Gold ETF and Bitcoin ETF Both make assets easier to own and more difficult to hold. One wraps centuries worth of shops. Other packages package new digital assets that move faster. This is the problem. They solve a variety of problems, behave very differently, and fit into a variety of investors.

Gold ETFs and Bitcoin ETFs: What are the problems these ETFs solve?

Both vehicles will remove custody headaches. Get price exposures within your regular brokerage account with simple trading and familiar statements. That convenience comes with fees, tracking habits, and a layer of fund structure risk that you need to understand before clicking (buy).

How do Gold ETFs work?

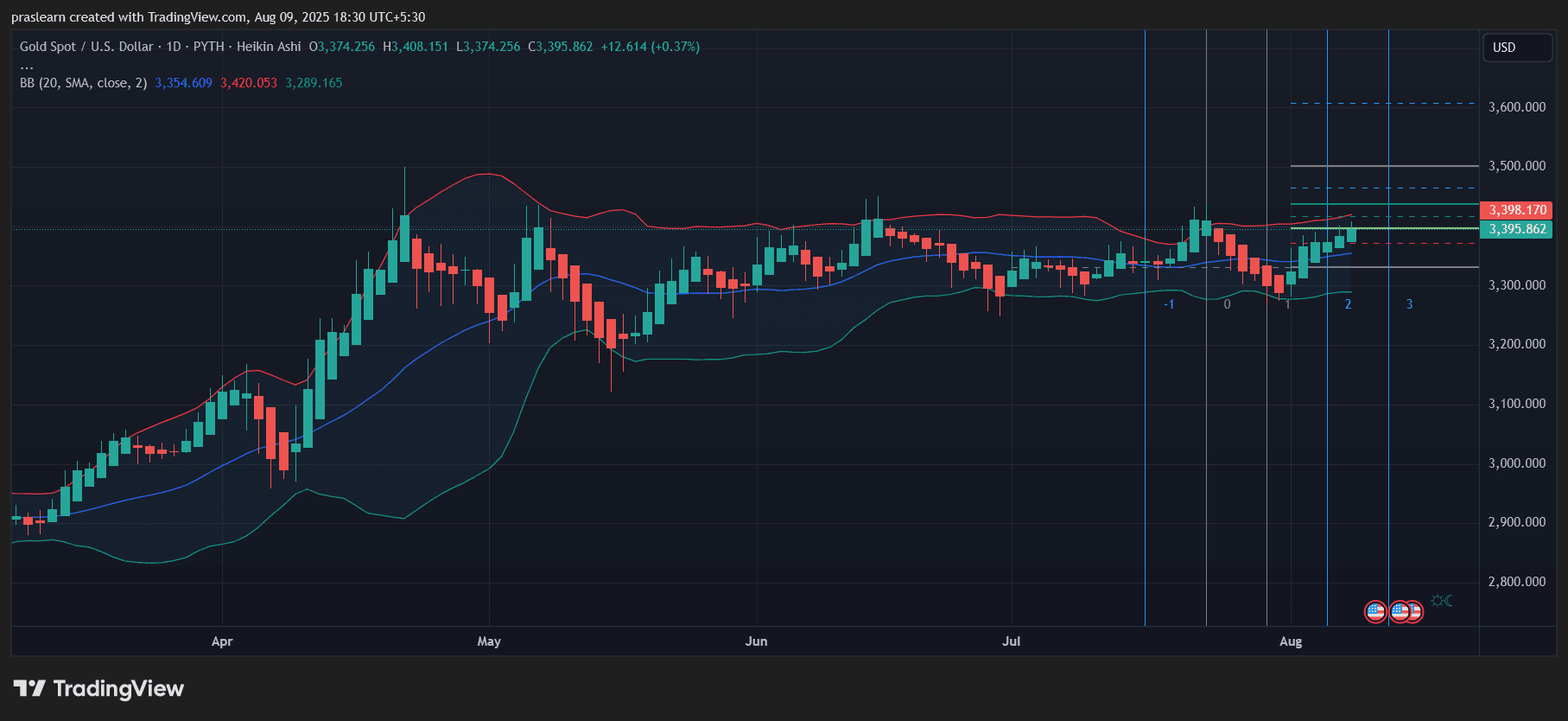

xau/usd Daily Charts – TradingView

Gold ETFs track spot prices for gold through custodian holdings. You don’t own a bar in your name. You own fund stocks. The expense ratio is usually in the range of 0.25 to 0.40. It looks low, but the meter runs every day. Adding brokerage fees, spreads, and platform costs and long holding periods will reveal prominent drugs. The fluidity of the major exchanges is strong, but timing is still important. When selling to a downdraft, pricing may be insufficient. If the fund ends, you may face forced liquidation at a troublesome moment. Tracking errors are usually small, but as they exist, returns of funds are a bit slippery against the metal.

