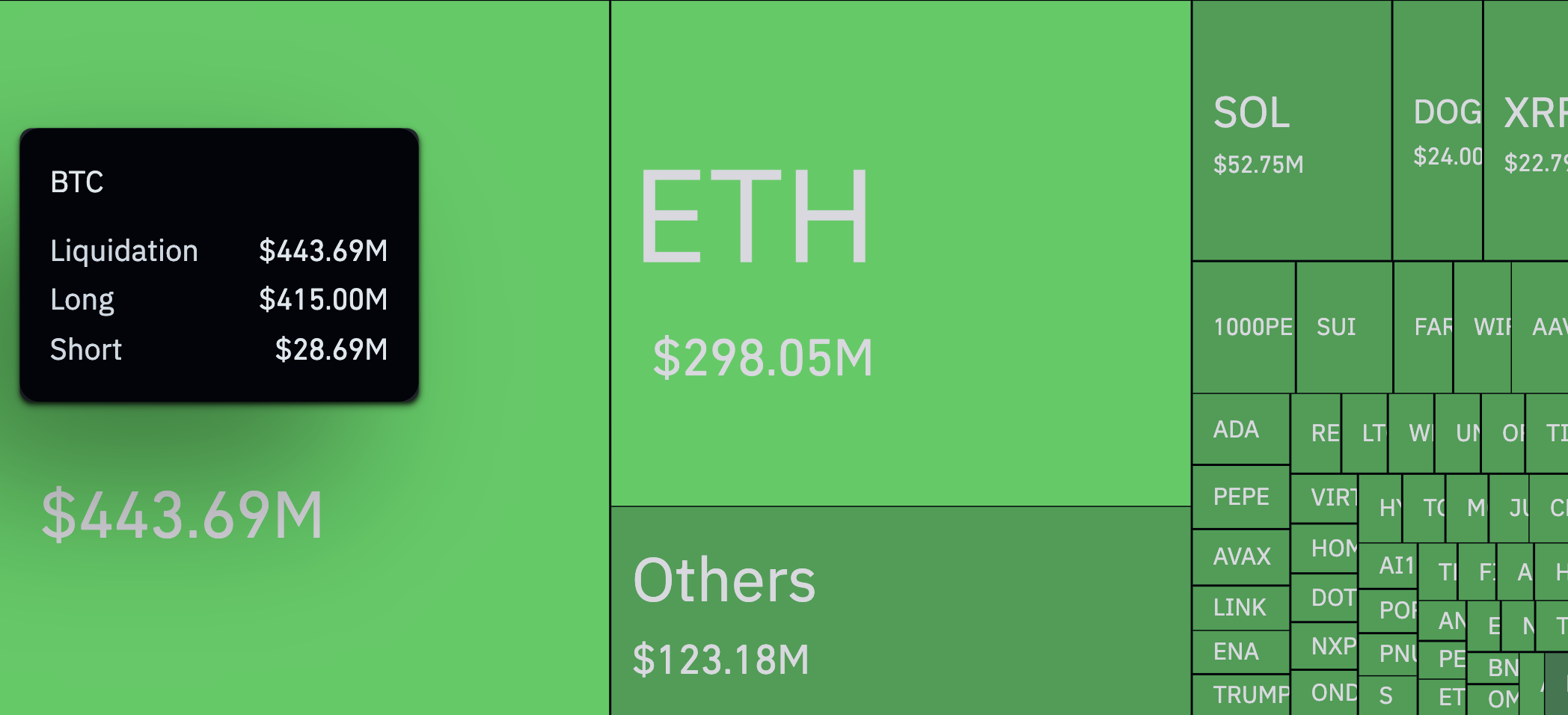

Over the past 24 hours, BTC has seen a literal tsunami of a long liquidation totaling $415 million – a 1,446% imbalance on both sides compared to shorts worth just $28.69 million. Coinglass data shows that this will reach up to $443.69 million in total liquidation of Bitcoin only.

The worst happened early when BTC fell below $103,000. The move sparked a chain reaction of forced liquidation, mostly hitting stacked longs.

ETH was then liquidated $298 million. Sol, Doge and XRP have also wiped out double-digit millions, bringing total crypto liquidation to $1.14 billion in one day.

The 12-hour chart shows the impact scale. Between the long and short positions, a whopping $524 million has been settled, of which more than $449 million comes from Long alone. The imbalance was also occurring in a short time frame, including $27 million in the four-hour window and $3.3 million in the past hour.

To put this into perspective, more than 241,000 traders were affected. The largest single liquidation? BTC/USDT long for $2 million at Binance.

Bitcoin has made a bit of a comeback, again exceeding $104,900, but the market is still nervous about the situation. Funding rates are everywhere, and liquidation trends allow traders to increase the turbulence over the weekend.

For now, the data suggests one thing. The leveraged bull was caught off guard. And the imbalance that follows can take a little time to relax.