Bitcoin (BTC) faces a combination of bullish signals and short-term uncertainty. Moody’s recent downgrade to US credit ratings has heightened long-term bullish sentiment around BTC and strengthened its role as a hedge against increased debt and fiscal uncertainty.

On the other hand, on-chain data shows that bitcoin supply is declining in exchange, suggesting investors are leaning towards holding rather than selling. Despite these bullish fundamentals, BTC is in a short-term integration phase, with price action requiring higher momentum.

Moody’s downgrade ends a century-long US full credit rating streak

Moody’s downgraded the US credit rating from AAA to AA1, removing the country’s last perfect score among the major credit institutions.

This is the first time in more than a century that all three ratings have been shortened by S&P in 2011 and Fitch in 2023.

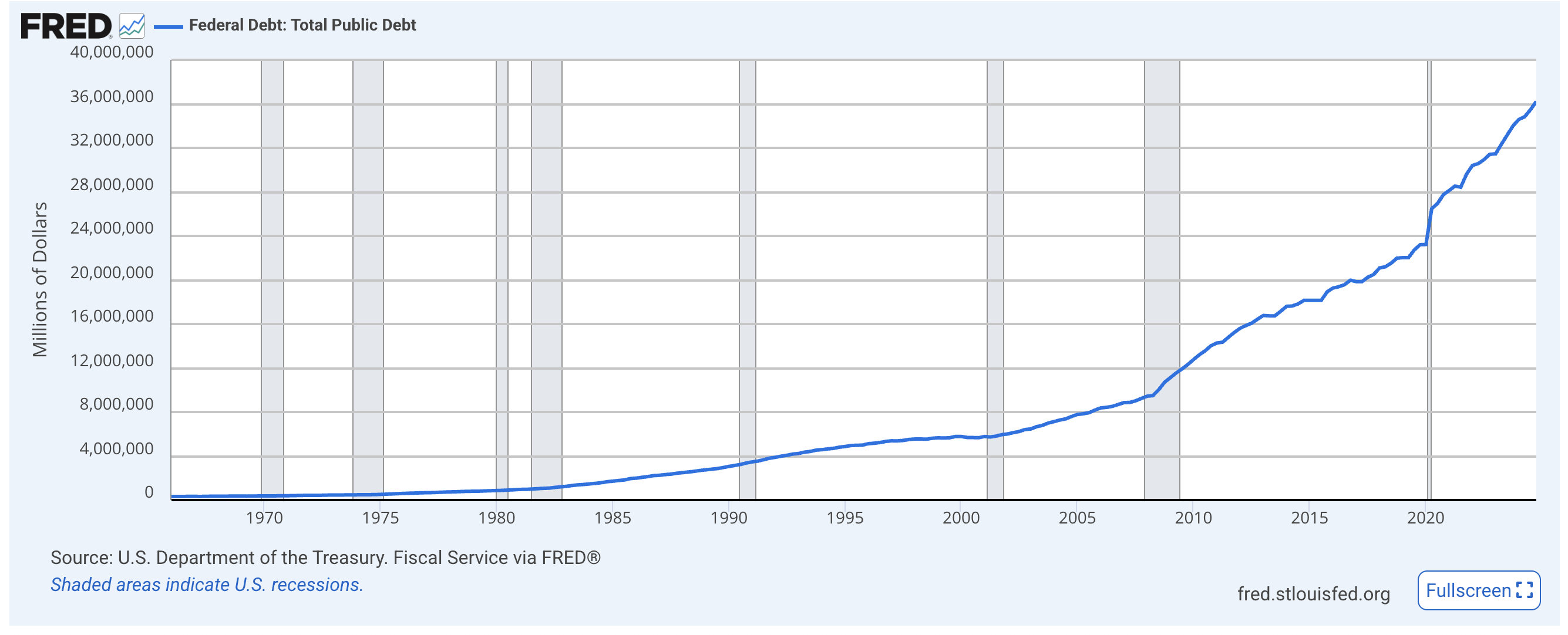

U.S. public debt. Source: Fred.

The market responded quickly. Finances climbed, and stock futures slipped. The White House rejected the downgrade as politically driven, and lawmakers still negotiated a $3.8 trillion tax and spending package.

