Market strategy and research firm Fundstrat said that ether will become the “largest macro trade” in the next decade as it predicted that ether would rise to up to $15,000 by the end of 2025.

“ETH is undoubtedly the biggest macro trade in the next 10-15 years as AI creates token economy on blockchain and Wall Street acquires financial position on blockchain.”

Meanwhile, Sean Farrell, head of digital assets research at FundStrat, said ETH could reach $12,000 to $15,000 at the end of the year.

Lee reflected his comments in the company’s bulletin Wednesday, where he explained that the Wall Street push was spurred by the stubcoin regulations of the genius law and the Securities and Exchange Commission’s “project code,” which aims to modernize institutions due to the age of digital finance.

Lee also pointed out that the majority of the Stubcoin and Wall Street projects are built on ether (ETH).

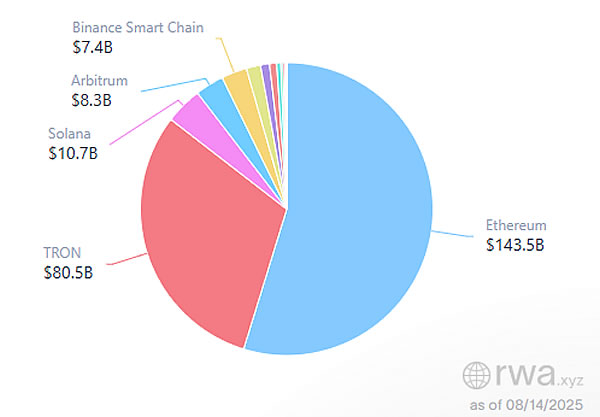

According to RWA.xyz, Ethereum Network currently leads a 55% market share in the $25 billion real-world asset (RWA) tokenization sector.

Ethereum has 55% of the total Stablecoin market. sauce: rwa.xyz

Big price prediction for ether

Farrell also predicted that the ether would reach $10,000. This is more than twice the current value.

ETH has skyrocketed 60% over the past 30 days, reaching a four-year high of $4,770, just 2.5% from its 2021 peak during early trading on Thursday.

“Ethereum outperforms Bitcoin YTD, earning +28% vs. 18% in Bitcoin,” Lee pointed out.

Bitmine has $5.5 billion worth of ETH

Tom Lee is chairman of Bitmine Immersion Technologies, the world’s largest Ethereum treasury company, and is aiming for a $20 billion salary increase to increase the Treasury Department.

Related: Pantera says that if he bets $300 million on cryptocurrency companies, profits could surpass ETFs

The company has been actively accumulating 1.2 million ETH since the beginning of July, and its Treasury Department is currently worth nearly $5.5 billion. Meanwhile, the company’s stocks (BMNR) have skyrocketed 1,300% over the same period.

Recipe for sustained upward pressure

In a note seen by Cointelegraph, Rachael Lucas, Crypto analyst at BTC Markets, said these positions were strategic and long-term and “deprived of considerable liquidity from the market.”

“When you combine record-breaking ETF inflows with corporate and sovereign balance sheet allocations, the results are deep structural demands meeting finite supply,” she said.

“This is a recipe to maintain upward pressure on prices and is a sign that digital assets are firmly integrated into the global capital market.”

In July, Bitmine suggested that the implicit value of the ether could be $60,000.

magazine: Altcoin season 2025 is pretty much here…but the rules have changed