Bitcoin (BTC) shows signs of a potential breakout, with recent price action showing positive momentum.

As the broader market conditions cool, BTC is stable, with consistent investor behavior driving further hopes for further profits. Altcoin has growth potential as it continues to attract investors’ attention.

Bitcoin has keychain support

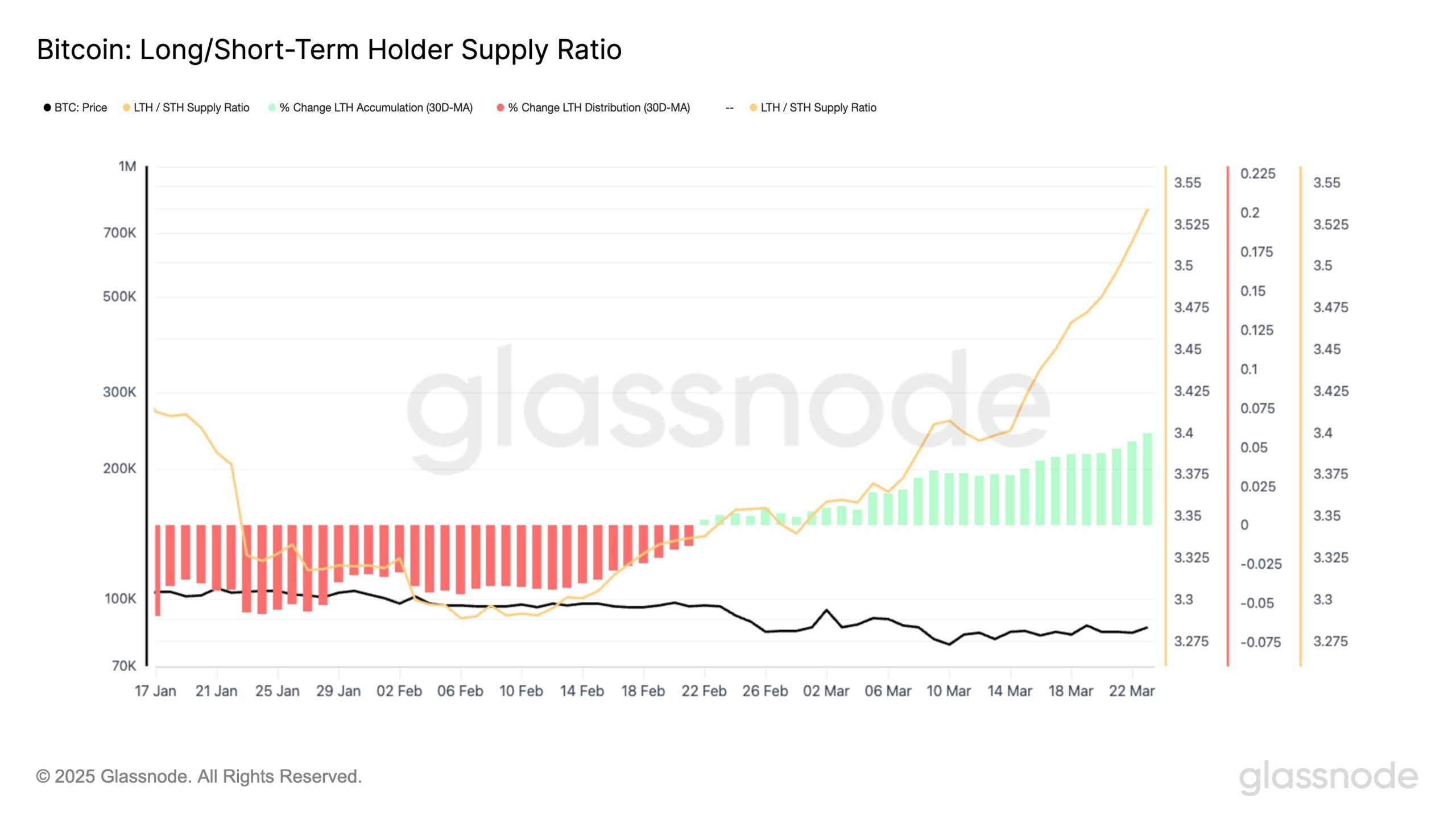

The long-term/short-term holder supply rate has shown significant growth since the end of February, indicating positive changes in investor behavior. Long-term holders (LTHS) are steadily accumulating, with the 30-day accumulation rate currently approaching 6%. The rate of this change has also increased, with an average daily rate of 7% since late February.

This sustained accumulation suggests that LTHS strongly believes in the future potential of Bitcoin, and could help BTC maintain recent growth. LTH is often seen as a stabilizing force in the market, and its consistent accumulation could serve as the basis for an ongoing upward trend in Bitcoin prices.

