Strategy – A strategy known as micro-strategy has achieved a historic milestone as the total value of Bitcoin (BTC) holdings skyrocketed to a new history high.

The peak coincides with Bitcoin, which exceeds the $100,000 threshold, just a month after it plunged to a months-long low of 74,393 on April 7th.

How strategy benefits from Bitcoin’s $100,000 rally

Beincrypto yesterday reported that its biggest cryptocurrency had regained its $100,000 mark for the first time since February. Over the past month, its price has risen by 37.1%.

Performance at BTC price. Source: Beincrypto

Additionally, at the time of writing, Bitcoin is trading at $102.921, representing a daily increase of 4.0%. This increase marks a historic peak, marking the value of the strategy’s BTC Holdings $53.9 billion.

Strategic Bitcoin Holding Value. Source: Bitcoin Treasuries

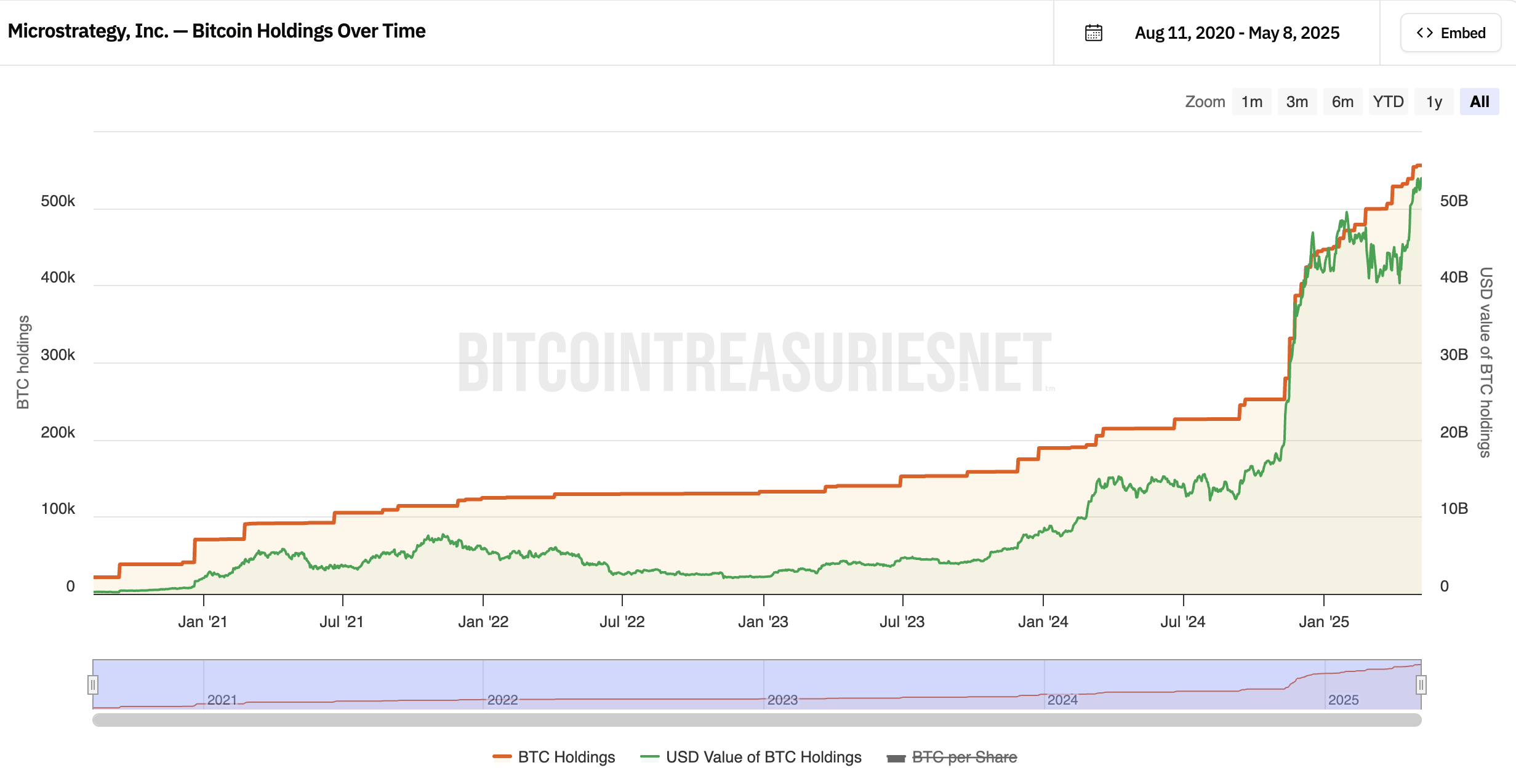

According to the latest data from Bitcoin Treasuries, the company currently owns 555,450 Bitcoin, which is purchased at an average cost of $68,550 per Bitcoin. This has an investment of $38.08 billion.

Furthermore, Bitcoin rallies position the strategy at a profit of 50.1%. The company purchased 13 BTC this year, most recently on May 4th. Michael Saylor announced the acquisition of 1,895 BTC on the X (formerly Twitter) post for around $180 million.

“MSTR got 1,895 BTC at ~$95,167 per Bitcoin, achieving a 14.0% YTD 2025 BTC yield,” Saylor posted.

This reflects a systematic approach to accumulation, with strategy holdings growing from 446,400 BTC at the end of 2024.

The surge in Bitcoin’s value is driving strategic stocks. Beincrypto emphasized that the value of MSTR has been highly valued at 75% over the past month alone. However, strategy-active Bitcoin investment is not without its challenges.

The company reported a net loss of $4.2 billion in the first quarter of 2025. Despite these economic hurdles, the strategy continues to double the Bitcoin strategy. In fact, they plan to significantly increase their investment in Bitcoin by raising $42 billion in both stocks and bonds to fund further acquisitions.

The move highlights the company’s commitment to a Bitcoin-centric financial strategy that began in August 2020. In a recent interview with Natalie Brunel, Saylor reiterated his belief in the potential of Bitcoin

“I think Bitcoin will be worth $13 million in 2045, so any Bitcoin you don’t buy costs $13 million,” he said.

Meanwhile, the positive impact of BTC price rallies is not isolated by strategy. Data from Bitcoin’s Treasury highlighted a broader trend. Almost every company that accumulates Bitcoin is currently profitable.

For example, Metaplanet has a profit of 18.8% on Bitcoin Holding, while Semler Scientific closely follows a profit of 16.1%. This is in stark contrast to a month ago when we faced many losses due to the lower price of BTC.