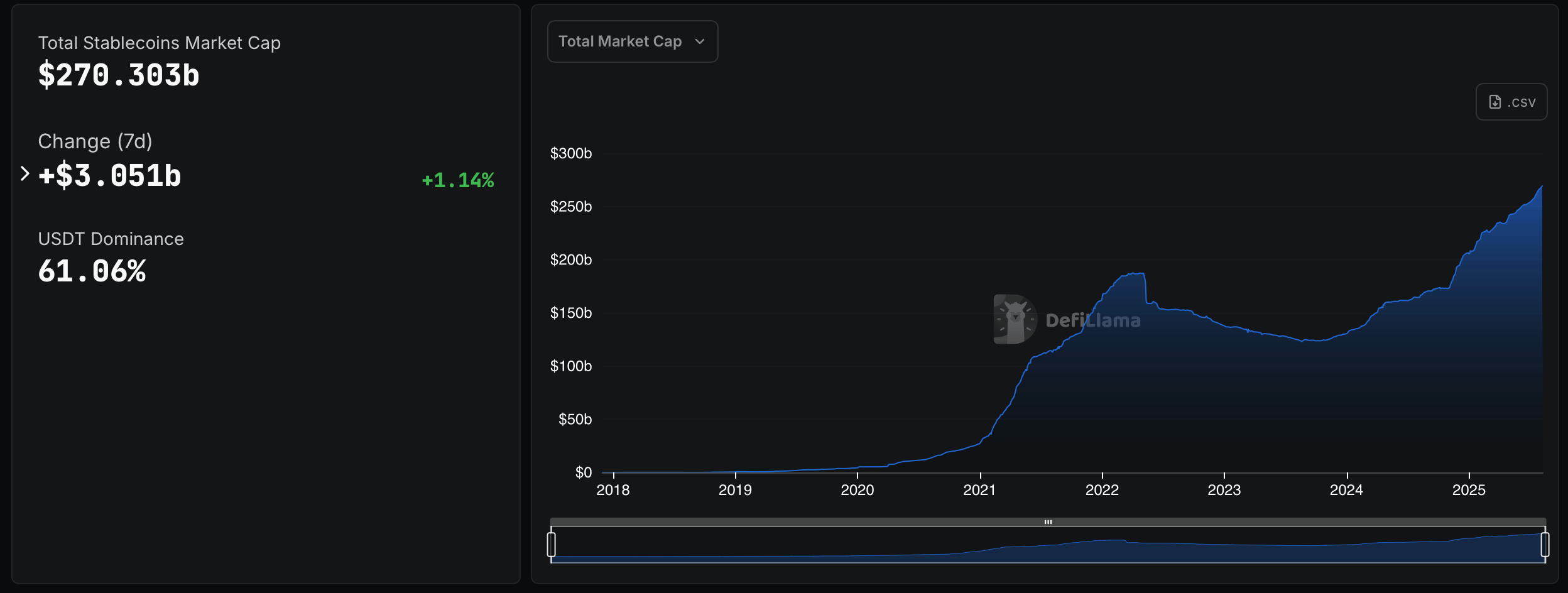

Statistics collected by Defilama.com and Artemisanalytics.com show that the total value of the Stablecoin Market is over $270 billion, marking a new milestone for the sector.

The stubcoin economy rises as activity expands

Over the past seven days, Stablecoin Capitalization total has increased by $3.051 million, a profit of 1.14% per Defillama dashboard. The new Total will place the asset class within sight of previous peaks, extending the stable climb that will be carried through 2024 and 2025. This number reflects circular supply multiplied by the price and focuses on tokens covered in dollars.