The Moody’s also warned that extending the Trump-era tax cut could deepen the deficit and push it to 9% of GDP by 2035. This is a scenario that could enhance the appeal of Bitcoin, particularly as a hedge against long-term fiscal instability.

Bitcoin integration: A decline in exchange supply meets unilateral indecisiveness

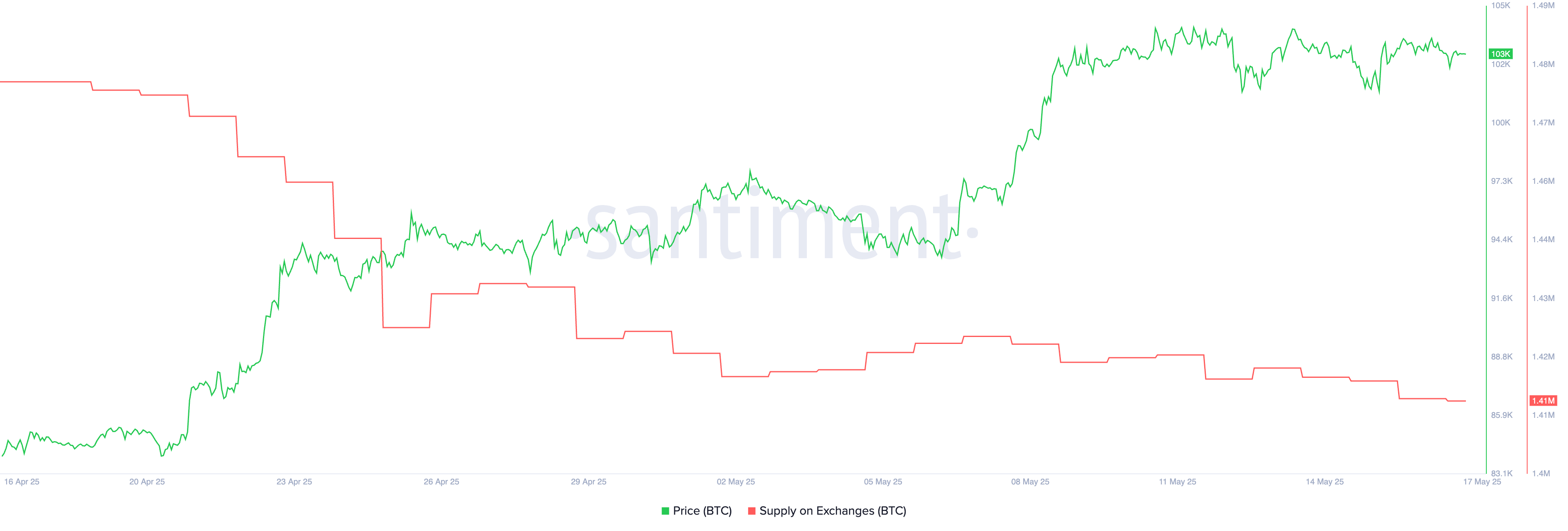

After a brief rise from 142 million to 1.43 million between May 2 and May 7, Bitcoin exchange supply has declined again.

This short increase followed a larger decline between April 17th and May 2nd, when exchange supply fell from 1.47 million to 142 million. Currently, the metric has resumed its downward trend and is currently sitting at 1.41 million btc.

Bitcoin supply on exchanges is a key market indicator. If more BTC is held on the exchange, it often indicates potential sales pressure.

Exchange BTC supply. Source: Santiment.

Conversely, a decrease in exchange balance suggests that owners will move the coins to refrigerate and reduce recent sales pressure (bullet signal). The current drop reinforces the idea that investors may be prepared to hold rather than sell.