Bitcoin long/short term holder supply rate. Source: GlassNode

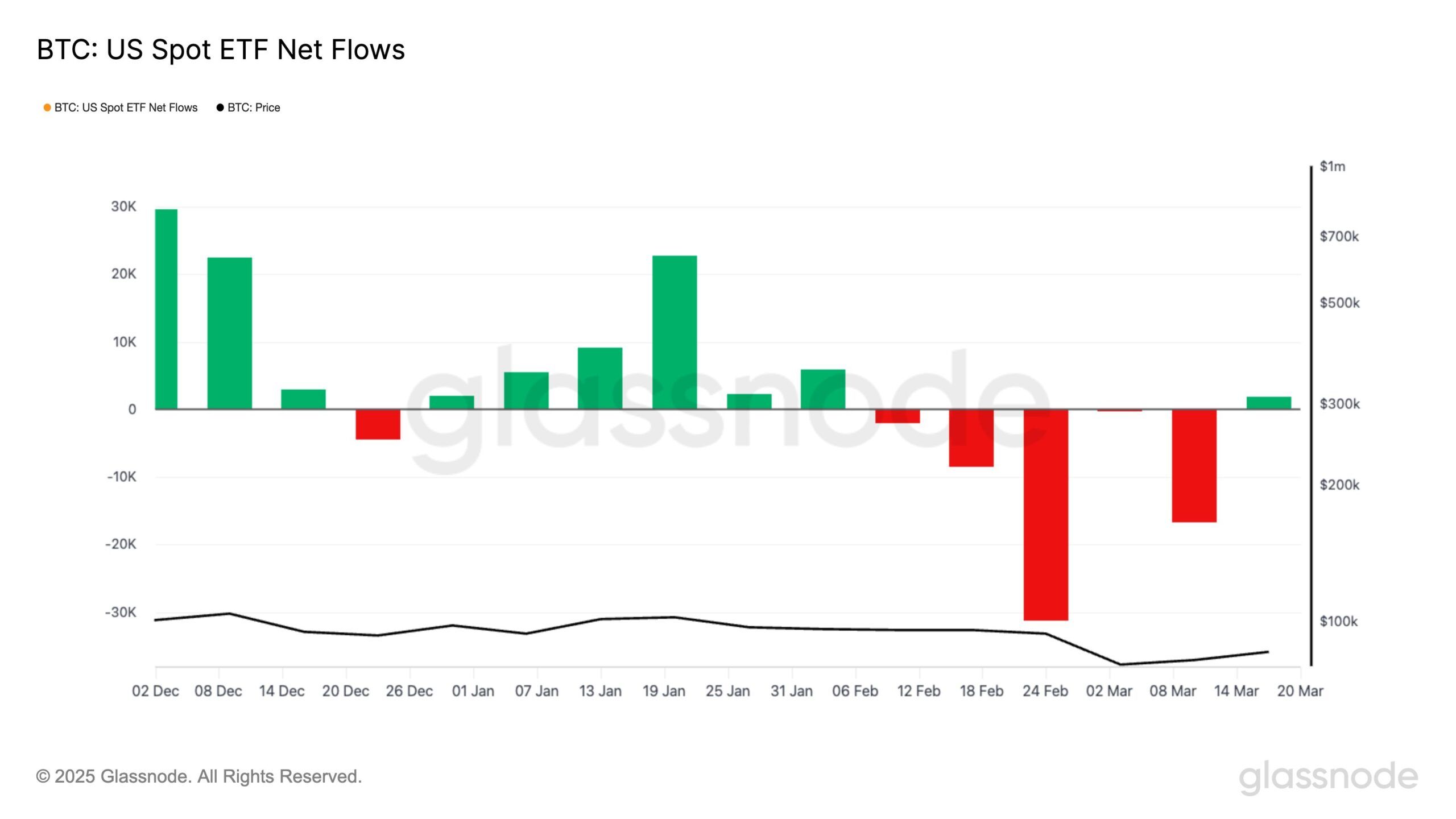

Bitcoin has also seen a positive change in macro momentum, particularly with the recent inflow into Bitcoin spot ETFs. Last week marked the first ETF inflow in a month, beating the four-week outflow. This change shows that trust is returned among investors, particularly macrofinal investors. The renewed interest in BTC ETFs reflects the growing demand for Bitcoin exposure in facility portfolios.

The influx shows that bigger investors once again view Bitcoin as a valuable asset. This is a strong signal that demand for Bitcoin is recovering and could help drive prices even further. Institutional investor involvement could drive a significant price rise in the coming weeks.

Bitcoin US Spot ETF Netflow. Source: GlassNode

BTC price rises consistently

Bitcoin is currently trading at $86,630, breaking out of a declining wedge pattern. The price is about to secure $86,822 in support. This is important for BTC’s next move. If support is retained, Bitcoin can continue its upward trajectory towards a $89,800 resistance level.

A breakout confirmation will be made when Bitcoin successfully flips to support $89,800 resistance. A sustained move beyond this level will push the price further to $93,625, potentially to $95,000.

Bitcoin price analysis. Source: TradingView

However, if Bitcoin does not violate $89,800, you may have a hard time maintaining your current momentum. A consolidation below this level or drop to $85,000 will slow the recovery and turn market sentiment into attention. This will halt progress and potentially lengthen the integration phase.