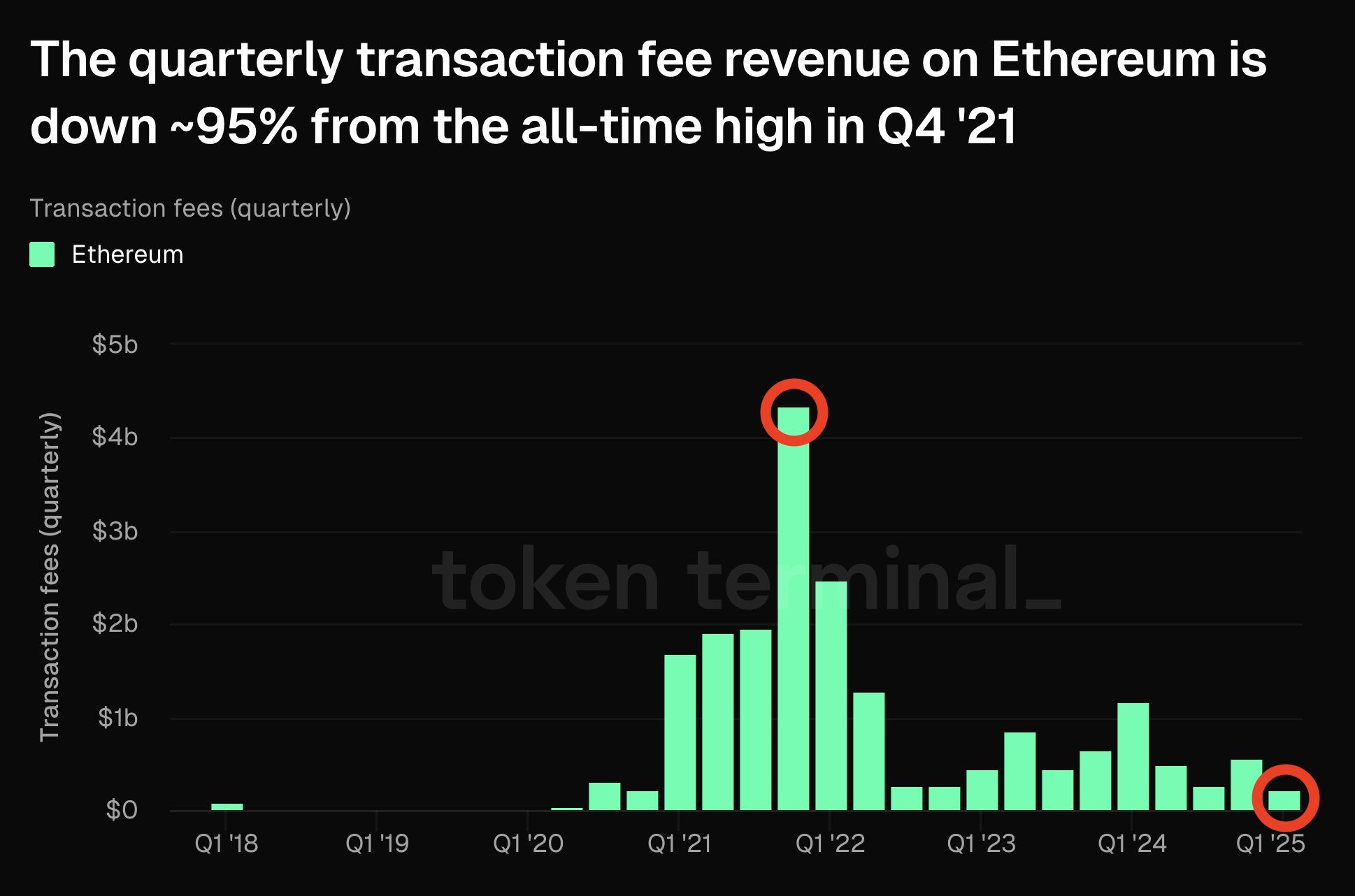

Ethereum (ETH), the world’s second largest blockchain, saw a dramatic decline in quarterly trading fee revenue, down about 95% from its all-time high in the fourth quarter of 2021.

This decrease could mainly be attributed to a decrease in layer 2 contribution, coupled with a significant drop in activity within the Impossible Token (NFT) market.

What is the decline in Ethereum’s transaction fee revenue?

The token devices highlighted this shift in the latest X (formerly Twitter) posts. Based on estimates, Ethereum’s transaction fee revenue for the first quarter 2025 is projected to reach approximately $217 million.

Ethereum transaction fee revenue. Source: X/Tokenterminal

This figure represents a dramatic 95% reduction from the all-time high of $4.3 billion recorded in the fourth quarter of 2021. At the time, Ethereum revenues increased by 1,777% year-on-year. By the last quarter of 2021, it had risen from $231.4 million in the fourth quarter of 2020 to $4.3 billion.

Additionally, Ethereum’s Defi Ecosystem saw significant growth in Total Value Lock (TVL), Distributed Exchange (DEX) Volumes, NFT Sales, and Layer 2 TVL. But since then, the dynamics have changed.

This is evident from Ethereum’s recent performance. In 2025, monthly revenues fell sharply, reaching $150.8 million in January and just $47.5 million in February. Assuming the trend of decline in transaction fees continues, we can see similarly low numbers for March.

Additionally, in the fourth quarter of 2024, Ethereum generated only $551.8 million in transaction fee revenue, highlighting the continued downward trend.

One of the main contributors to decline is the shift towards layer 2 solutions. These are becoming increasingly popular for their ability to process transactions in chains, while still settling in the mainnet of Ethereum.

Additionally, the activation of EIP-4844 significantly reduced the data costs for posting to the Ethereum chain, further reducing L2 fee contributions. According to a report from Coinshares, this upgrade has reduced transactions, but reduced the revenue collected by Ethereum mainnets from L2 activities.

“Layer 2-related fees, which were high between 2023 and early 2024, have been reduced due to the cost reductions introduced by EIP-4844,” the Coinshares report read.

Declining NFT activity also plays an important role. Q4 2021 marked the peak of the NFT trend, with platforms like Opensea hitting billions of dollars in monthly trading volumes. Nevertheless, interest has now faded, and the volume of transactions has dropped sharply, resulting in fee revenue.

ETH has suffered the worst quarterly decline since 2018

This decline exceeds transaction fee revenue. Ethereum prices continue on a similar downward trend. After arriving at ATH in November 2021, ETH has dropped significantly, and is currently trading at 58.8%, below that peak.

Even during the euphoria of the election, when many cryptocurrencies, including Bitcoin (BTC), saw new highs, Ethereum couldn’t keep up the pace.

“ETH experienced the sharpest decline in the first quarter, falling -40%, marking its biggest quarter loss since 2018,” analysts wrote about X.

Ethereum (ETH) price performance. Source: Beincrypto

Over the past month alone, ETH has declined by 25.1%. As of press time, Altcoin is trading at $1,997, representing a small profit in the past day.