Japan’s long-term inflation is coming to life, spilling out the country’s bond market and fiscal forecasts. Amid growing concern, Metaplanet, a rather unlikely company, captures market attention and skepticism.

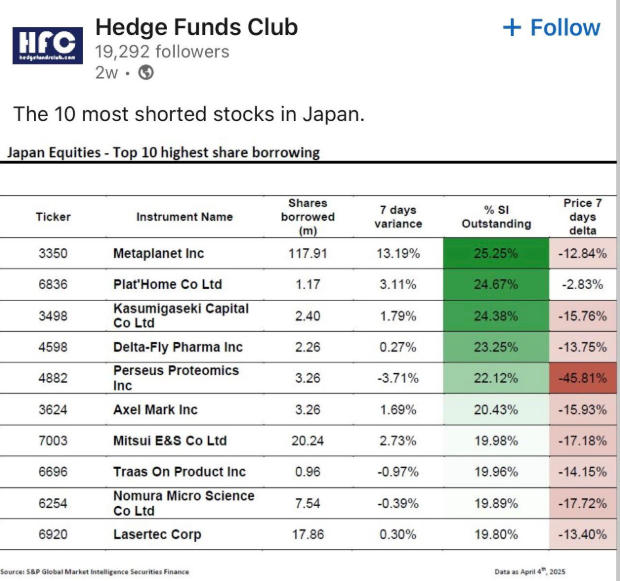

According to the CEO, Metaplanet, a Tokyo-listed company that surged more than 5,000% in 2024, is now Japan’s shortest stock.

Metaplanet: Japan’s most short-circuited stock amid financial turmoil

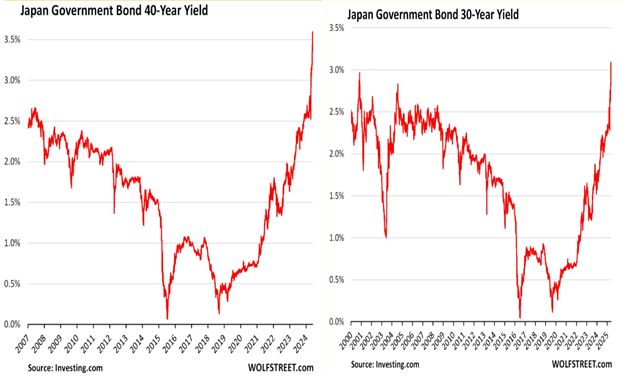

The increase in short positions in Metaplanet comes as Japan’s long-term debt market is revealed. Domestic inflation has reached 3.6%, and is now above the US Consumer Price Index (CPI).

“Apparently Metaplanet is Japan’s shortest stock. Do you really think that betting on Bitcoin is a winning strategy?” posted by CEO Simon Gerovich.

The shortest-circulated stock in Japan. Source: Simon Gerovich from X

High inflation has led to an unprecedented sale of Japanese government bonds (JGB). Since April, 40-year yields have increased by 1%, the highest for over 20 years, reaching an astounding 3.56%. Similarly, 30-year yields have skyrocketed to 25-year highs.

“It’s not just the “American Sell” deal that drives higher yields. In Japan, 25 years of extremely weak bond auctions have reached the highest level of 30 years of harvest. The Prime Minister (Isbaiba Island) is poorer than Greece’s financial situation. ”

Japanese government bond yields of 40 and 30 years. Source: Thuancapital of X

Against this backdrop, the Bank of Japan (BOJ) has started to actively cut bond purchases by loading and unloading 25 trillion yen ($172 billion) since its launch in 2024.

Despite this tightening, the real yield remains negative. Investors who previously purchased low-power JGBs suffered sudden losses, prompting a change in capital flow.

“Japan’s long-term bond market is in a free fall, causing surge in yields, losses to spread and global fallout,” Thuan Capital said in the post.

Structural changes in Japan’s bond demand have raised alarms overseas, particularly in the United States, where Japan holds $1.13 trillion in the Ministry of Finance.

A sustained setback from US debt could put more pressure on the already vulnerable American bond market.

Metaplanet’s Bitcoin Bet attracts short sellers to Japan’s crisis

Amid this dramatic macroeconomic upheaval, Japanese investors are seeking evacuation. For many young citizens, traditional office worker paths, Bitcoin and even Metaplanet have emerged as fundamental alternatives.