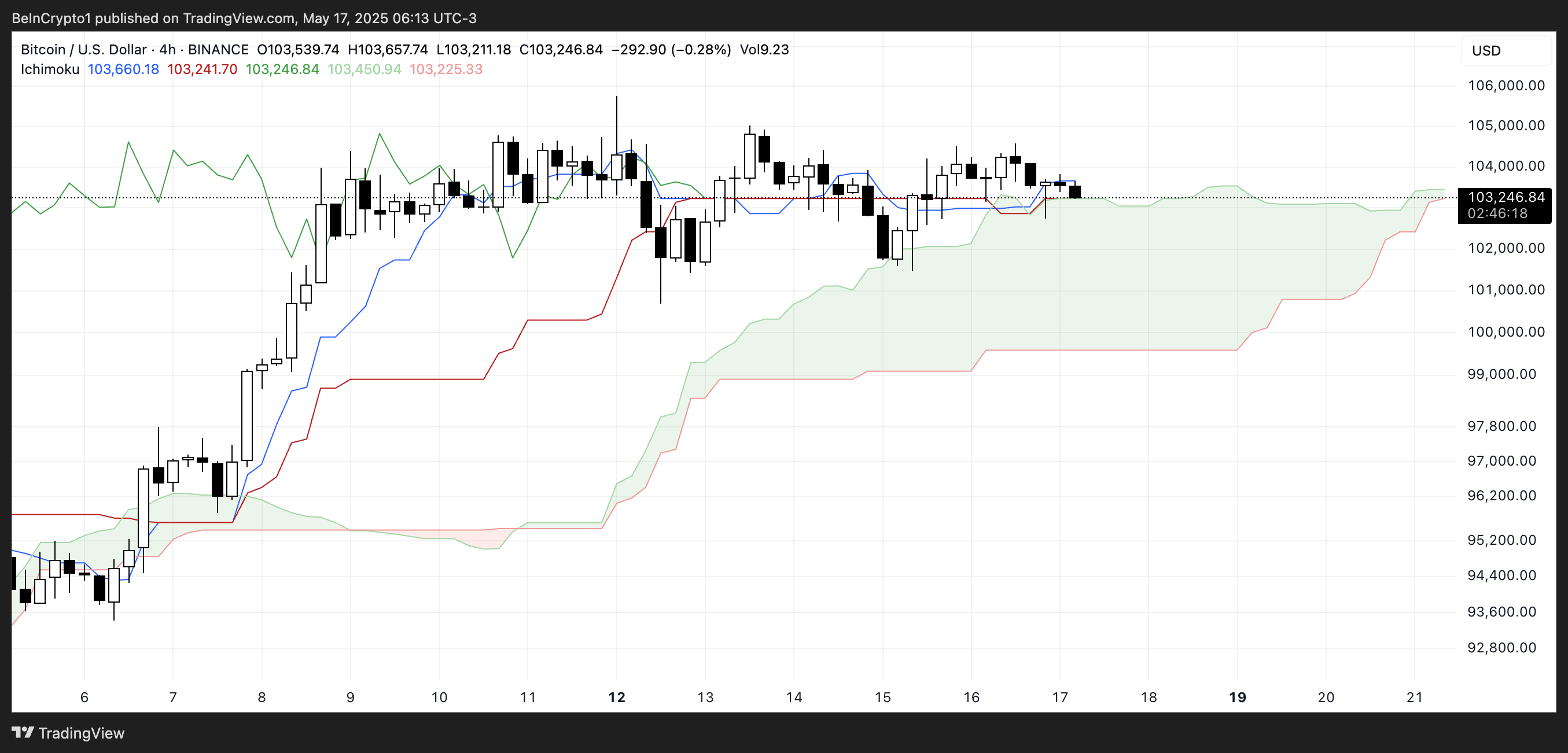

The Limb Cloud Chart for Bitcoin shows the integration period using signals with lights from neutral to light. The price currently sits around the flat kijunsen (red line), indicating that there is no strong momentum in either direction.

btc icchimoku cloud. Source: TradingView.

The Tenkan-Sen (blue line) is also flat, closely tracking prices, enhancing this lateral movement and short-term indecision.

Senkou’s spans A and B lines (forming green clouds) are also relatively flat, suggesting market equilibrium. Prices run near the top of the cloud and usually serve as support. However, there is no strong trend confirmation at this time, as the cloud has not expanded and it has a flat structure.

The Chikou span (green lag line) slightly outperforms the price candle, implying a mild bullish bias, but overall, the chart shows indecisiveness and the need for breakouts to see the next direction.

Moody’s downgrade strengthens Bitcoin’s long-term bull incident amid short-term integration

The US, which lost its final full credit rating after Moody’s downgrade, could be a major long-term catalyst for Bitcoin.

While it may not cause immediate price measures, downgrades reinforce the narrative of fiscal instability and growing debt concerns. This is a condition that strengthens Bitcoin’s decentralized hard cap appeal as an asset.

