Ethereum (ETH) discovered key price levels and regained a macro range of $2,200-$4,000. The rise has created excitement among investors, with analysts projecting an upward movement. A recent analysis by Crypto analyst Rekt Capital shows that a recovery from Ethereum above the $2,200 mark could lead to gatherings within newly revived ranges.

Ethereum regains the $2,200-4,000 range

The price of the Ethereum shows incredible strength, bouncing off a dip below $2,200 to ensure a critical range. According to Rekt Capital, this price recovery is likely to experience continuous upward momentum, especially as it settles within the macrozone of between $2,200 and $4,000.

$ eth

Key Ethereum Weekly Close is secure

Ethereum has regained the macro range from $2,200 to $4,000

History suggests that over time, Ethereum is likely to lift beyond its reach

If necessary, any DIP solidifies $2200 only as low-range support #ETH #CRYPTO #ETHEREUM https://t.co/gtm5xcznwp pic.twitter.com/fyglz8qefj.

-Rekt Capital (@RectCapital) May 12, 2025

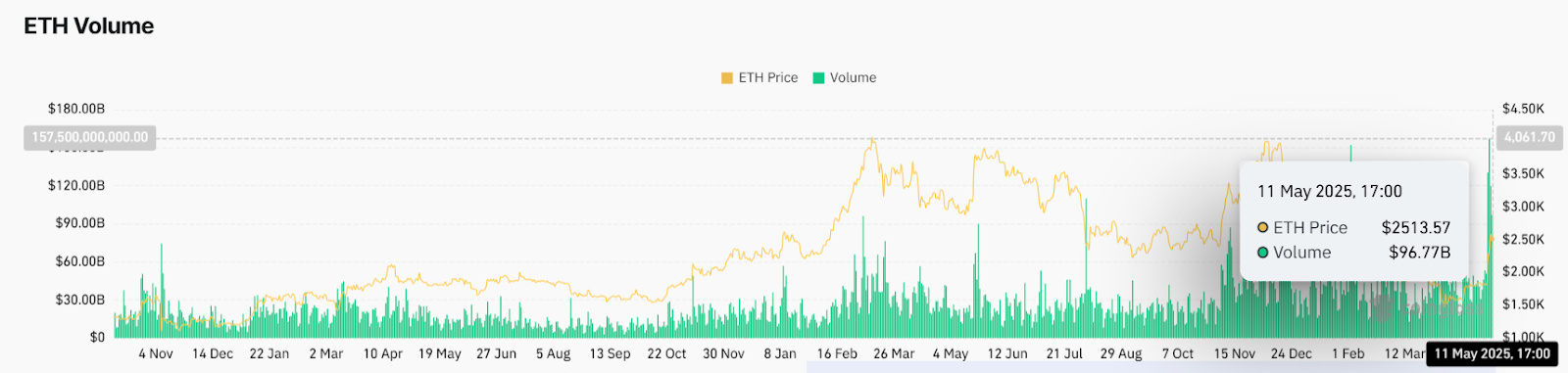

High trading volumes have driven a recent surge in prices. In particular, on May 11th, ETH reached a trading volume of approximately $96.777 billion. This surge in volume shows robust market participation, with price rises to $2,513.57. In particular, such volume patterns show solid support for Ethereum recovery, reducing the likelihood of short-term fixes.

sauce: Coinglass

After regaining this range based on past price movements, Ethereum showed upward momentum. According to Rekt Capital, a $2,200 support recovery indicates that the assets are resilient. If Ethereum continues beyond this support, a growing bullish view could encourage assets to be tested for $2,700 and ultimately $4,000.

Technical indicators signal strength

Key technical indicators support Ethereum’s price optimism. The relative strength index (RSI) is 70.13, indicating an excessive condition. This figure usually shows potential pullbacks, but also shows high purchase demand. If the buyer is active, bullish momentum could continue.

sauce: TradingView

Moving average convergence divergence (MACD) indicates a potential bullish reversal. The MACD line remains below the signal line, but the narrow gap and fadered histogram bars suggest that it weakens the bearish momentum and the possibility of future bullish crossovers.

Traders should be aware of integrations near the $2,500 to $2,600 level before another breakout attempt. The entry below $2,200 is a sign of strong bearishness, but this trend supports further growth.

Market Outlook: More profitable

If Ethereum can maintain its position beyond the $2,500 region, it can set the stage for a higher profit. Analysts believe retaining this support could open the door to travelling towards the $3,000 mark. As volume continues to provide the support it needs for the gathering, it will soon be able to test its next resistance at $2700.

Coinglass liquidation statistics provide further information on market sentiment. On May 11, 2025, the total liquidation reached $37.17 million, with Ethereum shorts accounting for $2763 million. The data suggests that many traders were positioned against the gathering, leading to short pressure. The high volume of liquidation for major exchanges such as Binance and OKX highlights the strength of this aperture and drives a fast price rise for Ethereum.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.