According to fresh data from the Ministry of Labor, claims of unemployed people surged at the end of April, but both traditional and crypto markets were repeated on Thursday morning.

Market Rally: Bitcoin reaches $97k even if employment data is disappointing

The number of unemployed Americans, which had been seasonally adjusted to 241,000 for the week ending April 26, has swelled to an increase of 18,000 from the previous week, according to U.S. Department of Labor data released Thursday morning. However, the market has not been affected, with Bitcoin (BTC) rising past $97,000, and the traditional market index rising.

Reports from Reuters show that investors were not caused by New York’s spring break and as they did not reflect a fundamental weakening of the employment environment.

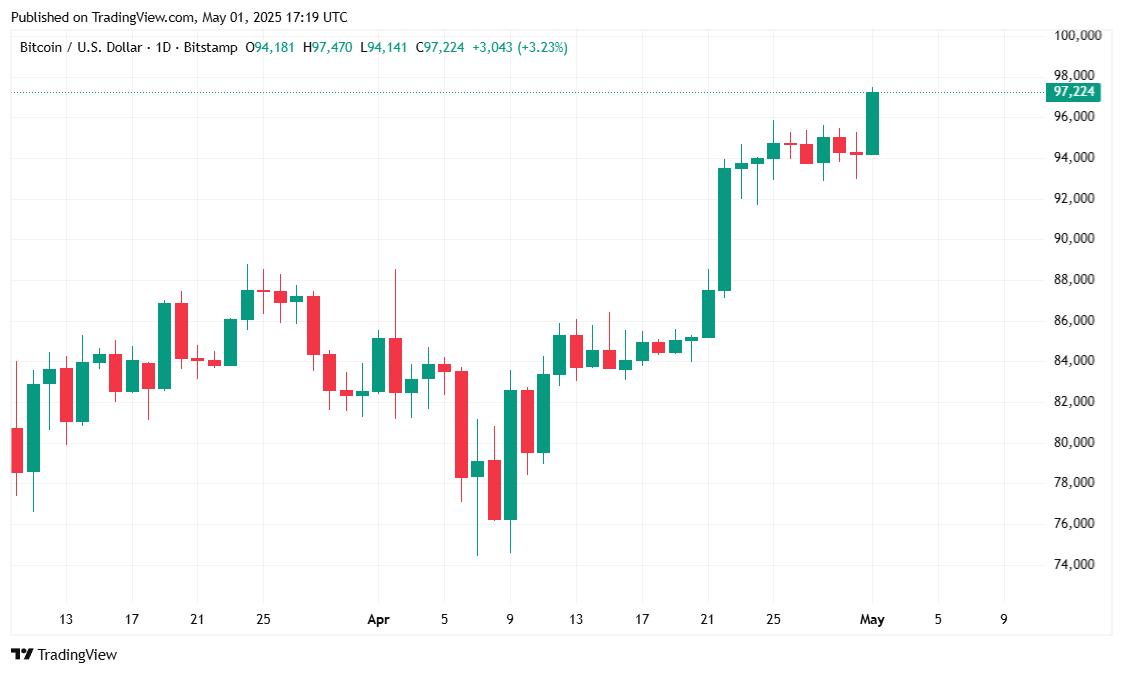

Interestingly, Bitcoin surges are in stark contrast to gold, a low gold, down 2.17% at $3,216.00 at report. “I repeat the rationale,” said Jeffrey Kendrick, director of digital asset research at London-based Standard Chartered Bank, in a note to his client on Thursday. “I think Bitcoin is a better hedge than gold against reallocating strategic assets from the US.”

Market Metric Overview

Bitcoin rose 3.37% in the last 24 hours, reaching $97,178.85 when it was reported, according to CoinmarketCap. The cryptocurrency traded between $93,762.50 and $97,437.96 over the same period, marking one of the most powerful intraday performances this week.

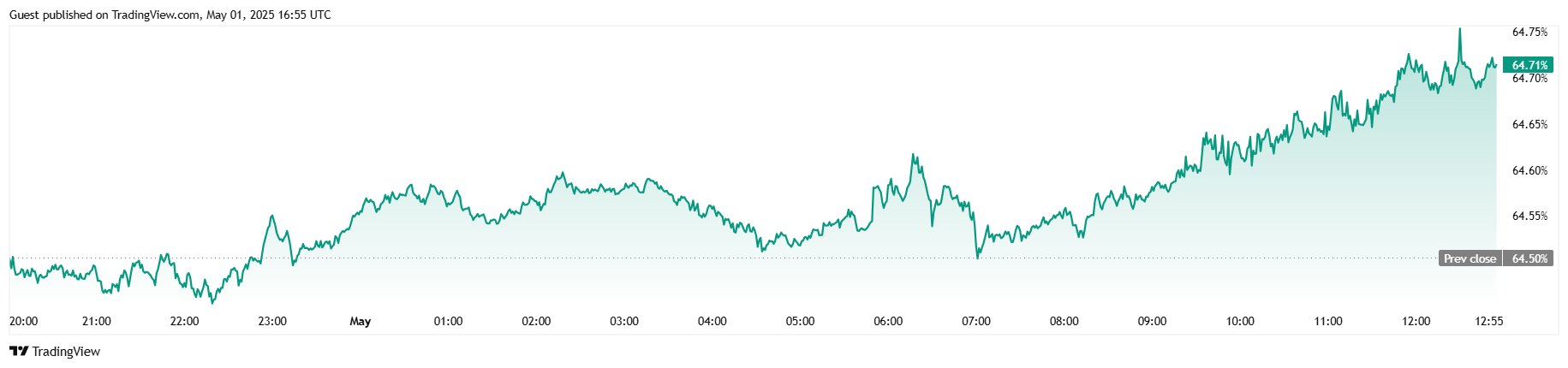

Trading activity intensified with price rise, with 24-hour volume increasing by 7.45% to $31.2 billion. Market capitalization also reflects a surge in prices, rising to $1.92 trillion, an increase of 3.40% from yesterday. Bitcoin’s dominance in the broader crypto market is currently at 64.72%, up just 0.085 percentage points.

The derivatives market also reflects bullish sentiment. Open interest on BTC futures has increased by 8.96% over the past 24 hours to $679.3 billion, increasing traders’ reliability, according to Coinglass data. The liquidation totaled $892,840, but the short seller was on the brunt of it, losing $860,900 compared to just $31,940 from the long position. The liquidation imbalance suggests the possibility of a shift in short-term market sentiment towards further profits.