Financial markets have witnessed interesting differences.

XRP, one of the leading crypto assets, recorded significant profits today, while Nvidia (NVDA), a powerhouse in AI and CHIP technology, is nursing a 7.82% decline.

The contrasting move sparked debate over whether crypto assets and traditional stocks are separate. Dom Kwok, a former bank analyst at Goldman Sachs, highlighted the trend in a tweet. He called XRP and NVDA two of the biggest “bell-shaped” in their respective markets.

His observations suggest that while the broader stock markets, particularly technology-related stocks, face downward pressure, crypto assets like XRP, have shown resilience and upward momentum following the latest blood bath.

Two biggest crypto vs stock Bellwethers decoupling. $ xrp vs $ nvda pic.twitter.com/qxwkvjgf3k

-dom(bull/ish) | Easea (@dom_kwok) April 3, 2025

In particular, XRP’s recent price transfer came after yesterday’s bearish storm. However, at the time of press, the XRP has rebounded 6.12%, approaching $2.10. Similarly, Bitcoin, which fell to $81,000, recovered to more than $83,000 at press.

Thursday’s crash in the crypto market followed the US stock market’s recent tariff implementation, followed by the US government’s recent tariff implementation.

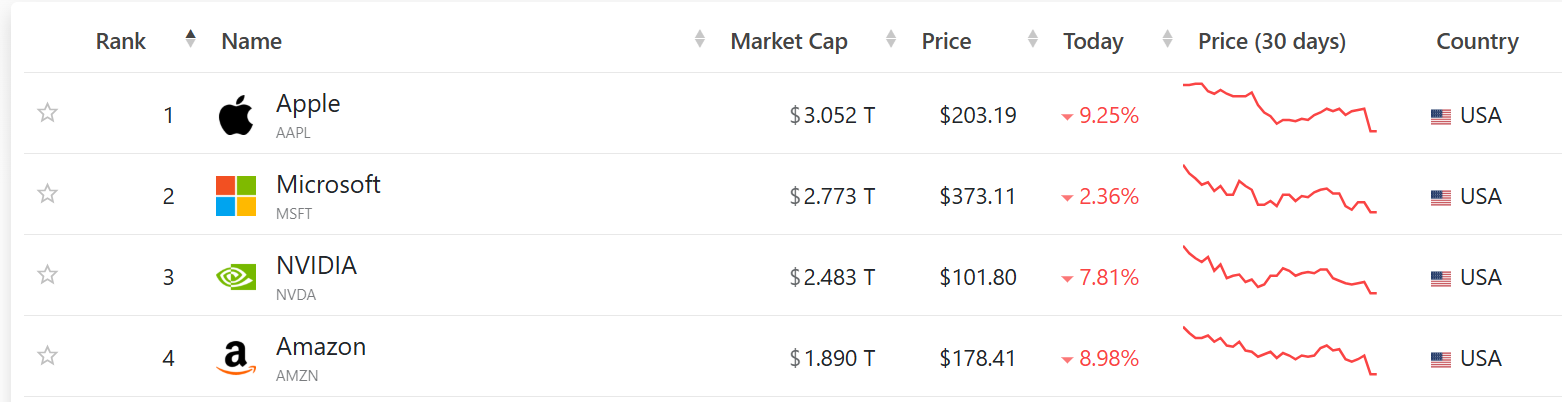

In particular, Apple’s AAPL fell 9.25% on Thursday, closing at $203.19. The Amazon and Meta platforms also fell sharply, with stocks down 8.89%, while Nvidia’s shares fell 7.8%, closing at $101.80.

Tanking for US companies

The crypto market initially reflected this performance, but the recovery is already underway as XRP leads the bill.

Why is XRP rising?

The XRP shift could be attributed to a massive “buy” campaign aimed at investors looking to take advantage of XRP’s low prices. Furthermore, the growth of optimism surrounding the recent announcement by Coinbase may have contributed to this rebound.

Yesterday, Coinbase announced its plans to list the XRP futures contract on April 21, 2025, after submitting a filing with the US CFTC for approval. This move follows the SEC’s decision to de-attract, particularly in Ripple’s case, among the preferred legal developments for XRP.

Coinbase will become the second US regulatory platform to offer XRP futures after the recent launch of Bitnomial. The decision reflects a more positive regulatory atmosphere, due in part to the new SEC leadership.

Coinbase’s XRP futures are now available with Coinbase derivatives, providing traders with a regulated, capital-efficient way to gain exposure to XRP. This follows the previous 2023 launch of XRP permanent futures for non-US customers.