Bitcoin

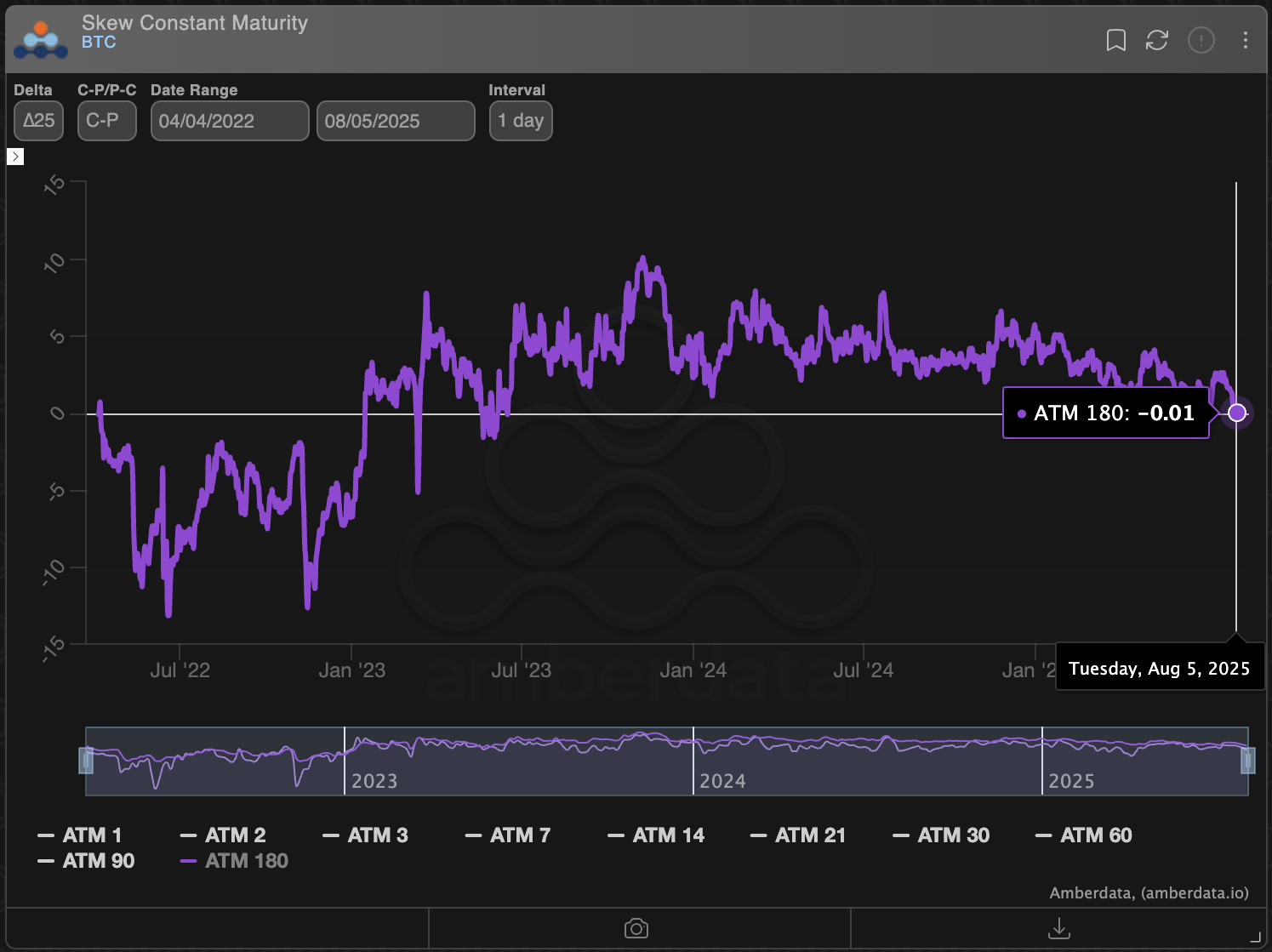

This is evident from the 180-day skew and measures the difference in implicit volatility between money out of the money call and put options registered in the Delibit. According to data source Amberdata, the metric has recently retreated to zero. This indicates that long-term market sentiment has shifted from bullish to neutral. This shift occurs, as some analysts warn the bear market in 2026.

A similar reset occurred at the start of the previous Bitcoin Bear market, according to Griffin Ardern, head of options trading and research at Crypto Financial Platform Blofin.

“I noticed some pretty worrying signs in the recent market pullback. The bullish sentiment about Bitcoin’s far-flung options has disappeared. Now it’s firmly neutral,” Ardern told Coindesk. “This means that the options market believes it will be difficult for BTC to establish a long-term uptrend, and the likelihood of new highs is decreasing in the coming months.”

“A similar situation last occurred in January and February 2022,” he added.

The PUT option provides insurance against price drops on underlying assets, while the phone offers asymmetric bullish exposure. Positive skew means bias against calls and indicates market bullishness, while negative skew suggests the opposite.

BTC 180 Day Option Skew. (Amber Data/Delibit)

A neutral shift in skew for 180 days could be driven in part by structured products selling higher strike call options.

The popularity of so-called covered call strategies can reduce the volatility that implied a call compared to PUT.

Macro Jitter

BTC fell more than 4% last week, nearly testing its previous record high of $11,965 as Core PCE, the Fed’s preferred inflation measure, rose in June.

The decline in prices has pushed short-term distortion below zero.

According to Ardern, the inflationary effect of “supply chain impulses” is already on display in economic data.

“In the final CPI report, the decline in car prices offsets the rise in prices for other products, but one thing cannot be denied. The impulse from the Pacific West Coast has reached the East Coast, and retailers are already trying to consume tariffs and related costs. Beware, we explain the updated neutrality of long-term BTC options.

According to JPMorgan, President Donald Trump’s tariffs are likely to raise inflation later this year.

“Global core inflation is projected to increase to 3.4% (annual rate) in the second half of 2025, primarily due to tariff-related US spikes,” investment bank analysts added that there is a high possibility that cost pressure will be concentrated in the US.

Increased inflation could make it difficult for the Fed to cut fees. Trump has repeatedly criticised the central bank for keeping interest rates up to 4.25%.

Traders will receive ISM’s non-manufactured PMI later Tuesday, providing insight into inflation in the services sector, which is a significant portion of the US economy. The July CPI and PPI releases will follow later this week.

Read more: Bitcoin is still on track at $140,000 this year, but 2026 will be painful: Elliot Wave Experts