The major digital assets continued their promotion as companies such as Stablecoin Behemoth Tether revealed billions of BTC in their books.

BTC will regain $85,000 as bullish businesses go shopping

The world’s largest stubcoin company announced on April 1 that it acquired 8,888 BTC in the first quarter of 2025, and currently holds $8 billion worth of Bitcoin. On the same day, Japan’s Bitcoin Ministry of Finance Metaplanet announced the purchase of 696 BTC, signaling the market that there is an increase in institutional interest in cryptocurrencies.

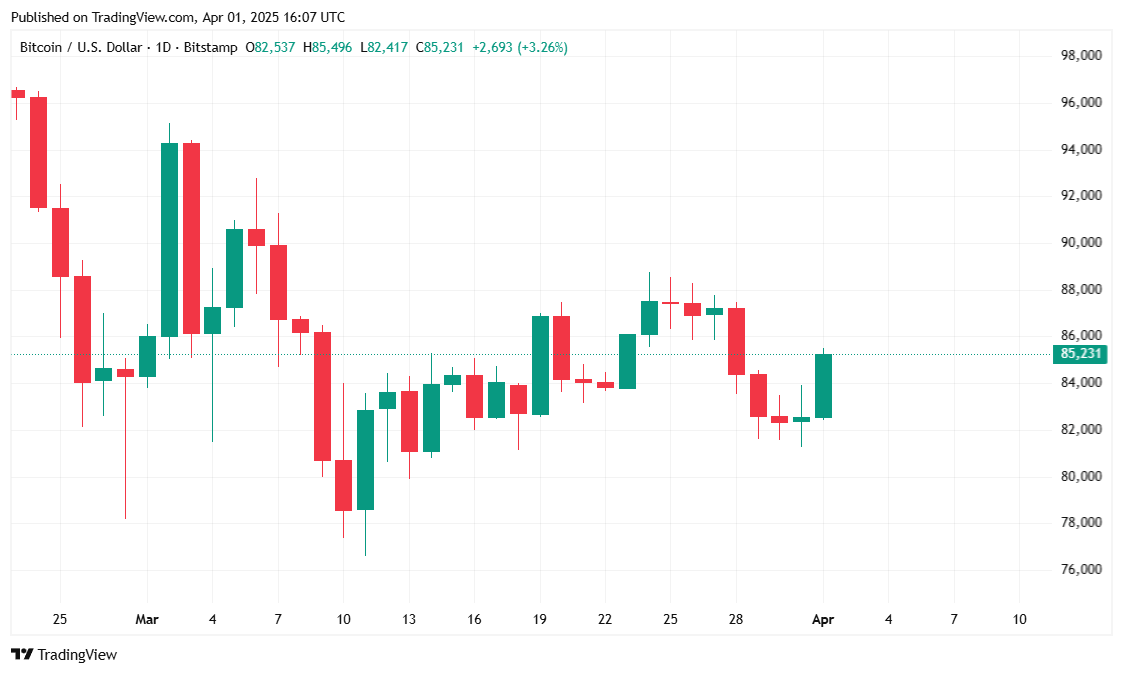

At the time of reporting, Bitcoin was trading at $85,240.06, an increase of 2.01% since yesterday, but a decline of 2.86% over the past week. Digital assets traded at $85,487.37 from $82,263.41 in the 24-hour range, with 24-hour trading volume rising to $27.45 billion, an increase of 0.37%.

(BTC Price/Trade View)

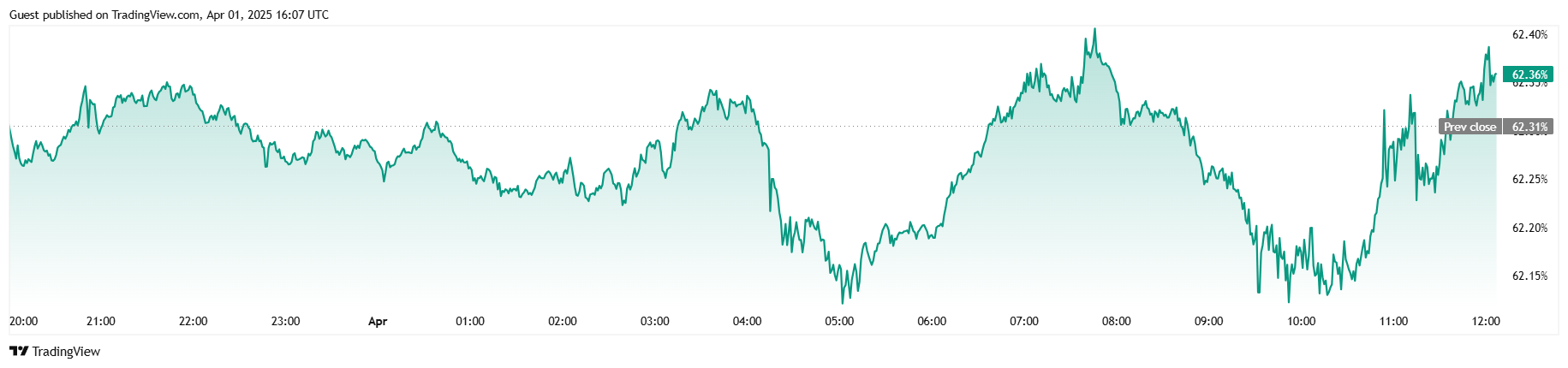

Bitcoin’s market capitalization is currently at $1.69 trillion, an increase of 2.22% from the previous day, reflecting new investors’ interest. Despite this, Bitcoin’s advantage was slightly soaked, resting at 62.37% and a minor drop of 0.09% over 24 hours. Meanwhile, the total BTC futures reached $553.8 billion, an increase of 3.03% as traders remained leveraged position ahead of key market movements.

(BTC dominance/trade view)

Coinglass liquidation data revealed that Bitcoin has seen $25.64 million in total liquidation over the past 24 hours. Notably, the long liquidation was only $443,490, while the short liquidation was significantly higher at $2,519 million, suggesting that bearish traders were primarily betting in the wrong direction.

Agency continues to buy Frenzy

Stablecoin Giant Tether announced on April 1 that it had purchased a total of 8,888 BTC in the first quarter of 2025, bringing Bitcoin Holdings to $7.8 billion.

According to X Post on April 1, Japanese Bitcoin finance company Metaplanet, which recently announced its $13.3 million (¥2 billion) bond issue, has added 696 additional Bitcoins to 4,046 BTC.

(Metaplanet announces 696 BTC purchase/Simon Gerovich x)

The purchases demonstrate an ongoing institutional interest in digital assets that contribute to Bitcoin’s long-term price stability.

Market outlook

Looking ahead, market participants are closely watching institutional movements and overall trading sentiment. With robust support from key players like Tether and Metaplanet, the foundations of Bitcoin appear to be solid. However, ongoing bear liquidation pressures and market volatility mean that short-term price movements may remain choppy.

For now, analysts have suggested that Bitcoin could further test the mid-term level of $80,000, but strong institutional support could help push it to a low $90,000 range in the coming weeks.