Risks inherent to gold ETFs

Gold ETF introduces counterparties and structural risks that physical coins do not. Metal sits with custodians and sometimes subcustodians. You rely on that chain to function as designed. Bar redemption is out of reach of regular owners. For example, a large flagship fund would require around 100,000 shares to exchange 10,000 ounces. For most investors, that means you can only leave by selling stocks in cash.

Why do people buy gold ETFs?

Investors often use gold as an inflationary spike, currency stress, or hedge against the stock bear market. ETF wrappers can easily hold and rebalance their hedges. Tradeoffs are stable expense ratios, potential for slippage, and small but actual risks associated with any fund structure.

How does Bitcoin ETF work?

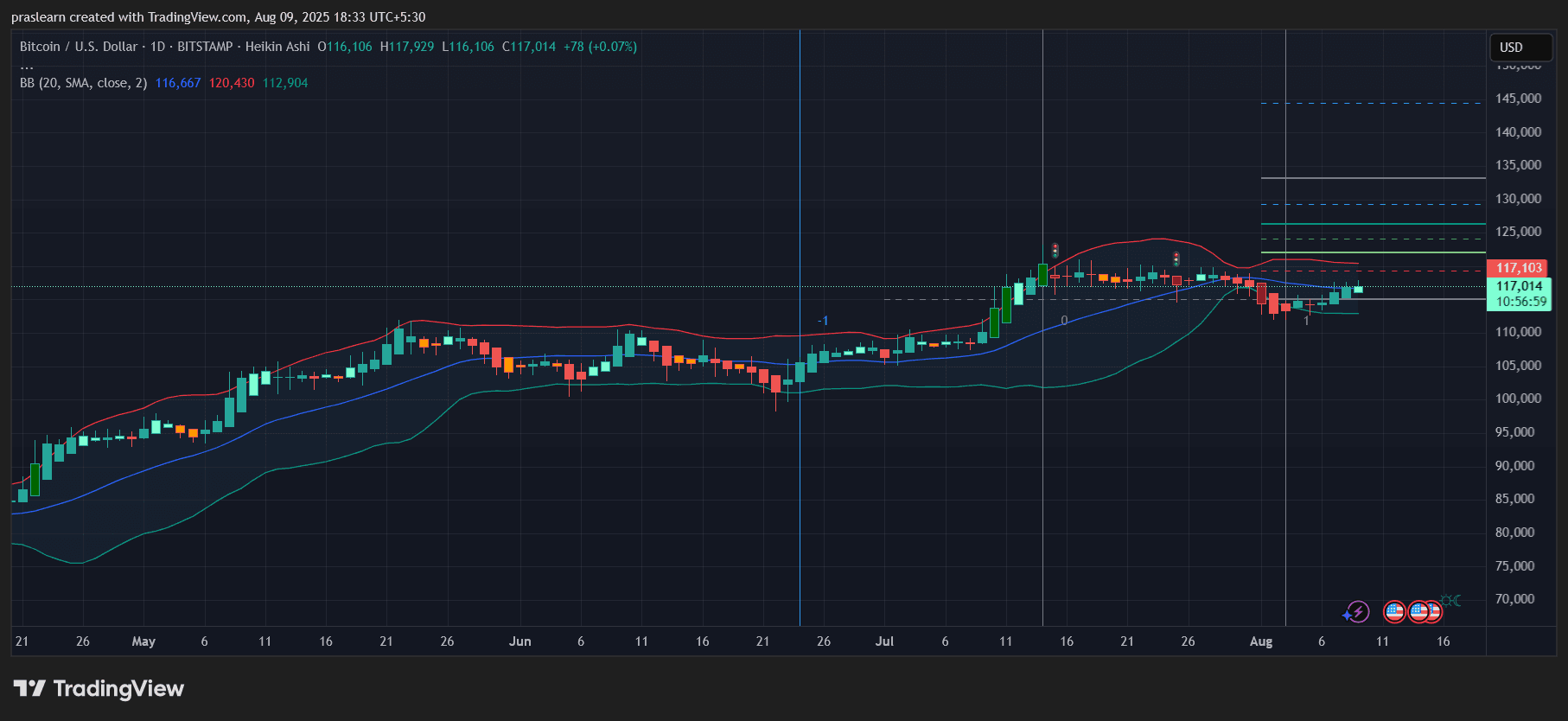

BTC/USD Daily Chart – TradingView

Bitcoin ETFs keep or track Bitcoin and turn it into mediation-friendly security. You can get exposure without a wallet, seed phrase, or learning blockchain tool. The fee is higher than gold funds, and is generally around 0.75-1.25. This reflects the costs of crypto market operations and custody management. Stocks trade on stock exchanges during market hours, similar to stock ETFs.

What really drives a Bitcoin ETF?

The engine is Bitcoin itself. Prices can move violently in both directions for emotional changes, fluidity changes, and policy headings. Small news can create a big swing. As capital flows, the rise increases. When risk preferences dry out, the drawbacks are painful. Fund-level issues can add noise, such as premiums and discounts in high-speed markets, and short tracking gaps on volatile sessions.

Risks inherent to Bitcoin ETFs

Expect higher volatility and sharper drawdowns than most traditional assets. Regulation changes can affect operations, index methodology, or access in a particular region. When market makers retreat during stress, spreads and makes it difficult to implement. This does not require any cryptographic skills from you, but you are still riding on very unstable assets through the financial rapper.

Fees, tracking errors, and all hidden costs

Gold ETF fees usually look modest, but they get worse. Bitcoin ETF fees are higher and you’ll bite faster. Adding trading commissions where they still exist, and custody that some brokers adds will add spreads to pay for each transaction. Both types of tracking errors can be constructed over the years. Fast markets can also avert estimates from short bursts of net asset values, which are important for frequent traders.

