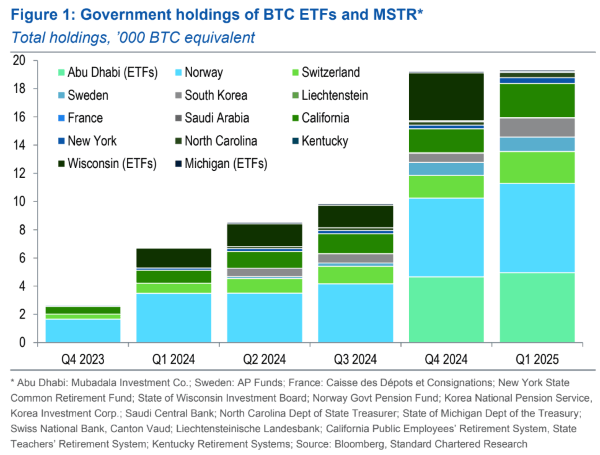

A wider range of institutions are purchasing Bitcoin proxy for their investment portfolios, according to a study by Standard Chartered Bank.

Bitcoin Eyes $106K Support Level As big money flows

London-based Standard Chartered Bank announced its investigation on Tuesday, according to a recently submitted 13-F document.

The Securities and Exchange Commission (SEC) requires institutional investment companies that manage more than $100 million to report their holdings quarterly by filing 13-F forms. The submitted forms are publicly available and provide detailed insight into the assets invested by large institutions such as public pension funds.

Standard Chartered reviewed 13-F data in the first quarter of 2025 and noticed an increasing number of companies seeking Bitcoin exposure via Strategy (NASDAQ:MSTR) stocks. Previous data shows that BlackRock’s Spot Bitcoin Exchange-Traded Fund (ETF) or Ishares Bitcoin Trust (IBIT) are the most popular routes to exposure to cryptocurrency. However, interest in Bitcoin ETFs subsided in Q1, which led to a surge in popularity, despite the long-standing view of MSTR as a proxy for Bitcoin. A standard charter is sufficient to predict a $500,000 BTC price by January 2029.

(13-F data/standard chartered studies showing public entities holding spot ETFs and/or MSTRs for Bitcoin in the first quarter of 2025)

“The latest 13F data from the U.S. Securities and Exchange Commission (SEC) supports a core paper that will reach the level of US$500,000 before Bitcoin (BTC) takes office before Trump takes office. “We believe that as more investors access assets and volatility decreases, the portfolio will move from the BTC’s underweight starting position towards the optimum level.”

