As Bitcoin continues to break records and reach record highs (ATH), a new wave of investment is emerging. This time, it’s not just from investment funds or individual investors. Traditional companies from various sectors are also jumping in.

From education, healthcare, housing construction to cybersecurity, businesses large and small all over the world compete to accumulate Bitcoin. They view it as a strategic asset sanctuary and are showing a major shift in companies’ perceptions of cryptocurrency.

Bitcoin accumulation throughout the industry in May

Public education company Genius Group recently announced a 40% increase in Bitcoin reserves. This move strengthens our long-term commitment to digital assets. Meanwhile, Basel Medical Group, a Singapore-based healthcare company, shocked the market by announcing its $1 billion in Bitcoin purchases.

These moves show that Bitcoin is no longer confined to technology and investment companies. Now we have reached a traditionally unrelated sector.

In Europe, the H100 Group became the first Sweden to adopt a Bitcoin Reserve Strategy. 4.39 We made an initial investment of 5 million knocks to buy BTC. Similarly, Blockchain Group, the first European company to hold Bitcoin reserve, added 227 BTC to its finances, bringing its total holding to 847 BTC. This solidifies its pioneering role in the region.

NIC, CEO and co-founder of Coin Bureau, commented on the news, “We’re building up Europe’s stack at the corporate level.”

These actions underscore the growing acceptance of Bitcoin as a strategic asset, especially as its value reaches new heights.

Manufacturing and retail companies will participate in the movement

Manufacturing and cybersecurity companies are also involved. Boxabl, a modular home maker, has declared Bitcoin as a reserve asset. This move shows the construction industry’s shift towards digital finance. At the same time, publicly available US electric vehicle retailer JZXN has approved plans to purchase 1,000 BTC within next year.

The participation of companies from seemingly unrelated industries, such as automobiles and housing, indicates that Bitcoin has become a popular option for diversifying its corporate portfolio.

Several Web3-related companies also moved to build Bitcoin reserves in May after reaching the new ATH. Cybersecurity company SecureTech has announced its preliminary strategy. Roxom Global raised $17.9 million to fund the Bitcoin Reserve and expand its media network.

These initiatives reflect a strong ambition to combine digital assets with innovative business models.

Bitcoin is a macro asset with limited supply

A recent report from Beincrypto suggests that there were few retail investors at this latest rally. However, the flood of the company’s announcement of Bitcoin acquisition shows a wave of institutional FOMOs (fear of missed).

Strategy is one of the leading companies in this trend. When Bitcoin reached a new high, the value of its BTC holdings surged to $64 billion. But they haven’t stopped. The company recently announced plans to raise another $2.1 billion to continue its Bitcoin purchasing strategy.

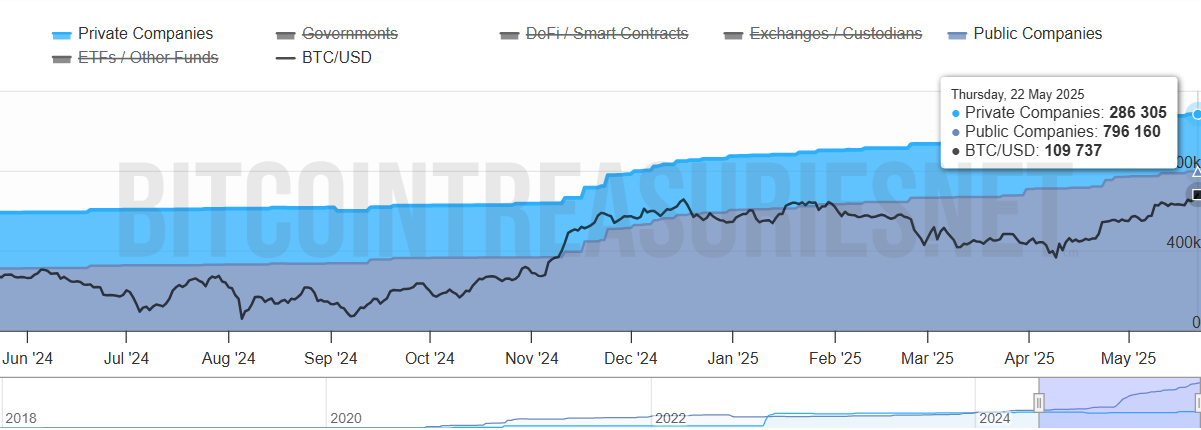

Total Bitcoin accumulated by companies. Source: Bitcoin Treasuries

Data from Bitcoin’s Treasury shows that private and public companies currently own more than 1 million BTC. This is more than 5.4% of the circulation supply. Meanwhile, the supply of Bitcoin remains fixed, and the number of companies accumulating it continues to grow each month.

“Bitcoin, which breaks over $110,000, reflects a new reality. It’s no longer a fringe asset. It’s a macro instrument, an influx of ETFs, and a sovereign interest, and structurally limited supply drives institutional demand on a large scale. Mike Cahill, CEO of Douro Labs, said in an interview with Beincrypto.

This trend proves that Bitcoin has gained institutional trust in 2025. It is no longer being rejected as a financial bubble. Instead, it is recognized as a strategic asset of the future.