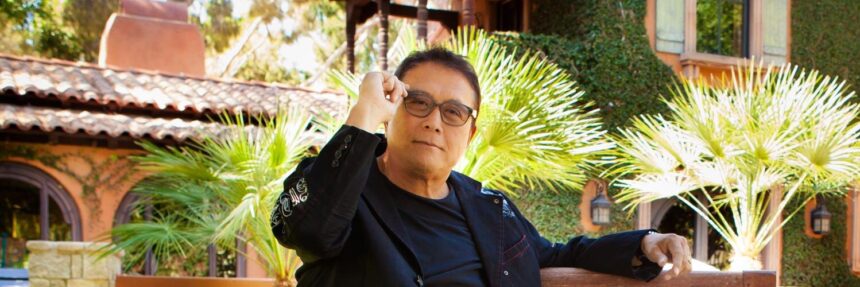

Robert Kiyosaki, author of the famous financial self-help book Padrelico, the Poor Father, spoke of optimism about certain assets. This is the second precious metal of silver, which is a larger capital letter.

It also maintains bullish expectations for gold and Bitcoin (BTC), but financial gurus argues that silver is “the most interesting investment of today.”. This is listed in a new publication on Social Network X on Tuesday, April 1st.

For Hisazaki, the silver price is about to be photographed in the current economic situation. In part, he awards this to his price, showing a major underestimation in terms of gold and bitcoin.

La Plata cites more than $32 (USD), 60% below the previous maximum reached 14 years ago in 2011. This was 49 USD.

Instead, gold marked a new historic maximum price of over USD 3,165 per ounce. And while Bitcoin is a revision period, he has registered a new record of USD 109,000 this year. It was exactly two months ago. These performances They show a strong contrast to silver.

“I expect Silver will double its value this year, reaching at least 70 US dollars per ounce,” Kiyosaki said before the panorama. Furthermore, he revealed that despite already having a significant amount of this asset, he made a new purchase for his bullish predictions.

These comments come in the midst of a wave of new imports into imports in the US, which is set up by President Donald Trump. Such measures have generated tariff retaliation from various countries, freeing the country’s fears of greater inflation and recession. As a result, money is usually shot, reaching economic uncertainty.

“You don’t have to be rich to invest in silver,” Kiyosaki says.

For financial specialists, “The best news is that you don’t have to be rich to invest in silver.” Due to the low price, “almost everyone in the world can afford to buy at least a ounce,” he added.

However, it should be noted that silver prices and gold are usually measured in ounces, but are also traded in small units. Therefore, you do not need to buy a ounce equivalent to 28 grams to get these metals.

For example, some traders can only get 1 gram. However, if you are not buying in physical form, you should take into consideration that it is a derivative and not a direct investment in the asset.

According to today’s prices, 1 gram of silver is quoted at 1,2 USD, Golden USD 110which is quite high, and the former is much easier to access.

Comparing, Bitcoin purchases are even easier to accessbecause it is divided into Satoshu. This term refers to the smallest unit is equivalent to 0.0000001 BTC. This is lower than the penny.

Satoshi is worth it at this time at 0.00082, as Bitcoin is currently quoting USD 81,000. Unlike precious metals, this active is not physical, but digital, and as Cryptopedia explains, it is possible to cherish it in your own custody wallet.

The prices of gold, silver and Bitcoin will not rise. fíat money loses value

The famous writer makes his bullish projections, mainly based on that fact These assets lack decentralized mining and supplyunlike fíat money. The prices of gold, silver and bitcoin can then benefit from increased purchases, due to simple supply and demand laws.

“I prefer to save silver over fake banknotes,” he said, as he usually does, his criticism of his Fear Financial System. This refers to an increase in Fíat currencies such as the dollar, and the loss of value due to the free decision to serve the government.

“Always remember that gold, silver and bitcoin prices aren’t going to rise. It seems to rise, but that’s because the purchasing power of fake paper is really diminishing,” he emphasized that. He therefore reveals in the book “The Father of Poor Father Rico,” he asserted that the saver (of Fear coins) was the loser.

To put it in perspective, it is possible to observe the following graph showing the loss of purchasing power that the dollar had in the last century.

This makes Kiyosaki suggest it Those who maintain cash, whether concrete or digital, will lose their purchasing power Over time due to inflation and devaluation due to impressions. “Don’t be a loser, except gold, silver and bitcoin,” the experts reached the peak.

According to the author, these three assets represent a better way to protect long-term value in an environment where Fear’s money continues to lose value. But not all his followers agree with this idea.

“If you understand Bitcoin, I wouldn’t recommend gold or silver,” says followers

A variety of people thanked and praised Kiyosaki’s predictions, which owns over 2.7 million followers on X, but raised questions about the upward hypothesis.

“If you understand Bitcoin, you wouldn’t recommend gold or silver,” a follower replied to his publication. This is something that resonates among different enthusiasts of this asset. Digital, rare and decentralized, offering the advantage that precious metals cannot matchease of resistance to relocation or confiscation.

Additionally, Bitcoin’s broadcasts are cut by half every four years at an event called Halving, driving its rise in the face of demand. For this, the event always attracted a wave of new purchases that brought prices to new records the following year, as the following graphs showcased.

And for even lower market capitalization (gives more volatility), The upward trend in Bitcoin has grown significantly throughout history. For reference, from the latest bear market funds in 2022, Bitcoin has recorded a 400% increase, with 93% gold and 72% silver.

This set of factors makes Bitcoin commonly referred to as “digital gold” or even “the best version” than precious metals such as value reserves. This is despite the fact that in the short term it is usually traded as a risky asset such as an action, and is usually correlated with US bags.

“Bitcoin surpasses gold, silver and everything else,” the enthusiastic people in question said before Kiyosaki’s message. He also criticized him for not mentioning that “everyone can afford it.”

Nevertheless, in another publication, Kiyosaki reiterated that he is currently seeing better opportunities for silver and Bitcoin purchases, as well as his shortage and lower price performance. The use of this metal differs at the industrial level, and forecasts maximum demand.

Is it the most valuable silver than gold or bitcoin? “I say yes,” said a popular financial advisor. “Because there is an increase in use in solar panels, electronic vehicles, computers, electronic products, weapons systems, medicines and water purification, there is an increase in demand for silver,” he said.

I will detail that, With these activities, the supply of gold and bitcoin will not decrease, but the silver will do so. “And more than anything, it’s the cheapest currency compared to both,” he argued if you want to buy an entire unit of that typical accounting scale (OUNCE).

“Silver is useful, its prices remain low for decades and keeps them affordable for the industry,” he added. In his opinion, this is an over-market operation and therefore could be valued at the new historic maximum price in 2025.

nevertheless That’s why he loses his long-term binding belief in bitcoin and gold.an asset that has not been fed up with recommendations as an investment in recent years.

Of course, it is important to note that predictions may not be met with anyone.

(tagstotranslate)bitcoin(btc)