Binance has seen an increase in activity over the past month, bringing the biggest boost from the futures market. A clear bullish trend has increased demand for leveraged and aggressive trading to make the most of the market direction.

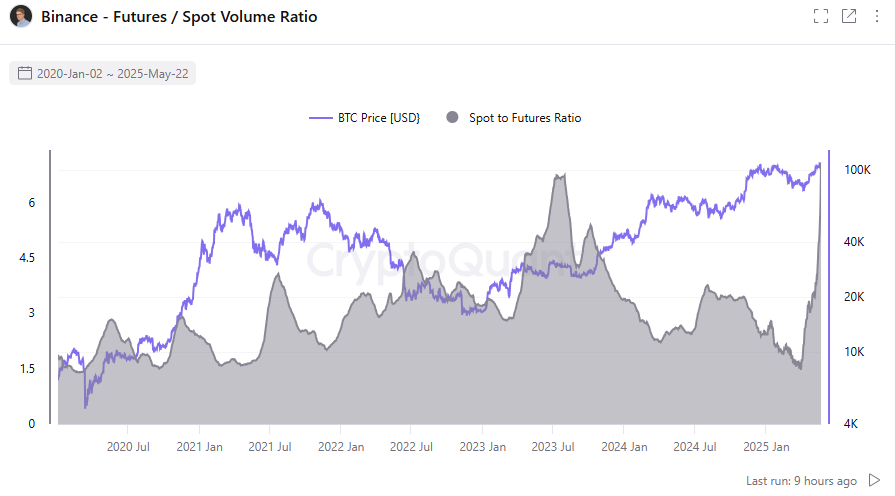

Binance is once again primarily in the futures market, increasing the proportion of future trading. The advantage in futures trading has been around nearly 1.5 years, reflecting an increase in open profits from BTC and other active assets. This ratio has increased vertically over the past month, reflecting changes in emotions and risk-taking.

Binance is carried $12.8 billion Of the open interest of total BTC, it maintains the most active market with a small price premium in the futures market.

The spot-to-futures ratio rose rapidly, returning to its highest level in 1.5 years. |Source: Cryptoquant

The volume of the future focused on Binance in 2025 as an uncontroversial leader. However, the OKX futures market has shown growth trends in the past years. In May, Binance Futures Markets carried a total trading volume of $1.250, getting back on track to surpass levels since April. Most of the volumes of Crypto futures are also concentrated in Bibit and Bitget.

Futures trading refers to speculative trends

Growth in futures trading suggests that the crypto market is returning to risk-on mode. Exploited futures trading offers the greatest short-term return, especially during periods of positive sentiment.

In Vinanence, futures traders are 4.9 times more active than spot traders. Although the accumulation continues with BTC and ETH, especially institutions and whale wallets, short-term profits are still considered in Altcoins or high-temperature assets.

The growth in futures trading has been transformed into higher terrifying and greedy indicators. Over the past week, the index has risen from 70 to 78 points, crossing into extreme greedy territory. Even the fear of liquidation does not stop traders from betting on a reversal of BTC’s direction.

Currently, most bets on BTC range from $110,000 to $112,000, with two price levels having the highest liquidity in futures positions.

On past days, BTC’s short positions also expanded to over 53% on most major exchanges, against the long positions of 46%. The behavior of a dangerous trader can be converted into another short aperture. Long-term traders have shown bullish sentiment, but remain cautious about liquidation.

Stablecoins flow from spot exchange

The main cause of increased futures and derivative activity is the availability of stubcoins. Binance is the main goal of the USDT inflow, carrying more than $24 billion in available tokens. Binance has increased its impact and currently holds more than 22% of all exchange reserves.

The spot exchange is barely carrying the $900 million reserve with ERC-20 USDT Stable Coin. Despite the record lows of BTC and ETH reserves, spot purchases from open markets remain very slow. Demand from whales, ETFs and corporate buyers also relies on OTC desks and private transactions.

Another source of futures and derivative activities comes from global market activities related to vinance. The exchange has blocked much of Europe from trading derivatives since 2022. Kraken tried to fill that niche and offered fully regulated crypto derivatives for the European market.