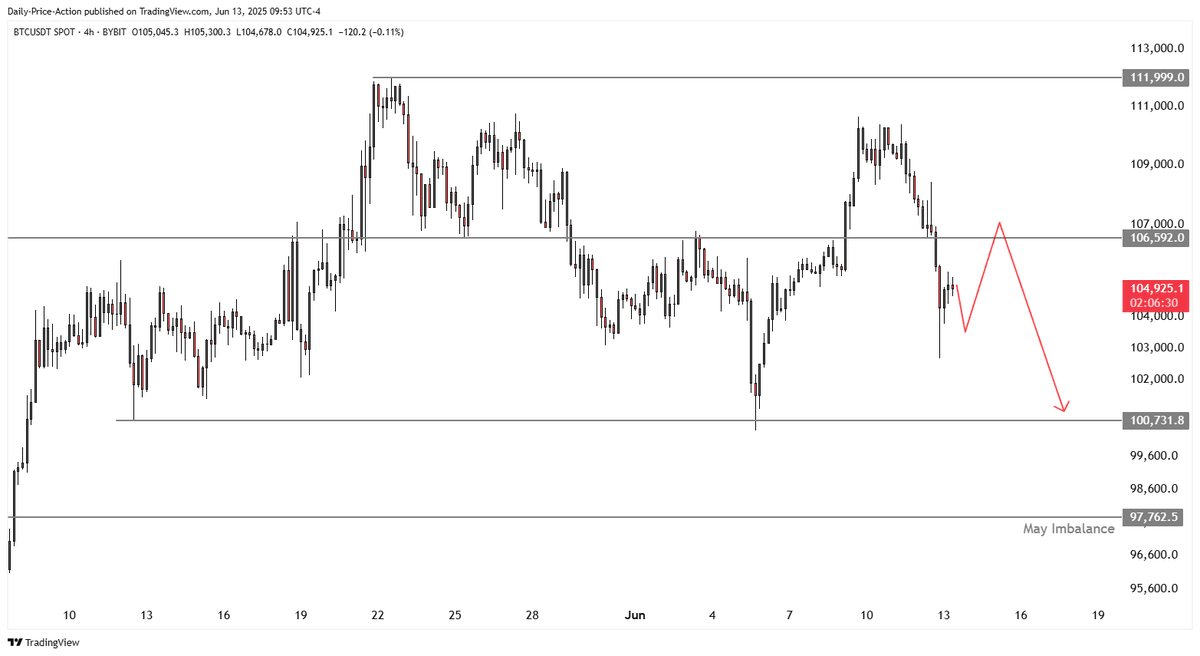

A widely-held Crypto analyst says Bitcoin (BTC) could be pulled back after it did not hold its main support level.

In a new thread, Crypto Trader’s Justin Bennett tells 116,000 followers on social media platform X that BTC could revisit the lower limit of trading range at the $100,000 level after a weekend bounce.

“A possible scenario for BTC following the $106,600 failure on Thursday. We will pull back from $106,000 to $107,000 for Friday weekend rally (because retailers do it), and revisit the $100,000 low.

Personally, I am not a buyer here and not after losing $106,600. It’s only shorts for me, but only if BTC gives me the opportunity to bounce. ”

Source: Justin Bennett/X

Bennett also says that BTC whales leaving their long positions in favor of building a short position in retail are causing the flagship crypto assets to weaken.

“The whales had strong retail shorts all day on Thursday. It was a scam BTC pump from the start.”

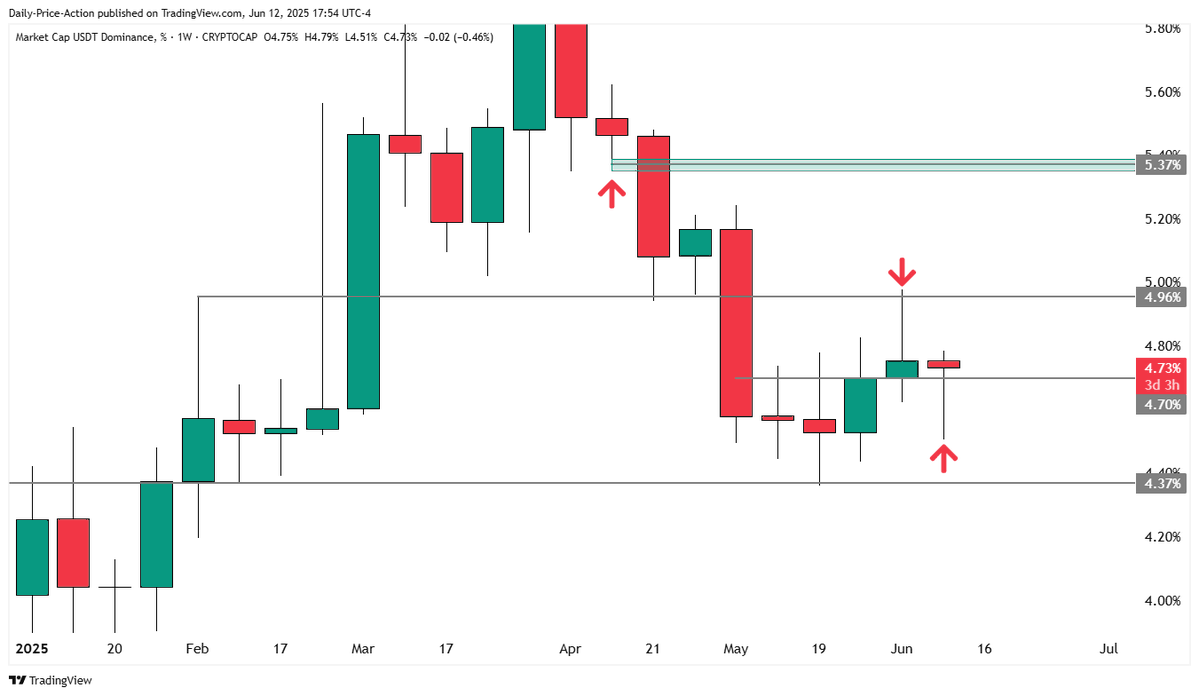

Finally, analysts warn that the USDT Dominance Chart (USDT.D) could start to blink Bitcoin bearish.

Many traders look carefully at the USDT.D chart, as it shows that Crypto’s market capitalization consists of Stablecoin USDT. Bullish usdt.d charts are generally considered bearish for Bitcoin and other cryptocurrencies as they show that traders are dropping their crypto holdings in favor of stubcoin.

“We’re not ready to call it yet, but USDT.D’s weekly chart is starting to prepare to push another primeback back to 5%. We’ll wait for nearly two days on Friday to get a more definitive answer on this idea, but so far it’s decent (tethered minance is inversely proportional to BTC and ETH).”

Source: Justin Bennett/X

Bitcoin is trading at $105,658 at the time of writing, down 1.6% over the past 24 hours.

Meanwhile, USDT.D is 4.79% at the time of writing.

Generated Image: Midjourney