Strategy (formerly micro-Strategy) which is a child of the corporate BTC accumulation poster has added another 3,459 BTC ($285.8 million), bringing that total to an astounding 531,644 BTC, exceeding $35.9 billion.

MicroStrategy (@Strategy) bought an additional $3,459 (285.8m) last week with an average price of $82,618.

– lookonchain (@lookonchain) April 14, 2025

How much has Strategy Inc been used since the latest purchase of Bitcoin?

Online rumors resolve the risk of strategies, but the data suggests that they are not.

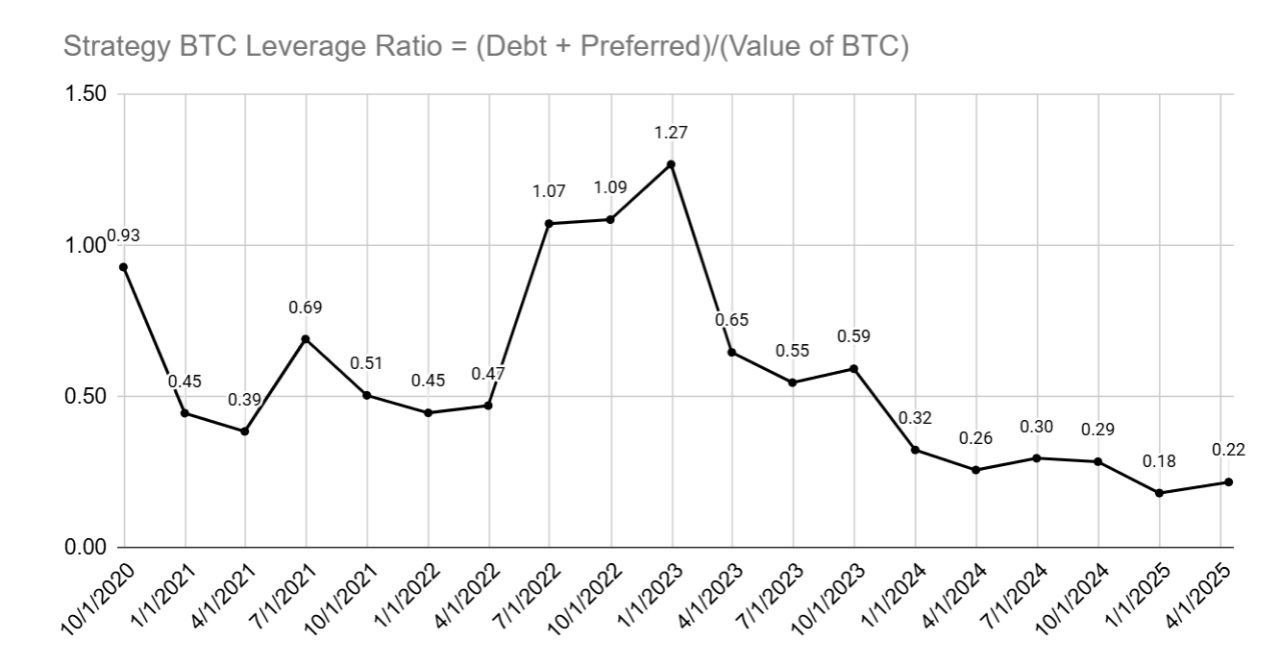

Breakdown of strategy BTC leverage ratios – Calculated AS (debt + preferred stock) ÷ Value of BTC held – Current risk exposure is well below the historical average.

Looking at the charts that range from late 2020 to early 2025, there are a few things that are clear.

- At its peak in the first quarter of 2023, the strategy leverage ratio reached 1.27. In other words, the value of the obligations temporarily exceeded the market value of BTC holdings.

- Fast forward to April 2025, the ratio fell sharply to 0.22, one of the lowest levels ever.

- This downtrend has been consistent since mid-2023, reflecting both a rise in Bitcoin price and a more measured borrowing strategy.

Even Bull Run, like in late 2021 and 2022, the strategy was operated with significantly higher leverage (for example, 1.07 in mid-2022 and 1.09 in fourth quarter 2022). Therefore, by comparison, the current attitude appears cautious, if not completely conservative.

Related: North Carolina’s “Digital Asset Freedom Act” looks like a Bitcoin bill

What is the low leverage signal for your strategy?

This historically low leverage ratio shows financial management rather than despair. It shows that the strategy is not actively borrowing to chase the price pump. Instead, the company uses profit-held combinations to maintain its stock, debt and revenue, and to build itself up without excessive exposure.

Because BTC trades are priced at $85,000, the average purchase price for the strategy is $67,556, which is a return of 11.4% per year despite market volatility.

Are other companies buying bitcoin for Treasury reserves?

The strategy approach seems to have influenced other corporate players as well. Japanese company Metaplanet added 319 BTC ($26.3 million) with an average price of $82,549, bringing its total holdings to 4,525 BTC ($386.3 million).

*Metaplanet buys an additional 319 $btc* pic.twitter.com/habs1njtwi

– Metaplanet Inc. (@metaplanet_jp) April 14, 2025

Related: “Keep a Watch”: Hayes links to Bitcoin profits that are coming stress in the bond market

Thanks to Bitcoin’s powerful driving, it is locked to a 108.3% return in 2025 alone. HK Asia Holdings also increased its games, buying another 10 btc, pushing the total to near 29 btc. Though small in size, this move is symbolically important, especially given China’s unstable regulatory stance on crypto.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.