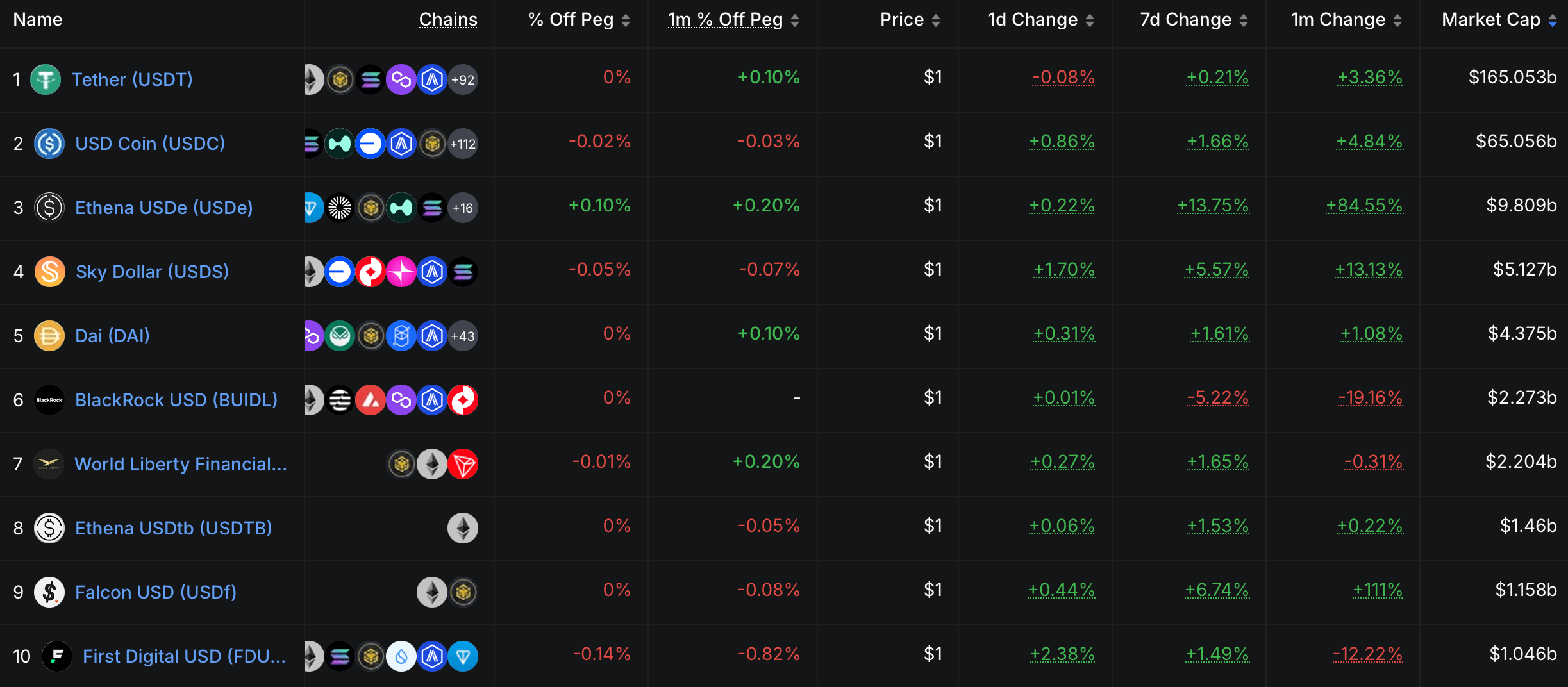

Currently, Tether (USDT) remains a market leader with a 61.06% advantage. USDC is the second largest component, but a single-digit stake is a combination of competitors such as Ecena’s USDE, Sky’s USDS, Dai and BlackRock’s Buidl. The Artemis Terminal market share chart shows that USDT held a wide lead in 2025, with the USDC portion trending higher than this year.

Source: Defilama.com

Activities remain wide. Artemis reports that addresses of 42.8 million people interacted with Stablecoins last month, down 15.2% from the last 30 days, but close to the high-end range of five years. Address activity per chain has expanded, with notable participation in BNB chains, Tron, Bass, arbitrum, Solana and OP Mainnets joining Ethereum.

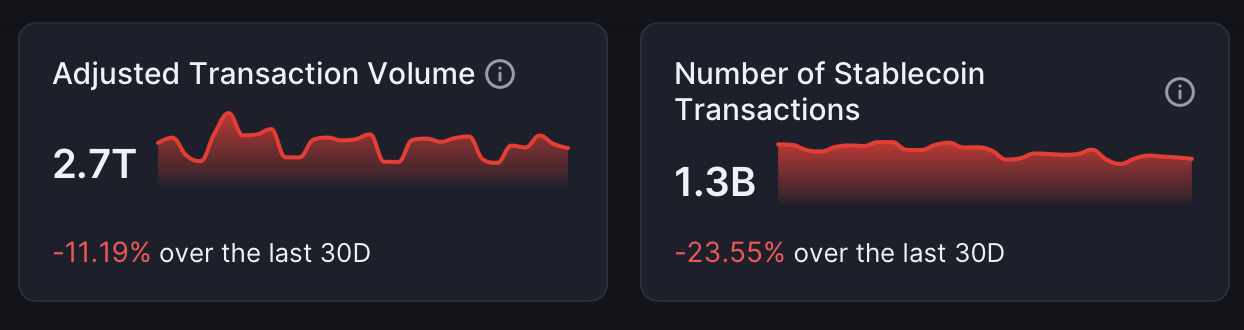

Sales are heavy. Artemis figures estimate $2.7 trillion in the amount of stability transferred adjusted over the past 30 days, even after a monthly decline of 11.19%. A multi-year view of the terminal shows a rolling adjustment volume of $1 trillion for most of 2024-2025. This is generally closer to visa levels, far exceeding the total PayPal and global remittances.

Source: Artemis Terminal

Transaction counts remained up at 1.3 billion over the last 30 days, down 23.55% from the previous period. That tally points to repeated use for payments, settlements, transactions and wallet financing across major networks and at centralized and on-chain venues.

The supply composition is decisively distorted by the US dollar. The Artemis currency collapse shows overwhelmingly issuance on USD terms as the euro, pound and other fiat pegs represent very thin slices of total supply. US Dollar Token continues to lock in crypto pricing and collateral practices across major exchange and lending platforms.

