The cryptocurrency market is currently at a turning point, with altcoins showing noticeable momentum, while Bitcoin remains locked in a narrow range. Despite recent attempts to rise in Bitcoin, flagship assets have struggled to overcome important levels of resistance.

At the same time, alternative cryptocurrencies are moving forward, supported by investor enthusiasm, increased leverage and changing emotions. This difference has led to a new stage in market dynamics. There, altcoins lead the rally, leaving Bitcoin in temporary uncertainty.

Bitcoin is stuck in high stakes range

Bitcoin remains stuck between around 115.6k and 119.5,000 dollars, according to analyst Michael Van de Poppe. The fact that it was not repeated beyond resistance suggests increased indecisiveness. Moves above the boundary could indicate the onset of bullish continuance, and could possibly set a new, all-time best test.

However, failing to keep support at $115.6K can cause deeper fixes. The zones serve as a storage area with zones ranging from $110,000 to $112K, attracting buyers to pay attention to discount input points.

Importantly, the lower part of the range reflects a concentration of fluidity, making it vulnerable to sudden sweeps. Therefore, any drop can cause ripple effects across the wider market, particularly affecting altcoins.

#bitcoin is still trapped in range and is waiting for the rise to come.

Break the South and see a deeper fix for #Altcoins.

– Mycal Van de Poppe (@cryptomichnl) July 23, 2025

Altcoins surge with record leverage

Meanwhile, Ether Wizz reports that Altcoins is experiencing explosive growth. Open interest in major Altcoins, including Eth & XRP, reached a $45 billion record since the beginning of July. This shows heavy leverage and increased confidence among traders.

Furthermore, Ethereum’s persistent volume surpasses Bitcoin for the first time since 2022. This shift highlights the growing preference for Altcoins among active market participants.

In sectors like AI tokens, defi, games and meme coins, profits outweighed Bitcoin last week. Furthermore, long-term ETH owners are refusing to sell.

The cost-based heatmap shows strong positions above $2.4k. This shows confidence, but sets a potential volatility stage if the exercise amount is reversed.

Altcoins are now obsessed with it, and it’s not just about hype.

Top Altcoin’s open interest reached an all-time high of $45 billion.

That means traders have more leverage than ever before.

And it’s not just a sector, it’s all major crypto sectors outweigh Bitcoin…pic.twitter.com/o5sxovejki

– Ether Wizz (@etherWizz_) July 23, 2025

Changing the growth of emotions and legal clarity fuels

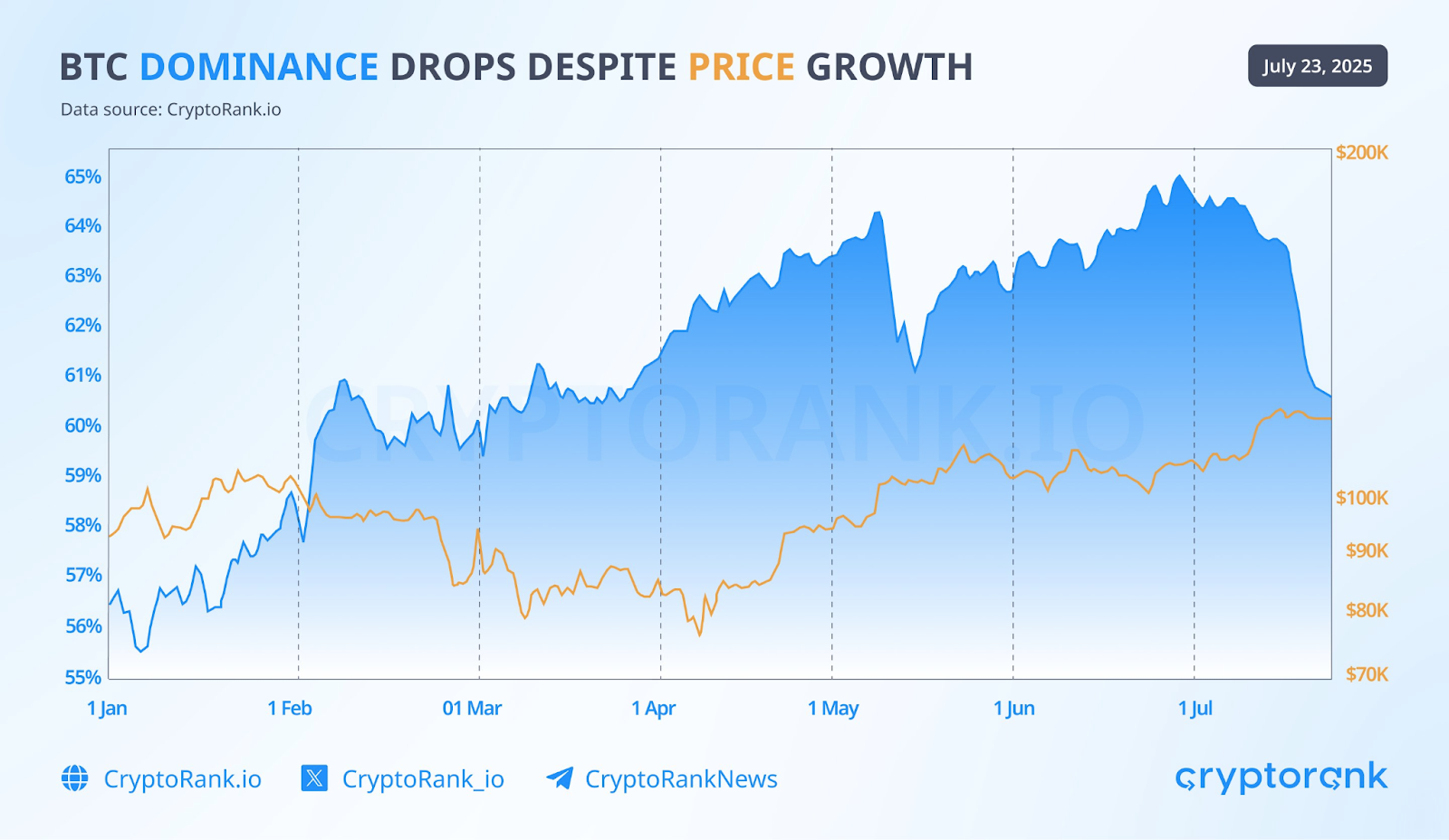

Data from Cryptorank confirms that Bitcoin control is sliding. Especially in the second half of July, the altcoins gained significant traction.

Source: x

The main driver behind this shift is the new law signed by President Trump. The regulatory move provides clearer legal guidelines for crypto assets. This boosts investors’ sentiment and institutional benefits.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.