In the race to control the institution’s holdings of Bitcoin (BTC), BlackRock is rapidly pulling ahead of the pack.

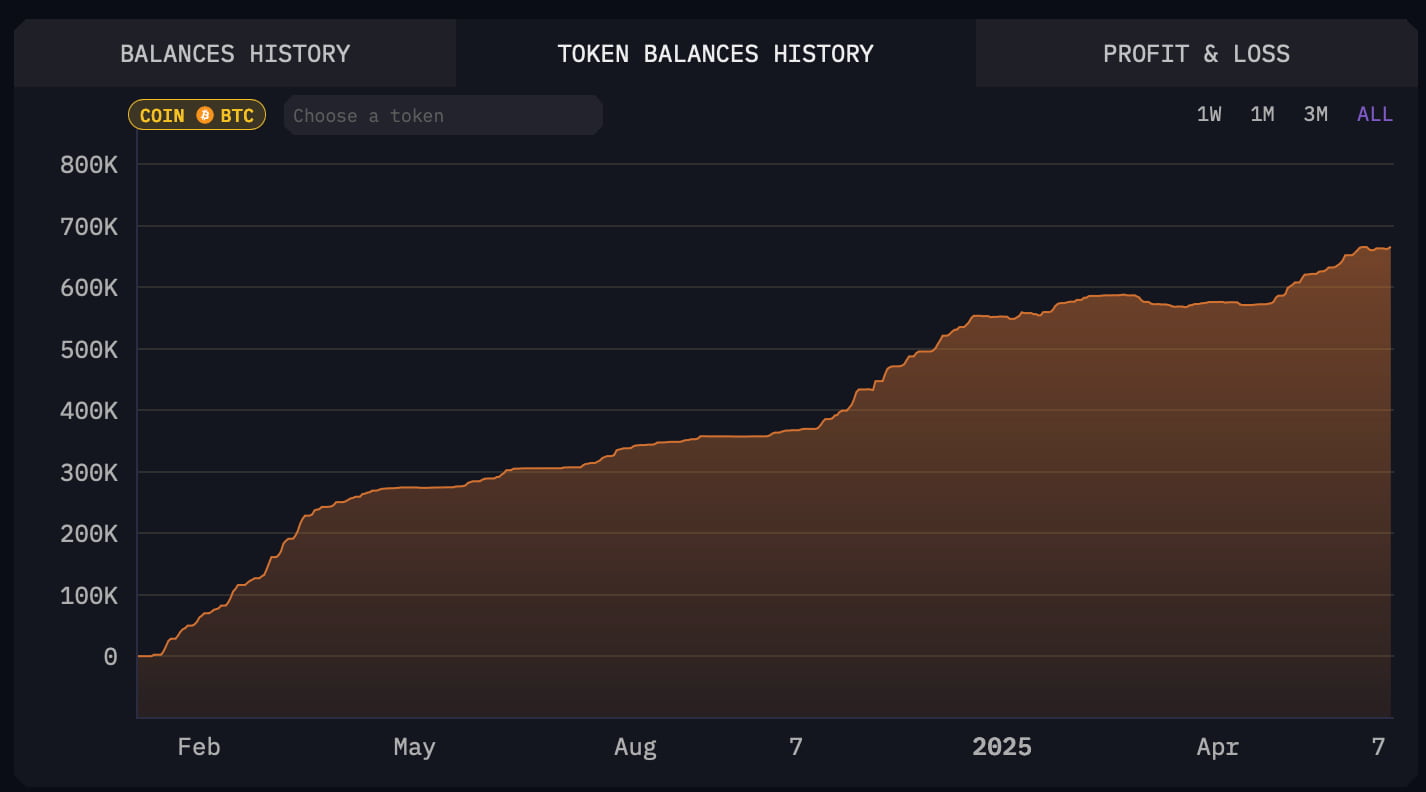

Through Ishares Bitcoin Trust (IBIT), the asset management giant has quietly built one of the world’s largest BTC positions.

According to fresh data obtained by Finbold from Arkham Intel, BlackRock currently controls 665,938 BTC, currently valued at around $69.83 billion as of Friday, June 13, 2025.

The position accounts for an estimated 94.8% of BlackRock’s $73.66 billion crypto portfolio, showing a clear focus on Bitcoin against other digital assets despite having purchased Ethereum daily for the past two weeks.

BlackRock is currently the second largest owner of Bitcoin globally

With this level of accumulation, BlackRock has moved ahead of major players like Binance and MicroStrategy. The IBIT Fund is currently the second largest owner of Bitcoin globally. Only the legendary wallet linked to Nakamoto Atoshi, the elusive creator of Bitcoin, holds more.

BlackRock’s aggressive move towards Bitcoin is part of a broader strategy. The company aims to become the world’s leading Crypto asset manager by 2030. In a corporate presentation issued Thursday, BlackRock stated its goal of managing at least $50 billion in digital assets within the next five years. Bitcoin remains the foundation of this goal.

Meanwhile, Bitcoin itself continues to attract institutional interest. Cryptocurrency is traded for over $104,000 at the time of press. As regulatory clarity improves and more capital flows into the market, BlackRock’s increasing share of Bitcoin ownership could reconstruct the landscape at the highest level of global finance.

Featured Images via ShutterStock