The recent decline in Bitcoin has led to an important technical fork. There, after a multi-week break from the Rising Channel, we test out key support levels.

Although the short-term momentum appears to be weak, long-term chain metrics may be key to understanding whether this fix has a more downside or whether buyers will return soon.

Technical Analysis

By Edris Dalakshi

Daily Charts

On the daily charts, BTC officially destroyed its 200-day moving average. This is around the $88,000 mark, a key technical element that often defines trends. This violation comes after weeks of side-to-down price action, with multiple rejections made from the $88,000-$92,000 resistance zone.

The asset is currently hovering from around $70,000 to $78,000 in the $77,000-$78,000 range just above the strong demand zone of nearly $74,000. The RSI also immerses near oversold areas, suggesting bearish momentum as well as potential fatigue. If $74,000 is not held, the next important support is around $68,000, but a recovery above $80k could open another $84,000 test, and ultimately a 200 DMA door.

4-hour chart

The 4H time frame draws a clearer picture of recent breakdowns. After weeks of integration within the rising channel, the BTC was firmly broken down on the downside, causing a wave of liquidation and fear.

Prices temporarily fell to a low $74,000 drop of $74,000, retesting resistance levels of $80,000. That rejection has resulted in low highs and enhanced short-term bear control. Furthermore, while RSI is beginning to recover from highly sold territory, the structure still supports sellers, unless BTC can support and re-claim zones between $80,000 and $82,000 and $84,000.

On-Chain Analysis

By Edris Dalakshi

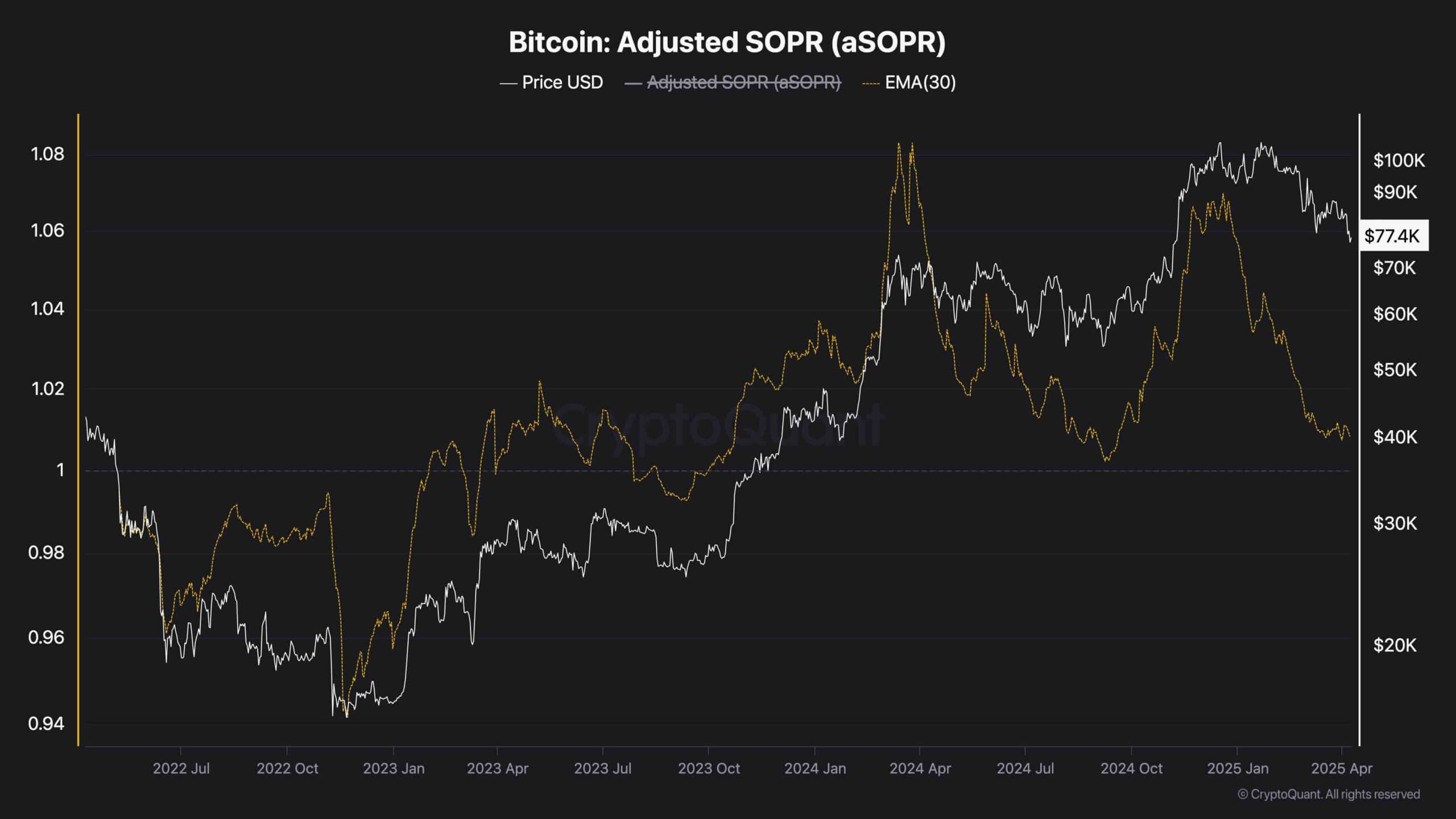

Adjusted SOP (ASOPR-EMA 30)

The adjusted SOPR is slightly above the neutral threshold of around 1.1, indicating on average that the holders are still selling BTC on profits. However, the downward trend of ASOPR is notable, suggesting that overall network profitability is shrinking. This trend continues, and as ASOPR approaches or soaks below 1, it can reflect growing surrender and short-term bearish feelings.

However, for now, the market is not in the realm of full loss realization, so there is more room for downside pressure before potential bottom scenarios. Investors need to monitor how quickly and steady ASOPR is. Holding it above may support quick rebounds, but drops below it may show wider risk-off behavior.