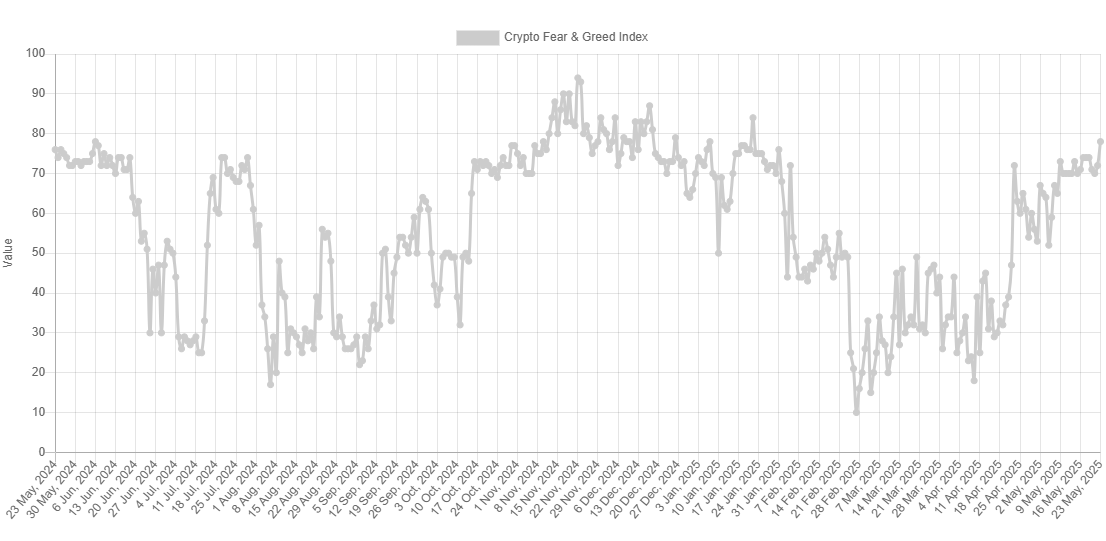

Data shows that sentiment in the Bitcoin market is split into territory of extreme greed after it surpasses the new high of cryptocurrency above $111,000.

The Bitcoin Fear & Greed Index has skyrocketed recently

“Fear & Greed Index” refers to metrics created by alternatives that communicate to us about the sentiment held by the average trader in Bitcoin and the broader cryptocurrency market. Metrics use numerical scales that run from 0-100 to express emotion. All values above 53 represent greed among investors, while values below 47 indicate fear. The index between these two cutoffs means a net neutral mentality.

In addition to these three main zones, there are two “extreme” areas called The Extreme Treed (over 75) and Extreme Fear (under 25). Currently, market sentiment is among the two former, according to the latest values of Fear & Greed Index.

Historically, extreme emotions have retained great importance for Bitcoin and other digital assets, as they tend to form major tops and bottoms. But the relationship was the opposite, but an overly bullish vibe allows for tops, meaning it goes beyond the bottom of despair.

This is because some traders use this fact to measure their purchase and sales movements. This trading technique is commonly known as reverse investment. A famous quote from Warren Buffet is, “Fear when others are greedy and others are greedy when they are greedy.”

With Bitcoin’s sentiment now returning to the extreme greedy region, it is possible that followers of this philosophy are beginning to look at the exit.

That said, the Fear & Greed Index is currently worth “Just” 78. For comparison, the top in December was around 87, and on January 1st it occurred at 84.

So, assuming that demand from investors is not lost, it is likely that the current market is not overheated in terms of sentiment. However, it remains to be seen how Bitcoin and other cryptocurrencies will evolve under this extreme greed.

Speaking of demand, Whale has just made a significant amount of withdrawal from the Binance platform, as pointed out by X-Post-encrypted community analyst Maartunn.

The indicator shown on the chart is “Exchange Netflow.” This shows the net amount of Bitcoin moving into wallets associated with central exchange.

Clearly, Binance Exchange Netflow has observed a large negative value, meaning investors have shifted a notable amount of coins out of exchange. More specifically, the net spill of the platform was 2190 BTC or about $237 million.

This could potentially indicate demand from large-money investors to embrace cryptocurrency in their independent wallets.

BTC price

At the time of writing, Bitcoin has increased by more than 4% over the past seven days.

Featured images from charts on Dall-E, cryptoquant.com, altrtivative.me, and tradingview.com