Ethereum Already the backbone of decentralized financial, NFT, and blockchain-based applications. It currently costs $4,740 and has a market capitalization of $572 billion, making it the second largest cryptocurrency in the world. But what if Is ETH-priced Sky Rocket up to $100,000? This is not just a price milestone, it will reshape global finance, technology and even macroeconomics.

Ethereum Price Prediction: Current Ethereum Snapshots

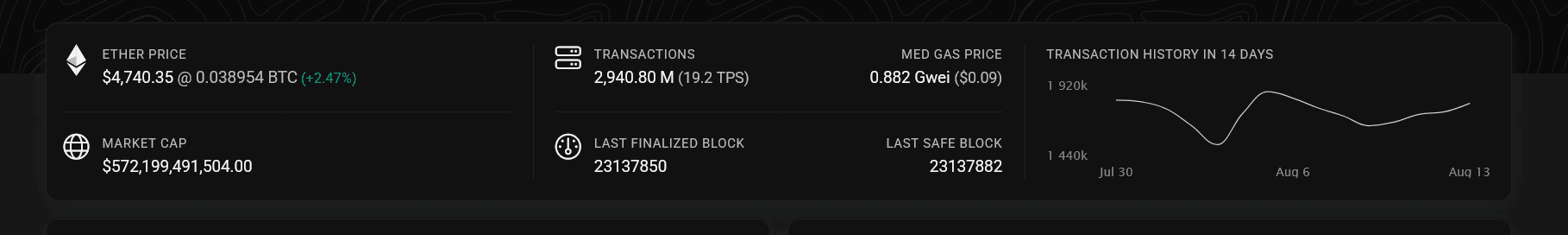

Ethereum Blockchain Explorer: Etherscan

From the latest blockchain data:

- price: $4,740.35 (0.038954 BTC, +2.47%)

- Market capitalization:~$572.2b

- transaction: 2.94b total, average 19.2 transactions per transaction

- Median gas price:0.882 GWEI (~$0.09). Shows highly efficient network performance

- Transaction Activities: Consistent throughput using healthy peaks over the past two weeks

These metrics show that Ethereum’s network is stable, affordable to use, and can handle important activities.

The reality of the market capitalization is $100,000

If your ETH reaches $100,000:

Market capitalization: ~12.07 trillion dollars (based on a circulating supply of approximately 120.7m). This will put Ethereum:

- Gold’s ~$14T market capitalization is on a relative scale

- 4-5 times the current market capitalization of Bitcoin (depending on the price of BTC at the time)

- Equivalent or exceed the total valuation of the world’s largest public companies

This would indicate a transition from Ethereum crypto assets The core pillar of the global financial system.

Macro drivers that can boost ETH to $100,000

1. Institutional capital inflows

The Spot ETH ETF leaks trillions of pension funds, sovereign wealth funds and insurance companies into the Ethereum market. With a staking yield of 3-5%, ETH becomes both a growth and an income-generating asset.

2. Real-world assets tokenization

Ethereum could be the default infrastructure for tokenizing bonds, real estate, stocks and products. The forecast would bring tokenized assets to $50-80 trillion by 2030, with Ethereum likely to gain the largest share.

3. Deflationary supply

After merge, ETH issuance is already minimal. The EIP-1559 combustion fees and more stakes can reduce circulation supply and create sustained price pressure.

4. Layer 2 Scaling

Low gas prices for Ethereum in the data suggest that Layer 2 adoption is working. Networks such as Arbitrum, Optimism, Base, Zksync can process hundreds of millions of transactions every day, while securing them in Ethereum.

5. “Flipping” scenario

If Bitcoin rises above $500,000 and ETH’s BTC ratio rises from 0.20-0.25, ETH becomes a mathematical reality at $10,000. This could coincide with Ethereum, which exceeds the market capitalization of Bitcoin.

On-chain indicators to support growth

- Low cost and high throughput:19.2 The median TPS and sub-$0.10 means that the network is ready to adopt large quantities without pricing users.

- Staking Growth: An increase in the proportion of ETH trapped in contract staking reduces circulating supply and promotes rarity.

- Defi Dominance: Ethereum still controls most of Defi’s Total Value Lock (TVL), an advantage that is enhanced with new applications.

- Resilient Network Activities:A total of approximately 3 billion transactions highlights the position of Ethereum as a global payments tier.

Risks that can slow or derail your path

- Regulatory obstacles: An adversarial approach by the US, the EU, or major Asian markets could limit institutional participation.

- A competitive threat: High-performance chains such as Solana and new blockchain architectures can erode market share.

- Macroeconomic shock: Liquidity crises and recessions can slow capital inflows.

- Security Incident: Large debt hacks or protocol exploits can undermine trust.

Timeline scenario

- Optimistic:2028–2030 ETFS expands quickly, Bitcoin exceeds $300,000, and real-world asset tokenization accelerates.

- Base case: 2030-2035 Adoption, layer 2 scaling, and institutional involvement grew steadily.

- Bear case: beyond 2035, if regulatory, competitive, or macroeconomic factors cause delays.

Ethereum Price Prediction: Final Results

$100,000 Ethereum will be more than a speculative milestone – it Full blockchain integration into global finance. Current network data already shows that Ethereum is operating efficiently, low transaction costs and potential for large-scale adoption. With institutional influx, deflationary supply mechanics and layer 2 scaling, the $100,000 goal is not only possible, but is more and more likely in the next decade.