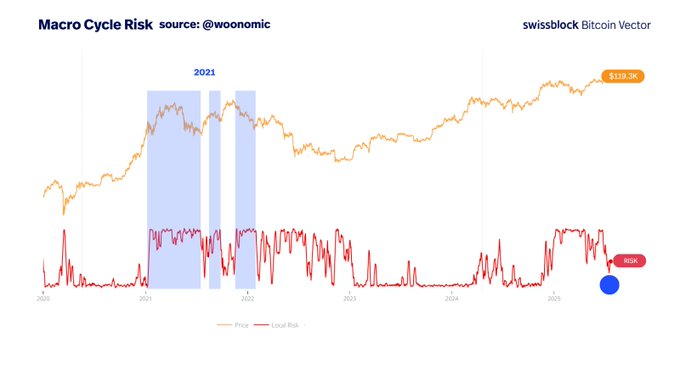

Bitcoin (BTC) has more upward potential despite just below record highs mid-month, according to Crypto Analytics platform SwissBlock.

The Analytics platform says that while Bitcoin is approaching an all-time high, the risk poses to the crypto king due to wider economic trends and global financial position remains low.

SwissBlock said the low macro risk is a “rare and historically bullish” signal for flagship crypto assets.

According to SwissBlock, the reason Bitcoin has enjoyed a small increase in the past few days is due to the fact that “the Bulls are not actively bidding.”

“They are waiting for volatility.”

Source: SwissBlock/X

Bitcoin is trading at $117,589 at the time of writing.

According to the Analytics platform, Bitcoin says it can rate around 17% from its current level before it realizes that Crypto King’s short-term holders are underwater based on the short-term holder cost-based model.

“The short-term holders are active, but not overheating.

The profit exists, but it has not reached the short-term holder risk zone (approximately $138,000).

This suggests there is still room for expansion before you see panic sales or happiness. ”

Source: SwissBlock/X

According to SwissBlock, Bitcoin’s bullish cycle has not ended despite Altcoins’ performance outweighing its short-term performance.

“BTC acts as a structural anchor rather than an explosive leader.

The bids are spinning into Ethereum, Solana, and High Collision Altcoins.

BTC keeps it. Altcoins will move.

The cycle does not end. It’s evolving. ”

Generated Image: Midjourney