“The young Japanese are searching for an escape hatch to the grave to avoid suffering as a salaryman,” one user stopped at X.

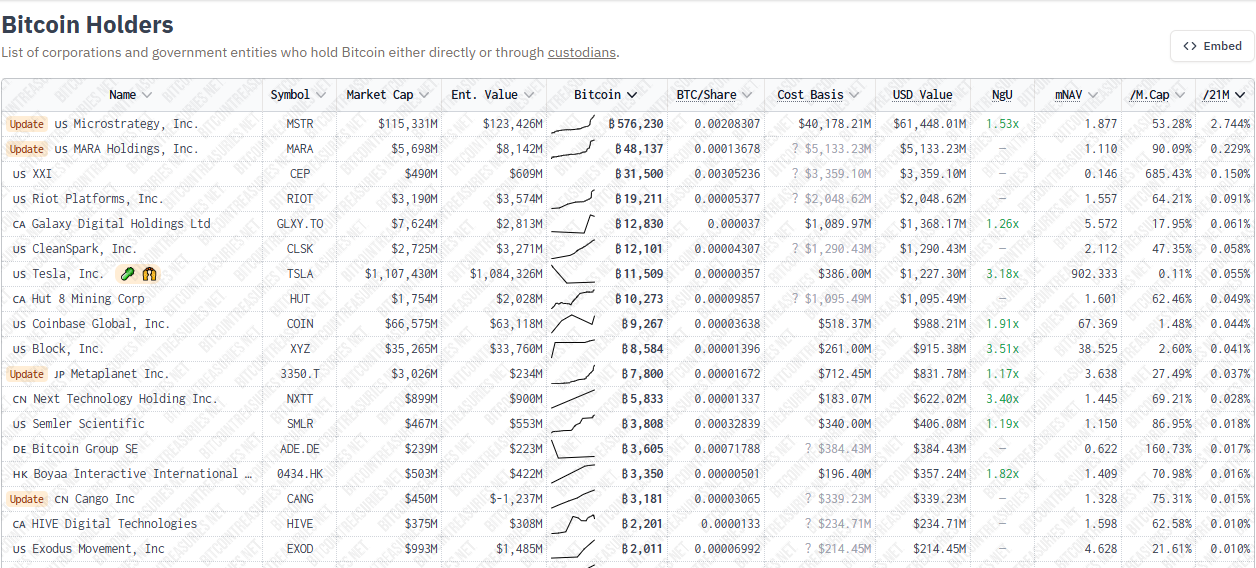

Metaplanet’s Bitcoin-centric strategy, reminiscent of US micro-strategy, made it stand out. Beincrypto reported that its stock, MTPLF, has reached a three-month height after a $104 million purchase of Bitcoin.

Similarly, its first quarter revenue reached $6 million, with Bitcoin earnings accounting for 88%. The company also outperformed El Salvador on Bitcoin Holdings metrics, following its recent BTC purchase worth $126.7 million.

Metaplanet Bitcoin Holdings. Source: Bitcoin Treasuries

But the rise has sparked a tough scrutiny from hedge funds and institutional traders. Some analysts suggest that short positions may be part of a sophisticated arbitrage strategy.

“Selling meta/purchase MSTR or selling meta/purchase BTC spreads alone looks like shorts, but they actually are spreading.

This suggests that traders will take advantage of the differences in valuation between metaplanets, Bitcoin, and Bitcoin proxy inventory, such as MicroStrategy. These dynamics reflect the Jim Chanos Playbook, shortening the MSTR while going for a long BTC.

As reported by Beincrypto, he cited the unsustainable premium of the stock compared to Bitcoin itself. However, others look at shorts in disbelief.

“Will Japan’s hedge fund bet on the Bitcoin Treasury and GDP on 263% debt on yield curve-managed land? You really can’t make up for this,” said Bull, a financial analyst.

Japan is wobbling at the edge of the sovereign debt crisis. Meanwhile, Metaplanet has become a lightning bolt of financial insecurity across the country, and a broader ideological clash between Fiat’s vulnerability and crypto convictions.

“Japan’s bond market is collapsing, and Metaplanet is the exit,” said Joe Burnett, head of market research at UNChained.

Whether the shorts are opportunistic or misguided, Metaplanet has now gone to zero due to Japan’s historic financial reset.