- The bearish momentum shows signs of weakening, so BTC is approaching $90,000 resistance.

- Bullish RSI divergence and falling wedges suggest a potential breakout.

- Persistent exchange outflow suggests that long-term holder trust remains strong.

Bitcoin (BTC) is approaching a resistance level of nearly $90,000 as major cryptocurrencies show early signs of weakening bearish momentum. Despite trading within the downtrend pattern since February 2025, recent technical metrics suggest that sellers may be losing control. According to CoinmarketCap data, on April 10, 2025, BTC experienced prominent volatility, returning to $78,665.59, exceeding $82,000.

BTC’s market capitalization rose 0.27% to $1.56 trillion, while 24-hour trading volume rose 12.36% to $6.949 billion. The rise in trading activity reflects the growth in market engagement amid price fluctuations. The market-to-market cap ratio is 4.34%, indicating moderate liquidity conditions.

Source: CoinMarketCap

Bitcoin prices opened near $78,400, rising to nearly $83,000 before sellers reaffirm their control. This allowed BTC to return to its stable $78,000 range later in the trading session. The circulation supply is currently at 19.84 million BTC, approaching a maximum of 21 million coins. The Full Dilution Assessment (FDV) is recorded at $1.65 trillion.

Bullish divergence and potential inversion of falling wedge signals

Crypto analyst Jelle emphasized that Bitcoin’s latest price moves are testing a descending trend line that has been acting as a resistance since early 2025.

The sale is losing momentum as the RSI returns to above the mid-level and prices are about to rise and fall again and again.

Break that trend line and charge $90,000.

You need one good push. #bitcoin pic.twitter.com/s9phcpss4f

-Jelle (@cryptojellenl) April 10, 2025

Despite recording lower prices, the relative strength index (RSI) on the daily chart formed a higher and lower value. This bullish shift often weakens the possibility of a sell-side pressure and price reversal.

Additionally, within the recent price structure, a falling wedge pattern is displayed. Falling wedges are generally associated with upward breakouts, especially when supported by bullish divergence. The RSI also rose above the resistance zone near 47 levels, suggesting a growing interest among buyers.

Source: x

Currently, BTC is approaching a horizontal resistance of between $90,000 and $92,000, which is in line with the downward trend. A breakout above this confluence region can turn out to be a signal to the onset of a bullish inversion. However, downtrends remain common until prices break above the cloud.

Exchange flow shows long-term bullish trends

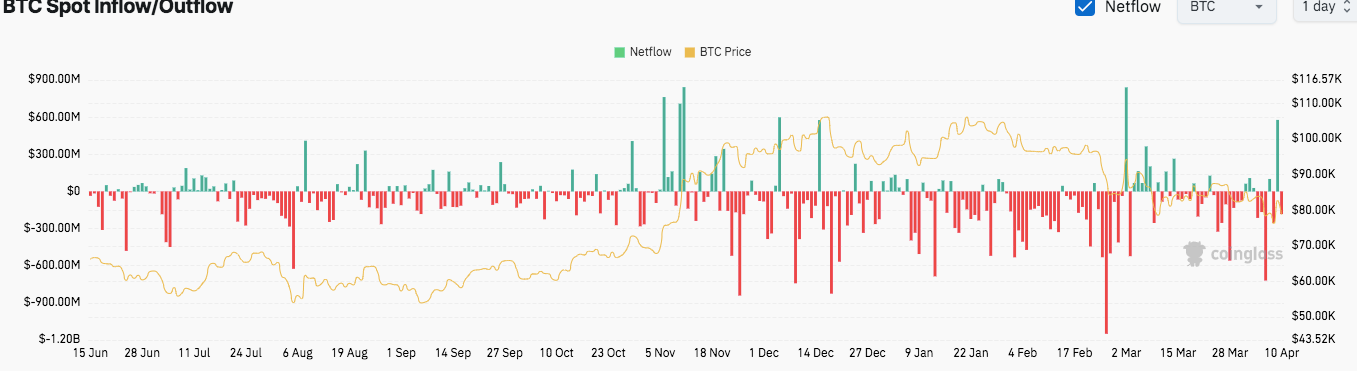

Coinglass data shows that Bitcoin spot exchange flows have maintained a strong net leak trend since mid-2023. This sustained control of outflow over inflow indicates that investors are moving from BTC to exchanges that are commonly interpreted as signals of long-term holding behavior.

Source: Coinglass

Major outflows were recorded during market volatility periods, particularly late December 2023, early February 2024 and March 2025. These moves coincided with the revision of BTC prices as investors appear to transfer their assets to cold storage.

The market observed short-term inflow spikes from early November 2023 to late February 2025.