According to Adam Livingston, author of Bitcoin Age and the Great Harvest, the US government can purchase even more Bitcoin (BTC) for US strategic preparation by introducing a surplus of tariff receipts into the acquisition of BTC.

Livingston proposed taking some of the surplus generated by trade tariffs each month and using it for trading, piles, sales, re-guarantees, funding programs or safe loans, or focusing it on safe refrigerated BTCs that are not being loaned for yields. He said:

“As of July, we collected $135.7 billion in tariffs, twice as fast as last year. Let’s repeat that we’re sitting in a $70 billion surplus from tariffs.

That surplus has been lifted. It’s not a pre-spent. It does not concern Medicare, qualifications, or debt services. It’s just floating, waiting, looking for productive use cases,” Livingston continued.

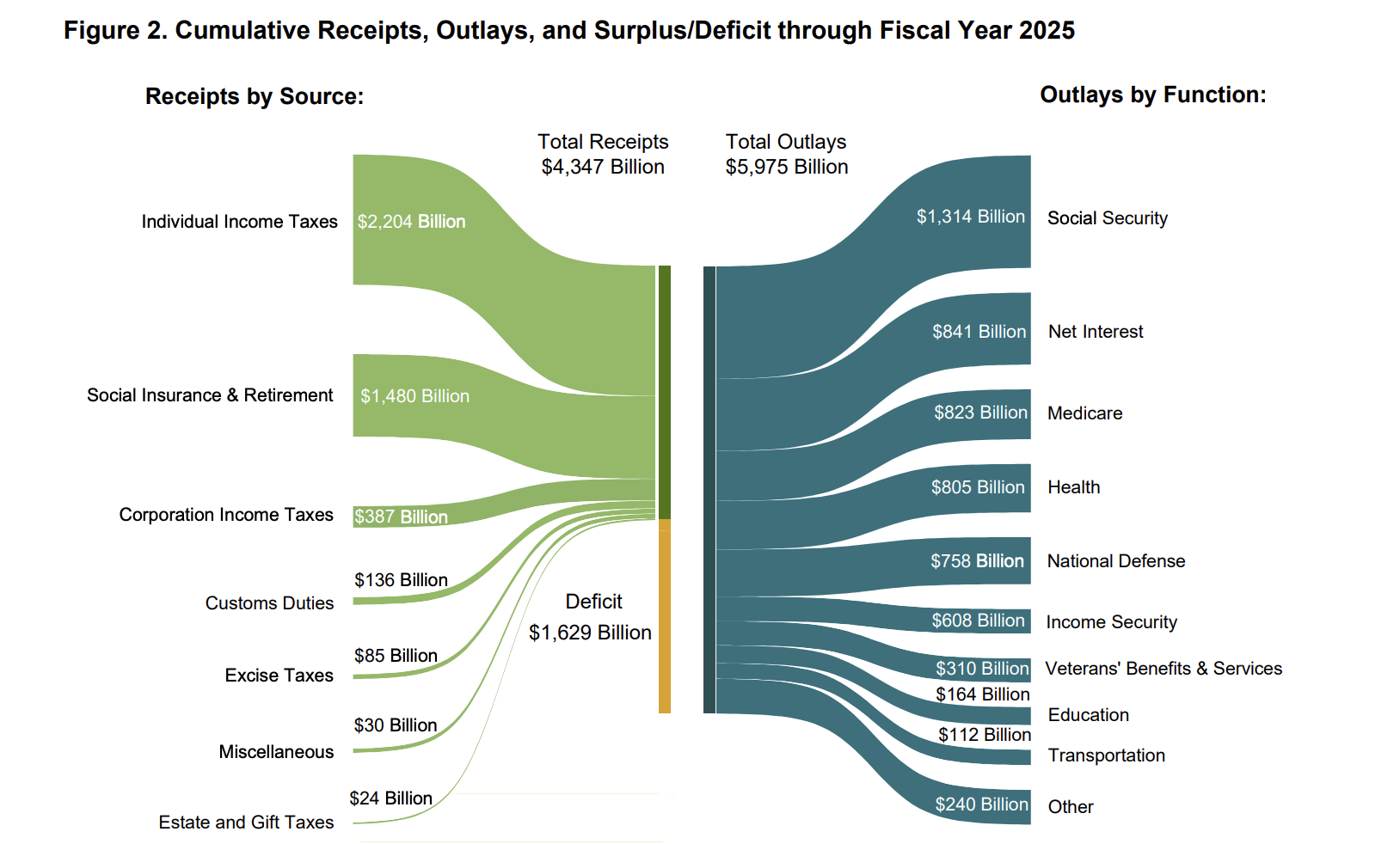

The cumulative concept shows that the US government has so far collected around $136 billion in tariffs through fiscal year 2025. sauce: US Treasury Department

The proposal to fund tariff surplus on the US Bitcoin Strategic Reserve could be a way for the government to buy more BTC under the US President’s executive order, and that additional BTC can only be obtained through budget-neutral strategies.

Related: White House Crypto Reports Mixed Bags for Bitcoin Advocates

US Treasury Secretary sends mixed signals to strategic reserves

US Treasury Secretary Scott Bescent said Thursday that the US government will not buy new BTC for strategic preparation.

“We’re not going to buy it, but we’re going to continue to build it using the assets that were confiscated,” Bessent told Fox Business.

However, later that day, Bescent retreated, revealing that the US government is still “exploring budget-neutral pathways” to gain more digital currencies.

Currently, several budget-neutral strategies have been proposed, including a revaluation of the Department of Treasury’s gold holdings, which is only $42.22 per troy ounce, but gold is trading at around $3,335 per ounce in the spot market.

Other neutral paths include reallocating some of the government’s other existing reserve assets, such as selling oil from strategic petroleum reserves, to acquire more BTC.

magazine: We risk being “front run” in Bitcoin reserves by other countries: Samson Mo