MicroStrategy Stocks are moving beyond Bitcoin navigation as Michael Saylor highlights a powerful structural factor that drives demand beyond the limits of direct Bitcoin exposure, which means investors are chasing it explosively upside down.

Michael Saylor has outperformed Bitcoin navigation and highlighted four factors that drive MSTR premiums

MicroStrategy’s Stock (NASDAQ: MSTR) is traded beyond the value of the underlying Bitcoin holdings and reflects structural advantages that are not available to directly use cryptocurrency ownership or products (ETPs) traded on spot exchanges. That market premium is measured against our Net Asset Value (NAV). This represents the per share value of Bitcoin holdings after liabilities. MicroStrategy Executive Chairman Michael Saylor was rebranded as a strategy and was shared on social media platform X on August 13th.

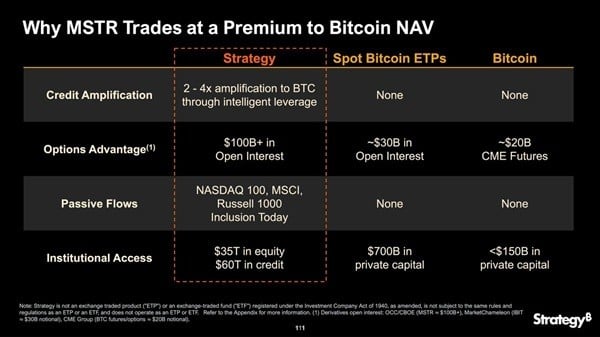

MSTR trades at Bitcoin NAV premium due to credit amplification, option advantage, passive flow, and excellent institutional access that offers fairness and credit instruments compared to the goods.

These factors collectively provide the leverage and liquidity benefits of micro-tactics that Bitcoin itself does not own.

The company’s ability to apply double to 4x leverage to Bitcoin through equity-based funding, which Saylor described as “credit amplification,” will boost performance during the bullish market stage. This contrasts with both Spot Bitcoin ETP and Direct Bitcoin Holding, but lacks such leverage capabilities. MicroStrategy also benefits from more than $100 billion in open profits over the traditional options market, exceeding approximately $30 billion against Spot Bitcoin ETPS and $20 billion in CME Bitcoin futures.

Why is MSTR traded at premium with Bitcoin NAV? Source: Michael Sayler

Additionally, as a component of indexes such as the Nasdaq 100, MSCI, and Russell 1000, MicroStrategy captures passive investment flows across Bitcoin and its spot-based ETP.

Institutional reach presents another major distinction. The stock market offers potential access to $35 trillion in stocks and $60 trillion in credits, warping $700 billion in private capital to find Bitcoin ETPS, directly having less than $150 billion in Bitcoin. While critics overlook the valuation gap, proponents argue that these market dynamics justify premiums, and microstrategies can amplify returns and widen their investor base beyond product-based Bitcoin exposures.

The company began acquiring Bitcoin in 2020 and adopted it as a major financial asset. The strategy funds purchases through debt and equity offerings, making it the largest corporate holder of Bitcoin and a de facto proxy for investors. At the time of its latest release, the strategy holds approximately 628,946 BTC.