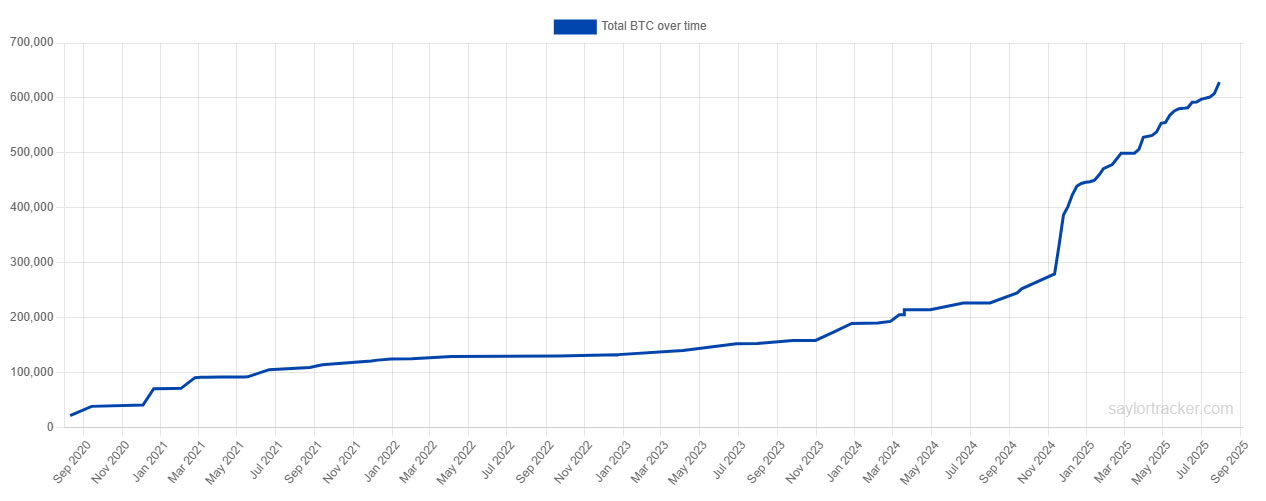

Michael Saylor’s Bitcoin Finance Company has more than doubled Bitcoin Holdings since last November. This is the month when US President Donald Trump won the federal election in a landslide vote.

The strategy has accumulated 376,571 Bitcoin (BTC), worth $43.2 billion at current market prices since Trump’s election victory. Before Trump’s victory, it took more than four years of strategy to accumulate 252,220 BTC.

This means that Trump has accumulated 60% of the current 628,791 BTC stash over the past nine months as he has guided the raft of major crypto regulatory restrictions and reversed previous Biden-era policies of enforcement measures against the industry.

Strategic holdings have doubled since the US election. sauce: SaylorTracker

The strategy discloses the third largest Bitcoin purchase

On Monday, the strategy was disclosed in a Securities and Exchange Commission application, purchasing $2.46 billion worth of $2.46 billion, worth $2.46 billion since starting to accumulate cryptocurrency five years ago.

It has been buying at a historically high price, with the latest acquisition averaged $117,256 per coin, indicating the ongoing conviction of the Bitcoin strategy despite rising valuations.

According to company records, the company amounted to two large purchases of 55,500 btc to $5.4 billion and $4.6 billion at 51,780 btc.

Bitcoin is a “free virus”

Saylor, executive chairman of strategy, described Bitcoin as a “free virus” on Monday in the Fox business segment.

“We consider it a herd creature because there are people everywhere in the world who support the Bitcoin ecosystem.”

It is as unstoppable as the Hornet flock, and its strategy aims to provide twice as much returns as BTC alone by issuing “credit means” through Bitcoin yields.

Today, @cvpayne and I will analyze why Bitcoin is a Hornet swarm, how to outweigh $btc with $MSTR, how to beat $USD money market with $strc and ride the wave of crypto innovation.pic.twitter.com/3jzmt1lqk9

– Michael Saylor (@saylor) August 4, 2025

Wall Street hasn’t got it yet: Michael Sayler

“I don’t think Wall Street has gotten that at all,” Saylor continued, adding that the company is currently the fourth most profitable financial company in the United States.

When asked about the rafts of companies currently employing Bitcoin finances, Saylor said:

“It’s not a problem. It seems that all companies that have adopted the Bitcoin standard are those that have decided to put internal combustion engines in machines, or use electricity, the internet, or computers. Over time it becomes the rules.”

The strategy recorded a record $10 billion in profits in the second quarter last week.

Strategic Bitcoin holdings are currently worth $72.2 billion and are purchased at an average cost of $73,277 per coin. It holds approximately 3.16% of the total circulation supply of BTC.