Key takeout

- Ethereum prices have risen nearly 50% to over $2,700 after the Pectra upgrade.

- Abraxas Capital has acquired 211,030 ETH, approximately $477 million after the upgrade.

Ethereum has increased nearly 50% more than $2,700 after the Pectra upgrade, about 6% below what Eric Trump held when he publicly promoted his asset, TradingView. data show.

The president’s son expressed bullish feelings towards Ethereum in the February 3 post. “In my opinion, it’s the best time to add $eth. You can thank him later.” He later edited the statement and deleted the last sentence.

His post came on A’s heels Market-wide sell-off The ether was tied to President Trump’s tariff proposal, which lost more than 15% on February 2 and 3, and at the time it bottomed out at around $2,300.

Despite a short recovery, the recession has been strengthened amid rising trade tensions and fears escalating inflation following Trump’s early April announcement Sweeping duty. April 7th, Ether is easy It’s been below $1,400 since November 2023.

The current price rally is Activating a Pectra Upgrade On May 7, we renewed a new bullish sentiment driven by positive developments in US-China trade relations and an increase in institutional accumulation.

Pectra introduces a set of Ethereum Improvement Proposals (EIPs) designed to improve staking efficiency, wallet ease of use and layer 2 scalability. This will help lay the key foundation for the next phase of Ethereum network growth.

Upgrades represent a crucial step for the platform, making them user-friendly and enabling systematic and programmable staking. Ethereum has skyrocketed by more than 40% in the five days since the upgrade was released.

Within the facility, UK-based investment company Abraxas Capital has acquired 211,030 ETH, which is roughly $477 million over the past six days. data From Arkham Intelligence.

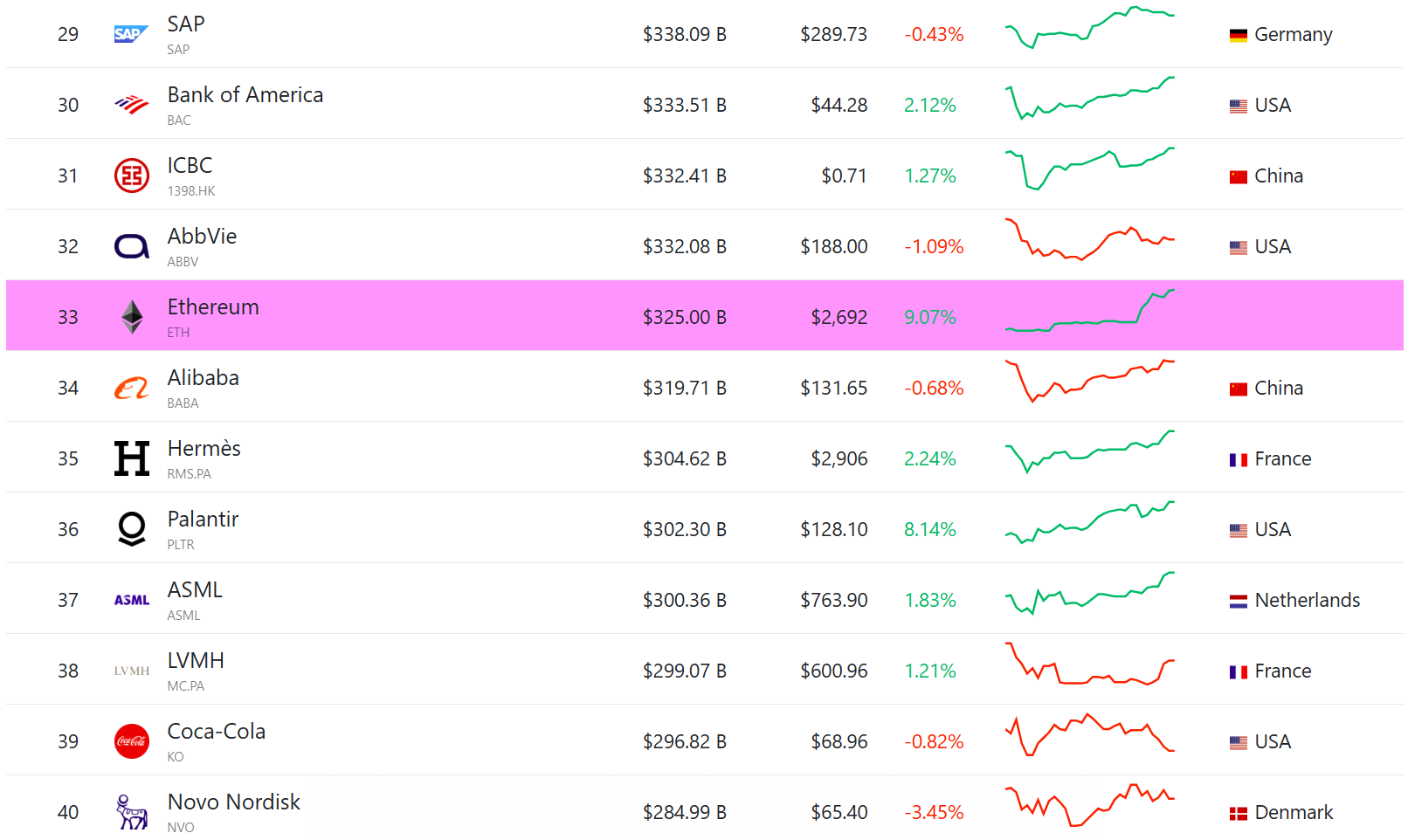

Ethereum surpasses Alibaba and Coca-Cola in terms of market capitalization

Ethereum ranked as the 33rd most valuable asset, surpassing Alibaba and Coca-Cola by market capitalization. data show.

Ethereum currently has a market capitalization of around $325 billion, surpassing Coca-Cola’s approximately $297 billion and Alibaba’s $320 billion valuation.

On Monday, the second-largest cryptocurrency temporarily overtaked Alibaba with a market capitalization of $380 billion, but the Chinese tech giant regained its lead after inventory surged by about 6%, increasing Alibaba’s market capitalization to more than $317 billion per marketwatch. data.