Bitcoin has fallen below the $85,000 level as sales pressures have been returned across the crypto market. After days of tough integration just under the $88,000 resistance zone, bearish momentum shows regaining control, lowering prices and indicating a termination of short-lived stability. The broader financial landscape remains tense, with the fears of a trade war and the growing uncertainty continuing to weigh on risky assets. And Bitcoin is no exception.

Driven by geopolitical tensions and vulnerable investor sentiment, global markets face increasing volatility. As traditional markets decline, the crypto space continues, showing signs of weakness amid macro headwinds. Today, many traders are seeing deeper corrections across the board.

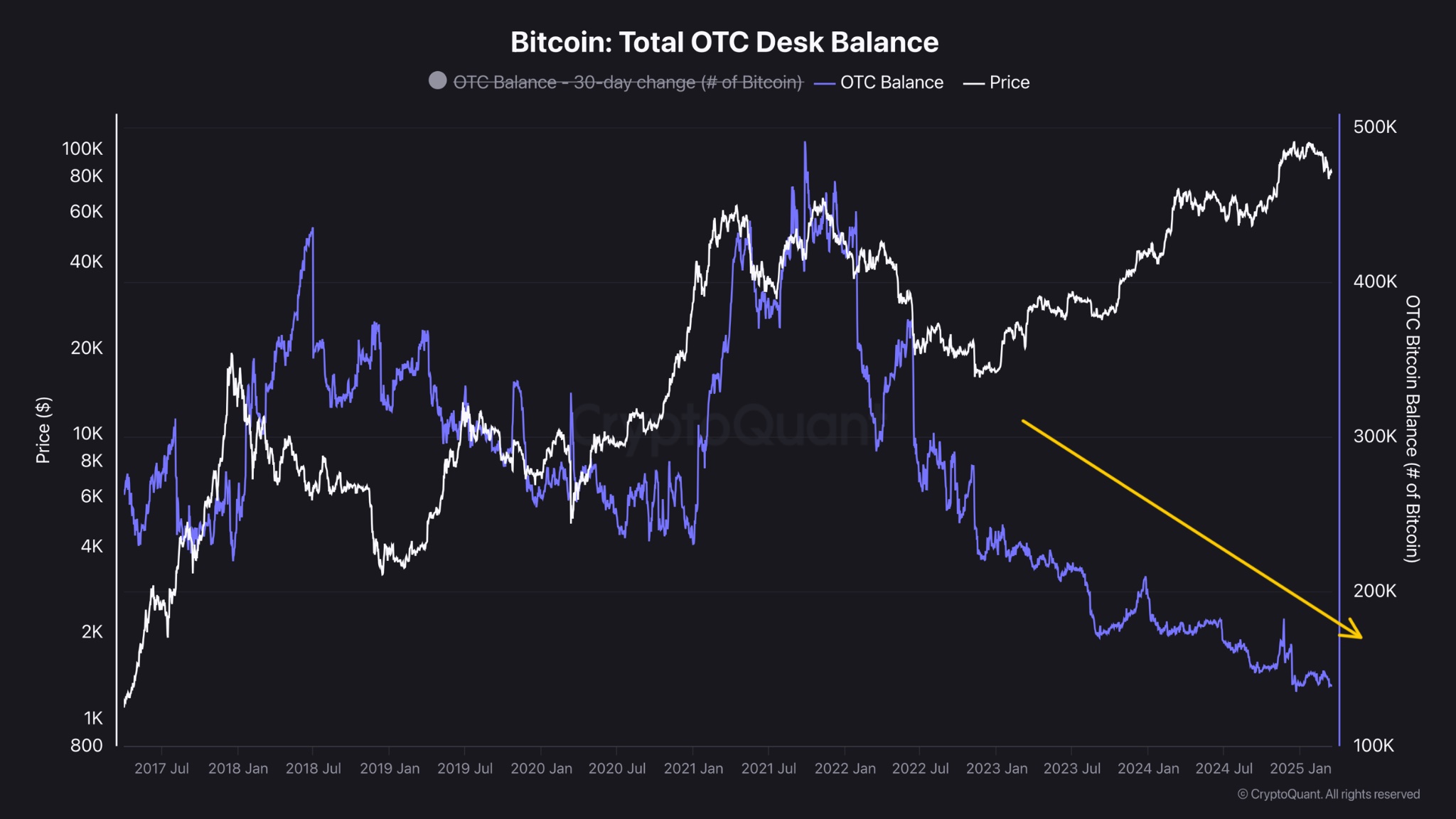

Despite the pullback, there may be a silver lining. According to fresh data from Cryptoquant, OTC (commercial) desks are ejecting at a fast pace. This trend often indicates an increase in institutional accumulation. This is because OTC transactions are usually used by large players to avoid slipping in exchanges. Short-term price action remains bearish, but a decline in OTC supply could be an early signal that it would be a subsurface long-term trust. For now, Bitcoin must find stability before the bull attempts a meaningful rebound.

Bitcoin holds $84,000 for analysts to discuss market direction

Bitcoin is at a critical point, and although the Bulls struggle to regain the $90,000 level, they managed to hold it firmly beyond the $84,000 support zone. This harsh range reflects the growing uncertainty in the market as price action stalls and emotions become more and more divided. Some analysts argue that bull markets are running its course, with momentum and macroeconomic pressures pointing to deeper revisions as indications. Others believe this is a healthy pause in a long-term uptrend, with a new all-time high still ahead.

Top analyst Quinten Francois weighs and points to key on-chain metrics that could support bullish cases. According to François, the total balance held by OTC desks has been steadily evaporating since January 2022. This continues until 2025.

A decrease in the balance of OTC desks usually indicates an increase in demand from large buyers, such as institutions and wealthy investors. These desks are used to promote large transactions outside the exchange to avoid slipping, so when the balance falls, it means that the major players are buying directly and moving their assets into cold storage or long-term holdings. This reduces circulating supply and serves as a build-up of quiet forms during periods of uncertainty.

While short-term price actions remain uncertain, the ongoing OTC desk outflow suggests that large investors are positioning for long-term profits. For now, all eyes are in the $84,000-$90,000 range. A breakdown below support can cause deeper losses, but breakouts beyond resistance can rekindle bullish momentum – especially when institutional profits continue to grow behind the scenes.

BTC is struggling to regain higher supply levels

Bitcoin is trading at $84,100 after losing its 200-day moving average (MA) and exponential moving average (EMA), both of which have reached around $85,500. This failure weakens the bullish structure, placing BTC in a vulnerable position, and momentum clearly supports the bear. The Bulls will need to hold above the $82,500 support level in future sessions for them to regain control.

Maintaining this level could demonstrate stability and pave the way for a rebound to the key resistance zone between $89,000 and $91,000. Reclaiming the area will be an important step in regaining bullish sentiment and potentially rekindling the wider uptrend.

However, if BTC cannot hold above $82,000, the market could see a sharp drop below $80,000. That psychological level of rest could confirm deeper corrections and further alter sentiment in favor of the bear.

A few days are important for Bitcoin’s short-term direction as volatility rises and macroeconomic uncertainty is shaking global markets. The Bulls need to act quickly to avoid further downsides and reestablish momentum beyond the $85,000 mark.

Dall-E special images, TradingView chart