Bitcoin (BTC) has moved to recover a price of $ 86,000 with a 2.65%profit over the last 24 hours. In particular, Premier Cryptocurrency has maintained more than 15% of the last few rise since resuming $ 74,000. During the resumption of a wider tan brown rally, Burak Kesmeci, a prominent password analyst, emphasized the remarkable development of Bitcoin short -term holder MVRV (realized value) ratio.

Bitcoin Market Recovery waits for the final signal: analyst

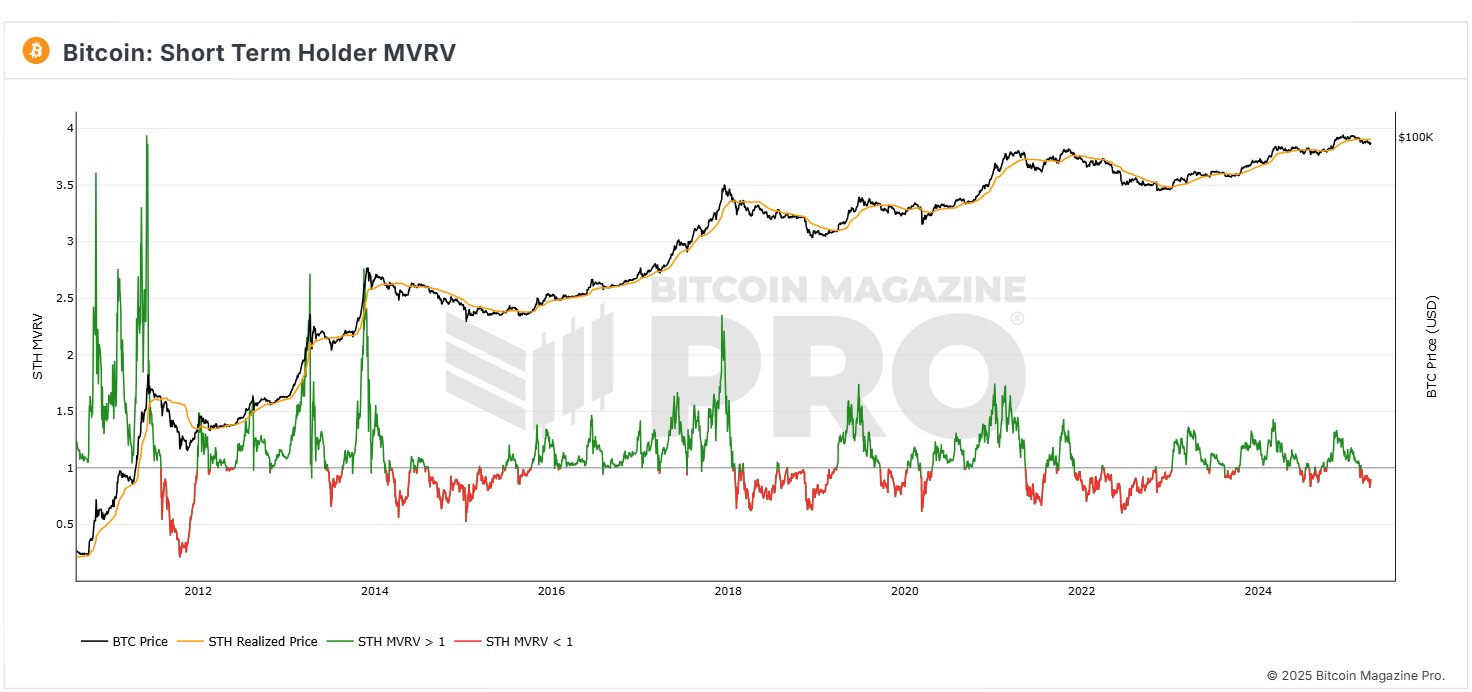

Kesmeci explains that in the new post of X, Bitcoin shows the initial signs of market recovery with the recent development of Bitcoin MVRV for short -term investors. In the context, MVRV measures the profitability of investors compared to the price of the asset’s market value. The MVRV score of less than 1.00 is lost, while scores of 1.00 or more show profits.

The MVRV of Bitcoin short -term holders is especially important because the address for the address with Bitcoin for less than 155 days is especially because the investor Cohort generally responds to price fluctuations. In particular, STH MVRV provides insight into market sentiment and potential price directions.

According to Kesmeci, Bitcoin STH MVRV is currently 0.90, which is close to 1.00 or more. STH MVRV has recently recorded 0.82 in the recent crisis of the “tax tariff poker” and has been ignited by the US government’s international tariffs. In particular, this decrease is lower than the level of Japan -based Carrie Trade crisis when STH MVRV drops to 0.83 on August 5, 2024.

In the last few days, STH MVRV has risen to 0.90 following the resurrection of the BTC price, but Kesmeci warns that Bitcoin still exceeds 1.00 to confirm the possibility of a significant price increase of short -term investors. Nevertheless, the increase from 0.82 to 0.90 still remains a positive development that represents the continuous change of market sentiment.

BTC price outlook

In Press Time, Bitcoin has been trading at $ 85,390 with some price recovery over the last few hours. Among the recent daily profits, premiere Cryptocurrency rose 2.11% on the weekly charts and 4.33% on the monthly chart, increasing 4.33% on the monthly chart. However, if the current upward trend must continue, Market Bulls should offset a 38.98% decrease in daily trading volume.

In particular, BTC investors are expected to face sufficient resistance at a $ 88,000 price range that acts as a powerful price barrier at the time. Meanwhile, in the emergence of price drops, the price support is about $ 79,000.

Istock’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.