BTC’s open interest is three months high, showing strong speculative activity.

The short seller has already lost $2.17 billion as Bitcoin surpassed the $100,000 milestone.

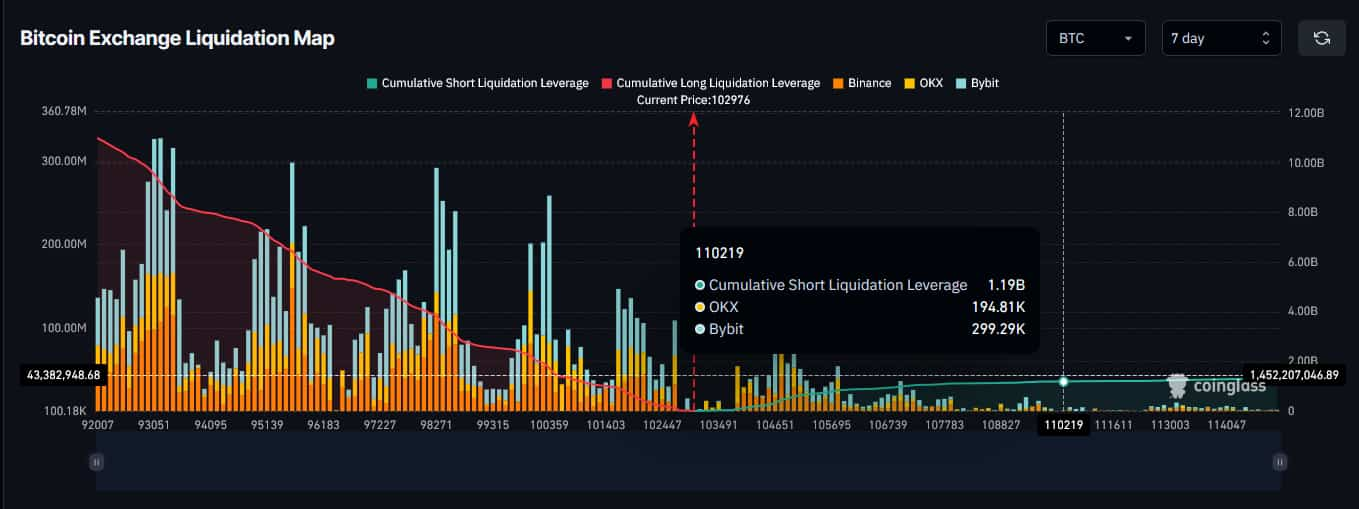

Bitcoin (BTC) rally above the psychologically important $100,000 mark is putting a large number of short positions at risk, especially when major digital currencies exceed $110,000.

To be more precise, if Bitcoin price reaches a level above $110,000 for each data Finbold acquired from the Cryptocurrency Market Analysis Platform on May 9th, the short seller would lose about $1.19 billion. Coinglass.

Risky short sellers are high as Bitcoin is likely to reach $110,000

The flagship cryptocurrency had changed hands at a price of $102,970 at the time of writing, earning 3.33% on the daily charts.

Currently, the meeting appears to continue. With Bitcoin’s open interest at three months high and potentially reaching the height of the year soon, traders have stepped up opening speculative positions.

Plus, short sellers have already lost around $2.17 billion due to climbing with BTC over $100,000.

As there is a steady decline in Bitcoin while the number of new BTC billionaires is increasing, all indications point to one conclusion.

Featured Images via ShutterStock