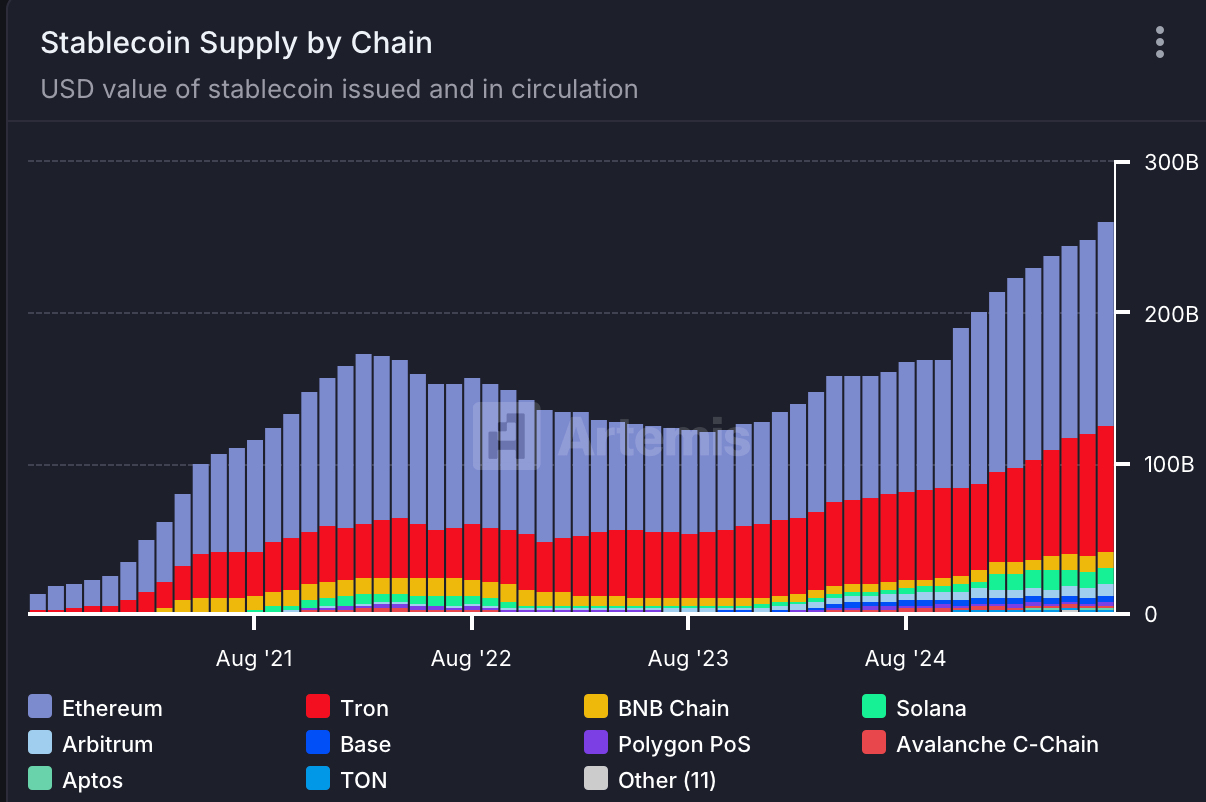

Chains are important. Artemis’ supply bi-chain chart shows that Ethereum and Tron hold the biggest outstanding balances ever, with BNB chains, Solana, Bases and arbitrum continuing. A five-year perspective on net supply change ranks Ethereum by absolute growth first, and Tron is second. Increased contributions from the base and Solana highlight additional venues for issuance and distribution.

Source: Artemis Terminal

In tokens, the 5-year netchange table will be much further than the USDT’s additional supply, and USDC will be supplied next. The USDE and USDS are smaller and contribute to a noticeable increase, while Dai and Buidl add an incremental amount. The mix suggests that even though new equipment targets Onchain Cash Management or Delta-Neutral Ivel Strategies, incumbents still dominate the issue.

Regional trends are diversified. Using Ethereum and Solana’s TimeZone-based methods, Artemis will attribute most of the adjusted transactions to North America and Asia, starting in 2024, with sharelifting in Europe. Latin America, Southeast Asia and Africa signal adoption by both retail and institutional users.

Active address charts by tokens highlight USDT and USDC as primary drivers, with address counts and interactions hitting new highs in 2025. Smaller publishers, including PYUSD and other niche pegs, show limited but stable engagement. Address participation width refers to the role of stubcoin as a crypto gateway and payment medium.

Both Defillama.com and the Artemis terminal data refer to larger, highly active, and geographically distributed systems. The $27.030.3 billion headline figure keeps consistent expansion periods, but liquidity is concentrated on a small number of issuers and blockchain. Asset classes serve as a bridge between trading venues, wallets and traditional finance, including centralized exchanges and on-chain protocols.

Source: Defilama.com

Once the float total reaches the $270 billion threshold, the liquidity conditions of exchanges and distributed finance (DEFI) are closely related to dollar peg assets. Although the rhythms of each month vary, the combination of dominant issuers, multi-chain distributions, and deep address activity indicates sustained demand for tokenized dollars across transactions, remittances, and settlements.

For context, Defillama lists a history of overall market capitalization, from under $10 billion in 2019 to over $250 billion by 2021, from under $10 billion to over $250 billion, then gradually recovering in 2025.