XRP, the fourth-largest cryptocurrency by market capitalization, attracted a growing interest from institutional and retail investors in 2025. Ripple’s recently published first-quarter XRP Markets report provides deeper insight into Altcoin’s performance.

This report reveals significant contrast. Spot trading volumes have skyrocketed, and on-chain activity in the XRP ledger (XRPL) has significantly reduced.

Spot volume and investment flow for XRP will rise sharply

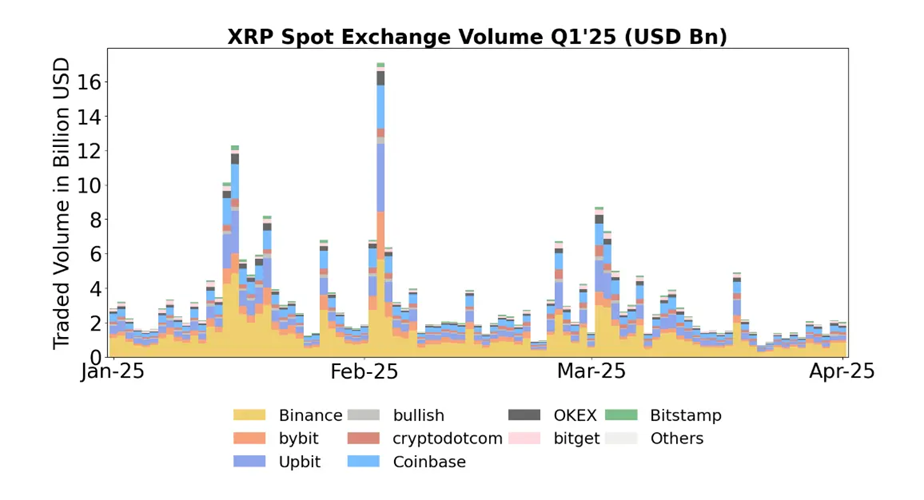

XRP spot trading volume remained stable in the first quarter of 2025, with an average daily volume reaching $3.2 billion on major exchanges, according to the report.

In particular, trading volumes skyrocketed from the end of January to early February. It exceeded $16 billion before gradually decreasing in March. Vinance led by about 40% of the total, followed by an increase (15%) and Coinbase (12%).

XRP spot replacement volume Q1/2025. Source: Ripple

The share of USD and USD Stablecoin volumes traded through the Fiat Pair increased from 25% in the fourth quarter 2024 to 29% in the first quarter. This increase indicates an increase in demand for Fiat trading. The XRP price also peaked at $3.40, the highest since January 2018, recording an impressive rally that surpassed Bitcoin and Ethereum in the same period.

XRP-based investment products also attracted strong inflows, reaching an annual total of $214 million, nearly overtaking the global Ethereum fund.

