Ethereum prices today are just above $3,640 after refusing to a sharp rejection from the $3,860 mark earlier this week. As ETH integrates under several important levels of resistance, recent breakdowns from its upward channel have shifted short-term sentiment towards attention.

What will be the price of Ethereum?

ETH Price Dynamics (Source: TradingView)

Ethereum recently ended its upward channel supporting rallying from mid-July. After peaking nearly $3,860, Price is below the lower limit of the channel and is currently retesting previous support as a resistance. The 1 hour RSI has recovered slightly to near 50.40, suggesting stabilization, but there is no confirmed trend inversion yet.

ETH Price Dynamics (Source: TradingView)

The weekly Fibonacci level shows ETH facing rejection at a 0.786 retracement level, around $3,525. The trends for the higher time frame remain bullish, but this zone now serves as a strong resistance until it is crucially recovered.

Why are Ethereum prices falling today?

ETH Price Dynamics (Source: TradingView)

The main reason for the decline in Ethereum prices today is that both horizontal resistance and the upper bollinger band cannot hold beyond the $3,800 zone where they intersect. That refusal led to a pullback to the $3,600 range.

The 30-minute chart shows prices that form a symmetrical triangle between $3,560 and $3,700. This is a pattern that usually resolves with a strong breakout. However, short-term traders are hesitant because RSI is still neutral and a parabolic SAR that exceeds the price.

In the 30 minute time frame, DMI shows a weak directional bias, ADX flattens out, and -DI is still above +DI. This confirms integration rather than trend structure. Meanwhile, the supertrend is red, with the bearded wimp at nearly $3,740, reinforcing the need for a breakout to regain bull control.

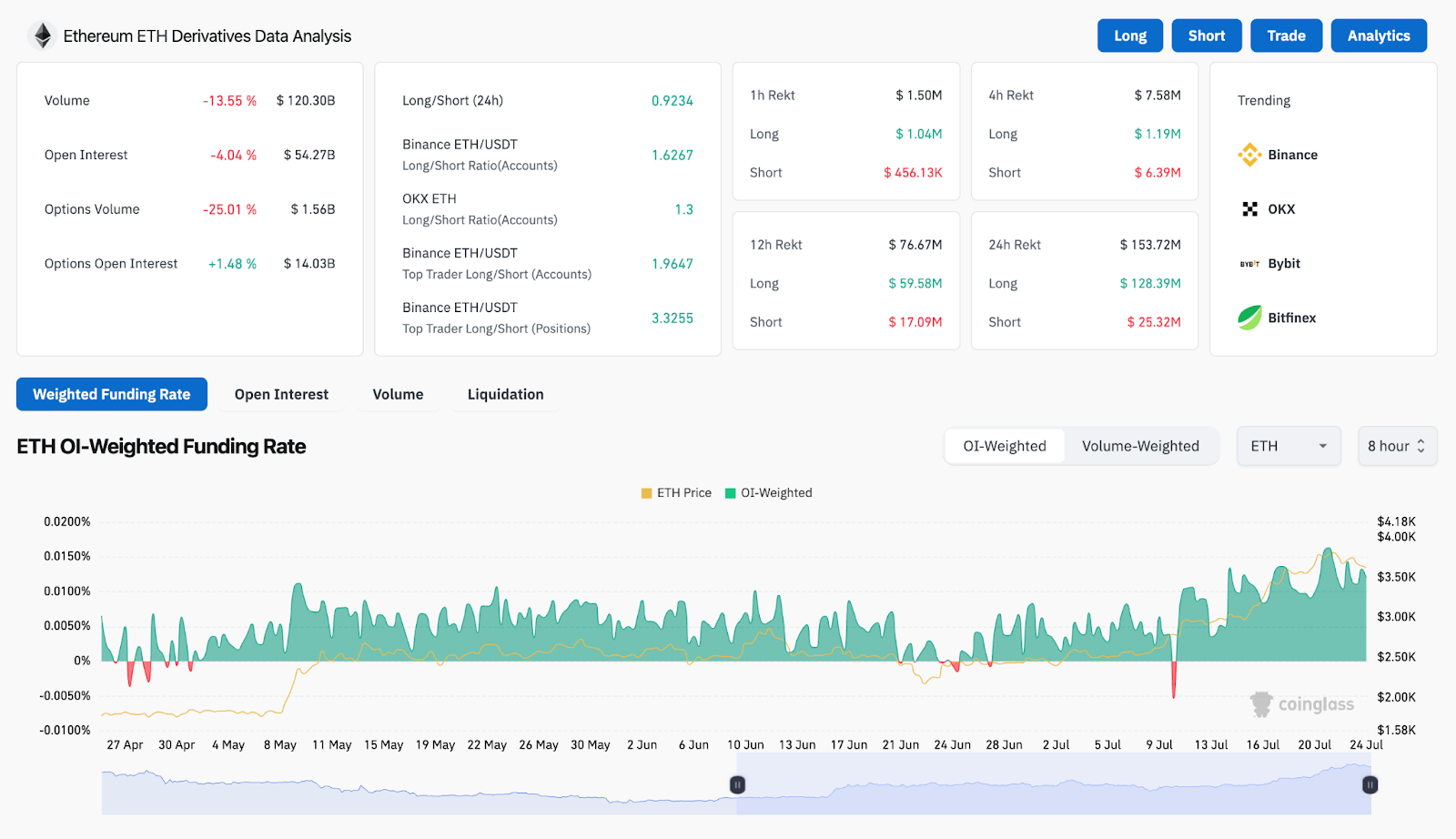

ETH derivative analysis (source: Coinglass)

Derived Coinglass data reflects this attention. The volume fell 13.55% to 120.30B, but open interest fell 4.04% to 54.27B. Furthermore, the amount of options has been reduced by 25%, indicating a speculative momentum of cooldown. Nevertheless, the long/short ratio for Binance and OKX top traders remains above 1.6, suggesting that many still support an upward continuation.

ETH Price Action Signals Resistance Clusters Nearly $3,700

ETH Price Dynamics (Source: TradingView)

Volume profile data on the daily chart shows an important point of control at around $3,299, but ETH is now well above that. However, the best volume nodes close to $3,800-$3,860 are still important rejection zones. Ethereum needs to break through this to continue its broader trend.

ETH Price Dynamics (Source: TradingView)

The 4-hour chart Bollinger bands are also beginning to be compressed, with prices lying between the mid-band and the low band. The most immediate resistance is $3,708, with support around $3,545 and $3,500.

On the four-hour chart, Ethereum prices trade just under 20 EMA at $3,669, embracing the middle bollinger band. The 50 EMA is $3,545 and serves as dynamic support. The candles are closing between $3,545 and $3,708, suggesting potential volatility breakouts over the next 24 hours.

Ethereum price forecast: Short-term outlook (24 hours)

In the short term, Ethereum prices could remain in range unless there is a breakout from a symmetrical triangle. A sustained move above $3,708 in volume could push ETH to $3,830 and then $4,000. If rejected again, the Bears could cut the price and retest $3,545 and $3,500.

If $3,500 cannot be held, the next demand zone will be $3,300, with 100 EMA and a large number of nodes offering Confluence support. As the Bollinger Band and RSI continue to flatten, traders should be aware of decisive breakouts above $3,700 or breakdowns below $3,545.

Ethereum price forecast table: July 25, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.