The sudden surge in Bitcoin has exceeded $107,000. This was an epic proportions liquidation event, and a major change to the table for the short seller.

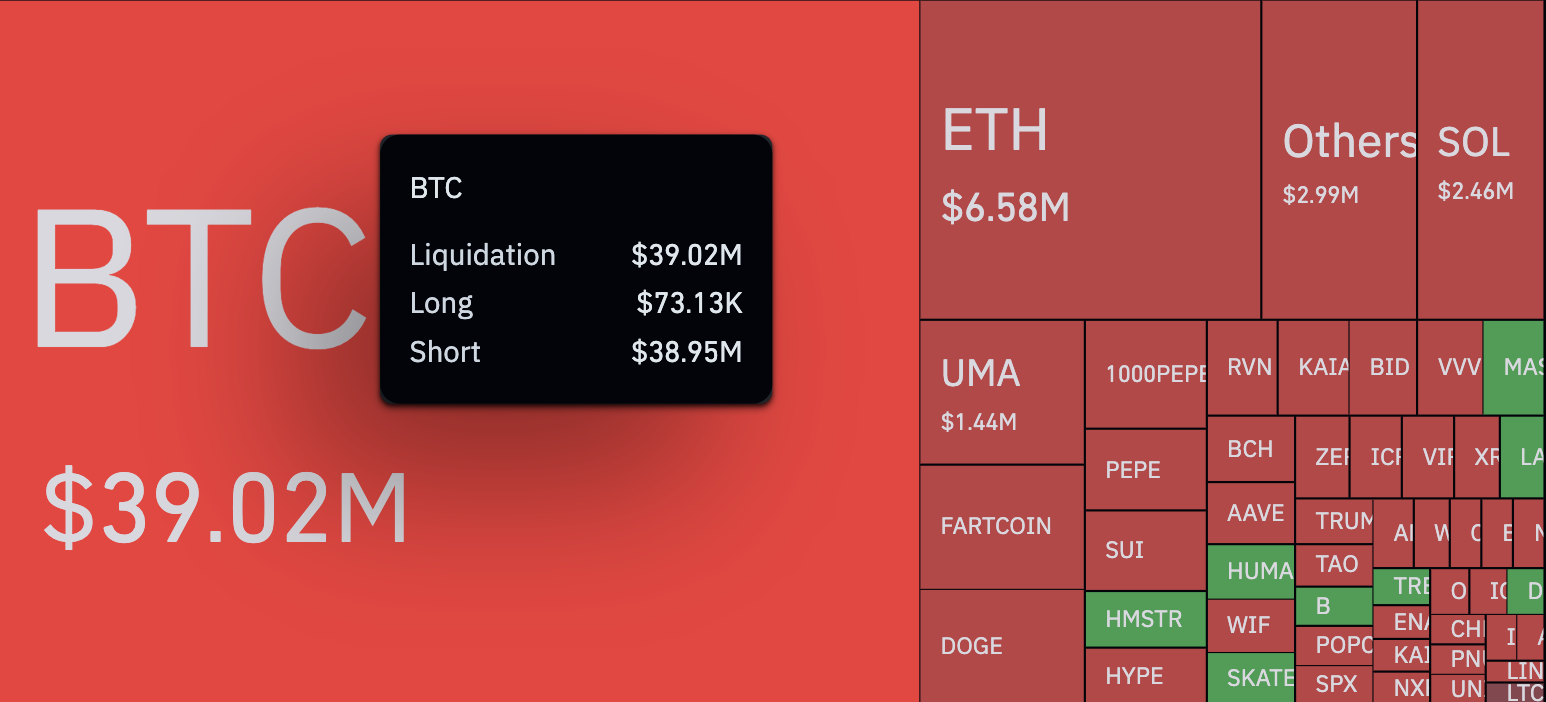

Over the past few hours, the rapid rise in BTC has liquidated an impressive $38.95 million, $38.95 million from shorts alone, and an impressive $38.9 million, $38.95 million, based on data visualized in Coinglass.

It’s not just an imbalance – it supports a long position with a distortion of 53,247%, making it one of the most biased liquidation snapshots Bitcoin has seen in a while.

Looking at the big picture, we have seen a total of $65.49 million in crypto liquidation over the past four hours, with shorts accounting for more than $61.6 million. It is clear that this was not just a BTC story, but a pain throughout the market for the bear.

Other major names have also been caught up in, but nowhere near the size of BTC. Ethereum had a $6.58 million liquidation, while Solana and Doge had small but notable clearing events. But what’s interesting is that Bitcoin completely dominated the heatmap in both its raw numbers and its relative influence. This suggests a concentrated bear squeeze.

The liquidation heat map changed to a deep shade of red, and the shorts were illuminated everywhere. Various Altcoins like Pepe and Sui follow suit, showing that the various story shorts were caught off guard by this sharp BTC breakout.

Unlike the typical slow climb, this is a full-speed, parabolic rise, a sudden vertical push that was partially fueled by the renewed US-China trade negotiations in London, which could have replicated global risk sentiment.