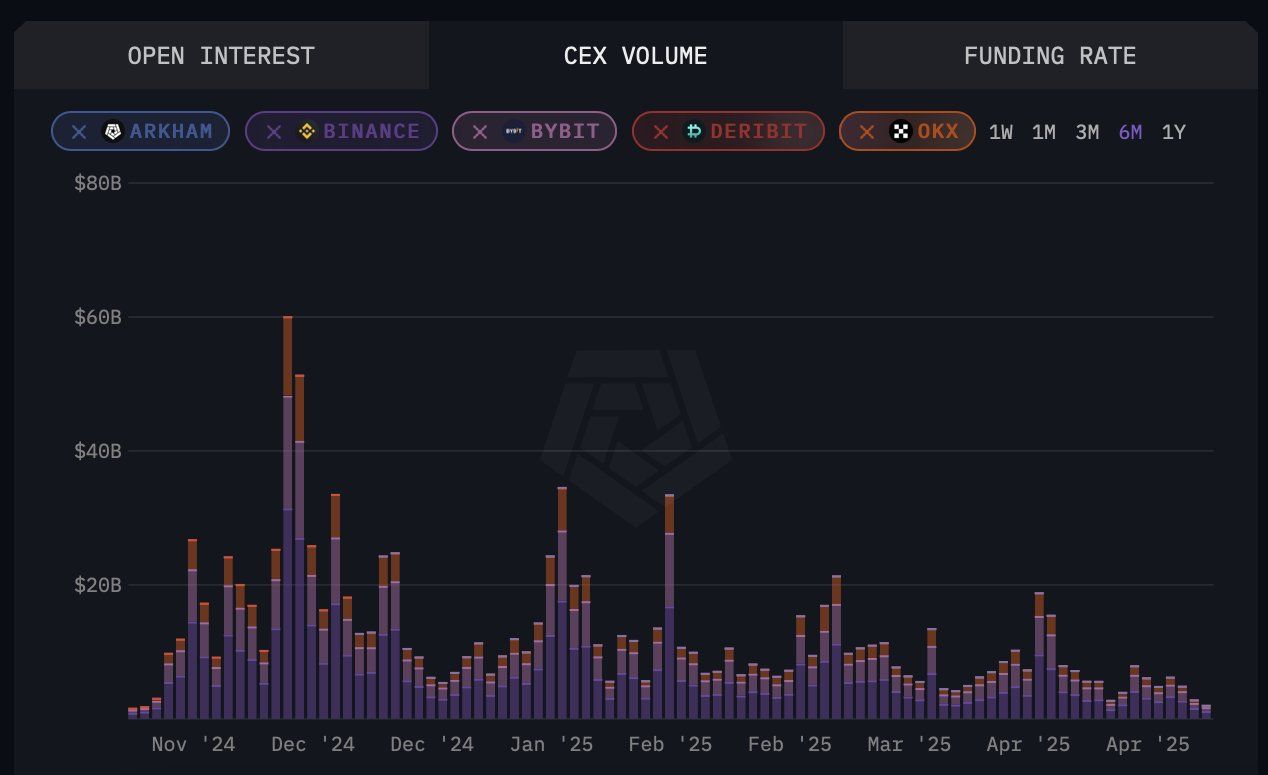

However, one analyst noted that daily trading volumes have plummeted by more than 86% over the past six months.

Daily XRP trading volume for intensive exchange. Source: Arkham

“XRP volume has collapsed from $60 billion in December to less than $8 billion now. Retail has been flashed out,” said Crypto analyst Steph.

Despite the decline in intraday volume, the overall market context for 2025 was characterized by positive regulatory changes, which helped XRP maintain its appeal. For example, the SEC officially retracted the appeal and ended its multi-year lawsuit.

Meanwhile, signs of growing institutional trust include the submission of Franklin Templeton to the XRP ETF in the US, the launch of XRP futures, and volatility stocks seeking approval of three XRP ETFs.

Chain XRP activity decreases sharply

In contrast to the active spot market, on-chain activity in XRPL has declined significantly.

The report shows that the number of transactions in XRPL fell by 37.06%, down from 167.7 million in the fourth quarter of 2024 to 105.5 million in 2025. New wallet creations fell 40.28% from 709,545 to 423,727. The amount of XRP consumed as transaction fees also fell by 30.89%.

Meanwhile, the volume of distributed exchanges (DEX) fell 16.94%, down from $1 billion to $832 million.

Defillama data reveals that the total XRPL value is locked (TVL) has levelled flat in 2025 at around $80 million. The monthly DEX volume was around $3.3 million, just $3.3 million. This seems disproportionately low given XRP’s position as the fourth largest crypto asset by market capitalization.

XRPL TVL and DEX volumes. Source: Defilama

However, the report suggests that Ripple’s acquisition of Hidden Road could help boost XRPL’s on-chain activities.

“Ripple acquired Hidden Road for $1.25 billion, one of the biggest M&A transactions in crypto history, increasing the institutional use cases for RLUSD and XRPL,” the report states.

Ripple’s first quarter report draws pictures of both sides. Reflecting investor confidence, spot trading volumes have skyrocketed and slower activity in the chain raises questions about the actual use of XRPL.