Market Metric Overview

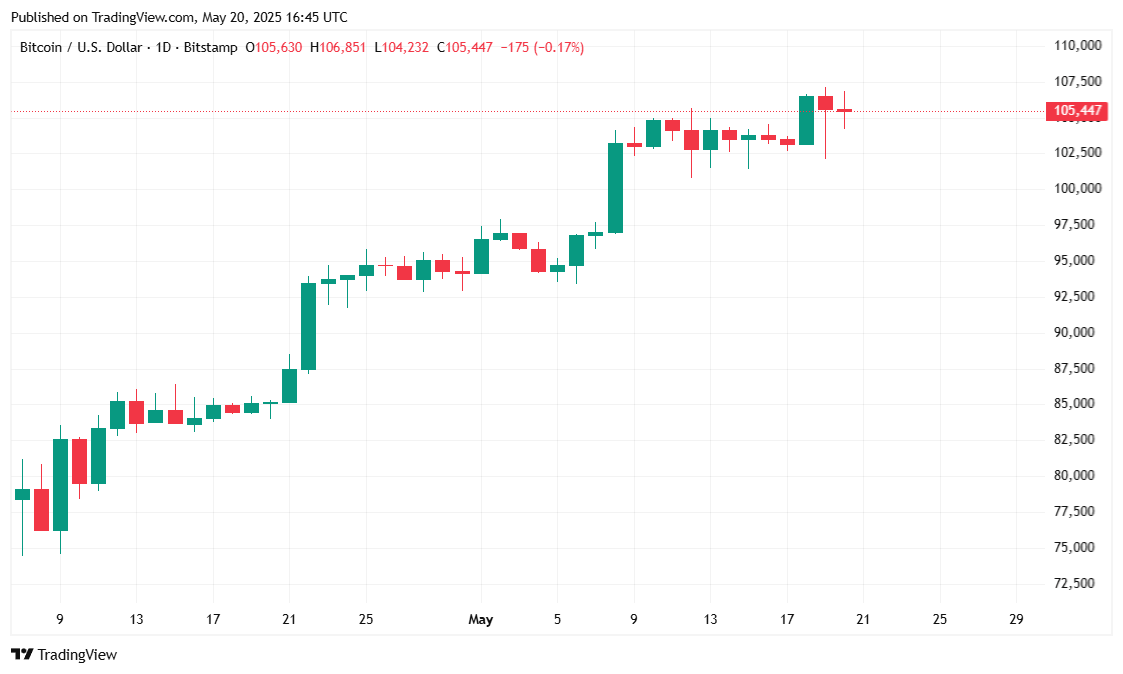

Bitcoin is mostly traded sideways, currently at $106,070.90, an increase of 0.95% over the last 24 hours and a 2.15% increase from last week, according to data from CoinmarketCap. Cryptocurrency is trading within the 24-hour range of $104,206.52 to $106,814.18, suggesting a relatively stable price action. It also saw a slight rise of 0.26% in its market capitalization, bringing the total BTC rating to $2.09 trillion.

(BTC Price/Trade View)

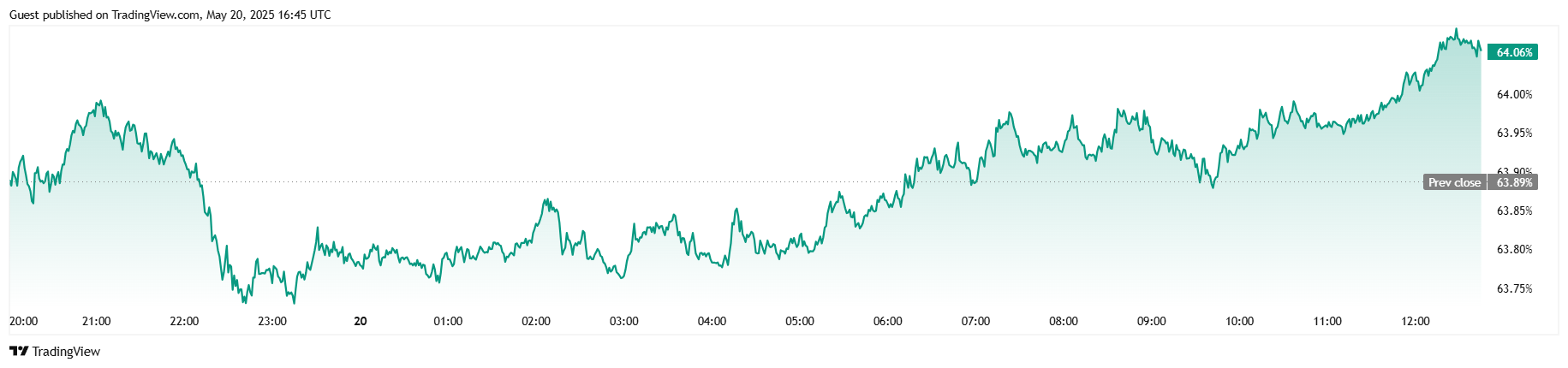

Despite its stability, trading volume has cooled considerably, falling 23.14% to $513.2 billion over the past 24 hours. However, BTC’s advantage in the crypto market rose just to 64.05%, up 0.26 percentage points, indicating a mild shift in capital to cryptocurrency despite a slightly restrained market activity. Open interest on futures has remained almost flat, up 0.05% to $71.2 billion, indicating traders are still cautiously involved.

(BTC dominance/trade view)

Coinglass data reveals that the Bears are betting the wrong way today and the same as yesterday. Of the $1.53 million total liquidation over the past 24 hours, almost all liquidation, almost all liquidation, came from short positions compared to the long liquidation of just $10,040.