In the medium to long term, more investors may turn to BTC as a hedge against sovereignty risk, which can undermine trust in the traditional financial system.

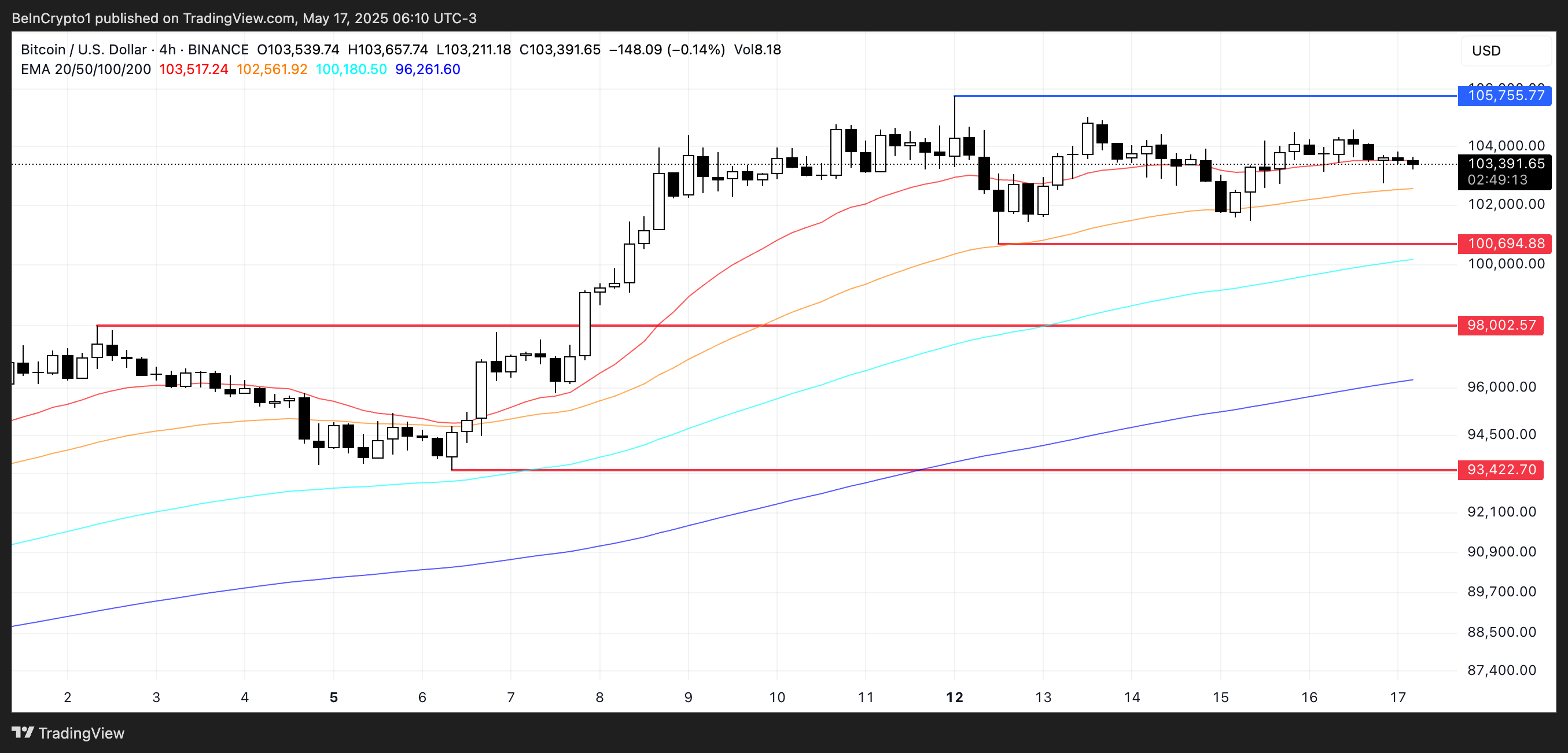

BTC price analysis. Source: TradingView.

However, in the short term, Bitcoin will remain in the consolidation phase after it exceeds $100,000. Its EMA lines are still bullish, with short-term averages above the long-term ones, but they’re flattened.

To resume bullish momentum, BTC will need to push beyond the $105,755 resistance.

On the downside, it’s important to exceed the $100,694 support. Opening the door to decline could be $98,002, potentially $93,422.