Liquidity and Accessibility

Both categories are traded in major exchanges for healthy daily volumes with larger funds. That said, not all funds are equal. Use the most liquid ticker if possible. Metal gold ETF redemption is not practical for regular owners, so stocks are treated as price exposures alone. Bitcoin ETFs, like all stocks, are settled in cash and cannot be redeemed for coins by retail owners, so if you need to self-manage your Bitcoin, the fund is not the way.

Volatility and Drawdown

Gold tends to move in a mild range and can be crushed for several months. Bitcoin could rise or fall in double digits in a week. That volatility is not a bug for all investors. Traders and growth hopes praise it. Capital preservation obligations usually avoid it or avoid very small sizes. Before you size your position, know which camp you are at.

Taxes and reports

Gold ETF sales cause capital taxes and are set accurately by local rules. Bitcoin ETF sales are also taxed and with a larger swing, you can achieve profits and losses more frequently. Always check the rules for jurisdiction and account type. The location of the tax is important. Retirement or keeping an internal tax deferred account can change your outcome.

Correlations and roles in portfolios

Gold often behaves like a hedge of crisis or an actual asset diversification device. It’s useful when inflation gets hot or when stocks come into contact with each other. Bitcoin behaves like a high beta growth asset associated with liquidity cycles and risk appetite. In a diversified portfolio, gold is usually a stabilizer and Bitcoin is a return amplifier. That framing helps determine the sizing and rebalancing of the rules.

Who should choose what when?

If your priorities include wealth preservation, inflation hedging, and low maintenance exposure, choose Gold ETF. It embraces the nuances of stable fee drugs and structure.

If you want the advantage of asymmetrical and can handle quick swings, headline risks, and higher fees, choose Bitcoin ETF. Conservatively planning location size and volatility.

Gold ETFS vs Bitcoin ETF: Clear Takeout

Gold ETFs package slow and stable hedges with known costs and small structural risks. Bitcoin ETF packages faster mobile assets with higher fees and true volatility that can promote or punish impatience. Match the tool for your purpose, size it to your risk tolerance, and write down your rebalance plan before purchasing.

$bitcoin, $btc, $bitcoinetf, $goldetf, $xau, $xauetf