis

By press time, Ethereum’s price was $4,442, down 0.15% over the past 24 hours, but increased 4.5% over the week.

From a technical standpoint, the 50-day Simple Moving Average (SMA) is $3,413.61 and the 200-day SMA remains at $2,596.84, confirming a strong upward momentum and a sustained bullish trend.

Meanwhile, the 14-day relative strength index (RSI) of 66.86 indicates strong purchase pressure, bringing you closer to the overbuying threshold. This suggests that further profits are possible at Ethereum, but excessive purchases can cause momentum to cool down or face minor corrections.

Featured Images via ShutterStock