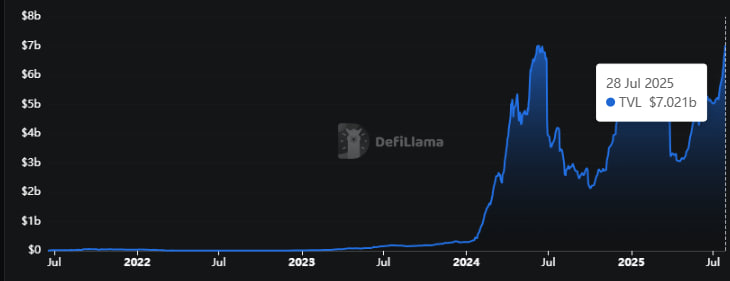

- Protocol’s TVL reached $7.02 billion today.

- Future developments such as Boros, HypereVM, and Converge suggest continuous growth.

- Pendle prices became bullish after an 8% rally.

Tokenization platform Pendle has reached $7.021 billion, reaching its highest ever-high in total value locked today.

The historic peak in June 2024 was $7.0113 billion.

The timing won’t improve.

The TVL milestone comes as Pendle awaits critical development in the coming weeks and months. This includes HypereVL expansion, Boross release and Converge launches.

Meanwhile, the total value locked surge shows more capital, especially as users trust Pendle’s yield trading mechanism, particularly in accordance with the latest Stablecoin regulations.

Digital tokens backed by real-world assets have grown their appetite since the US signed the act of genius.

In this article, we will evaluate what is expected as a protocol brace for the main catalyst.

HypereVM Expansion Causes Bullish Moment

Pendle stayed on the radar of the Crypto community as it prepares to launch HypereVM.

Speculation suggests that this fastest growing and most active EVM compatible chain could be released this week.

HypereVM enhances cross-chain interoperability of protocols and access to new audiences.

Future products are Layer 1 or Layer 2 or higher.

HypereVM provides information on the next generation of defi apps.

Early integration of Pendle will increase its appeal to new markets of collaboration, user activity and expanded liquidity.

The team launched HyperWaverfi on July 23rd, preparing for the launch of HypereVM.

As if there’s more evidence that HypereVM is the perfect place to build…but here’s it:

Pendle launched the hwhlp @hyperwavefi market just two days ago, but already has a $793 million tvl

Running $15 million on a 24-hour volume

In just two days, Hyperevm already has more tvls…pic.twitter.com/fudpetphld– July 26, 2025, Tobias Reisner (@reiisnertobias)

Boros unlock new utility

Another catalyst placement pendle for continuous growth is a Boros product.

Although details are still lacking, Boros aims to significantly improve the ecosystem’s TAM (total addressable market) and introduce new utilities in its yield assets.

Some people suggest that traders will be able to trade funding rates without having to interact with PERP and locking up fixed interest rates.

The product is scheduled for release in August and cements Pendle’s value proposition to attract more capital and users.

$PENDLE HYPEREVM Boros this week, August

ath tvl $700 million

All No. 1 price increase for Crypto over the last 30 days (438% increase)

Vependle Revenue Mooning

$ ena bread to butter

The direct beneficiary of the story of Ethereum Stablecoin and the currently passed genius law. pic.twitter.com/opkz4mbrea

– Big Ninja (@bigninjah) July 28, 2025

The Converge Alliance adds momentum

Pendle is one of the top partners of the upcoming Converge Platform, showing a deeper connection to the modular Defi protocol.

Tokenization platforms help you unlock yield transactions on multiple dollarized assets.

The collaboration reflects Pendle’s commitment to on-chain finance.

It is likely to increase the use and visibility of blockchain, and translates into more benefits for pendle holders.

According to Converge:

Tokenized assets require predictable, liquid, and configurable yield rails. By building Converge, Pendle brings in fixed-rate products, hedging, and liquidity strategies to bring tokenized securities and facility-grade dollar means.

Future launches, Stablecoin growth and the expansion of protocols could lead to increased Pendle growth in the coming era.

Pendle price outlook

Altcoin will trade for $4.72 after impressive performances over the past 24 hours.

Overcoming a critical resistance of $4.80 to $4.90 could support a significant benefit to $9.

Pendles are traded above the exponential moving averages of 50 and 100 on the 1D chart, showing opposite momentum.

Among the upcoming Pendle Catalysts, positive broad market sentiment is positioning altcoin for significant growth in the coming weeks and months.