Ethereum (ETH) is struggling to maintain its upward momentum despite repeated attempts to recover. Recent price movements show a $1,936 Ethereum deal, hovering just above the key $1,862 support.

However, the lack of volatility and lower market interest could lead to further declines in prices, potentially reaching a 17-month low.

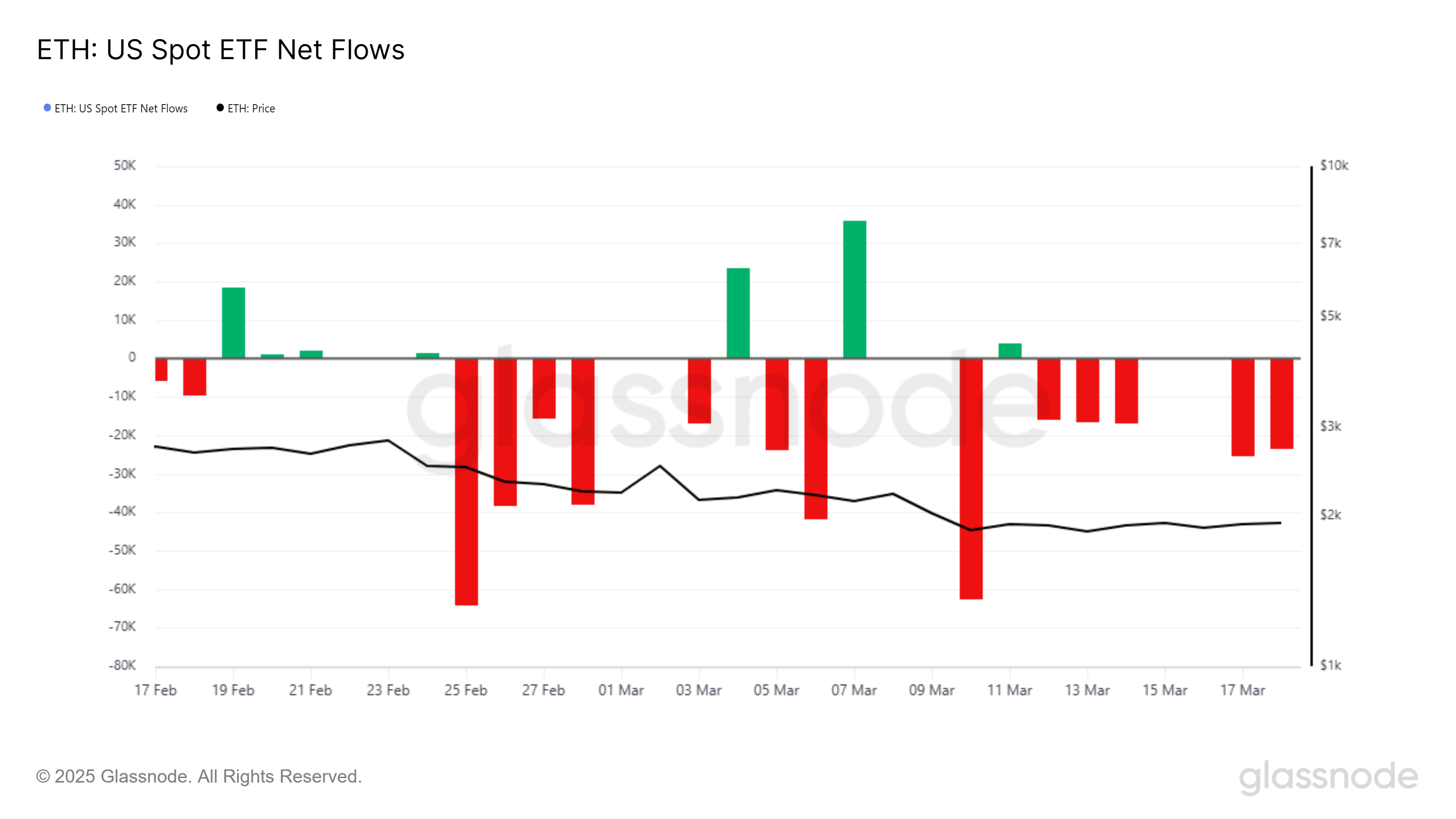

Ethereum ETF witnesses leaks

The Ethereum’s Spot ETF has experienced a major leak in the past month, highlighting a decline in interest in cryptocurrency. In the last 48 hours alone, nearly 49,000 ETHs have been withdrawn from the ETF, indicating that investors may be losing confidence in Ethereum’s short-term outlook.

The persistent outflow reflects wider market sentiment that is bearish towards Ethereum. There were several instances of influx, but they were far above the top by the outflow. As a result, market belief in Ethereum’s immediate recovery remains low.

Ethereum Spot ETF flow. Source: GlassNode

Technical metrics suggest that Ethereum prices may be due to further challenges. The Bollinger band is approaching the squeeze. This is a signal that volatility is imminent. Historically, when candlesticks appear above the baseline of a Bollinger band during such squeezes, prices tend to soak rather than surge. This raises concerns that if the pattern continues, Ethereum could experience a significant price drop.

Moreover, the inability to free Ethereum from its downward trend reflects a lack of momentum. Despite previous attempts to recover, technology metrics point to continued pressure on cryptocurrencies. If this pattern holds, Ethereum prices will be harder to maintain their current levels and will be further reduced.

Ethereum Bollinger Bands. Source: TradingView

ETH prices are retained

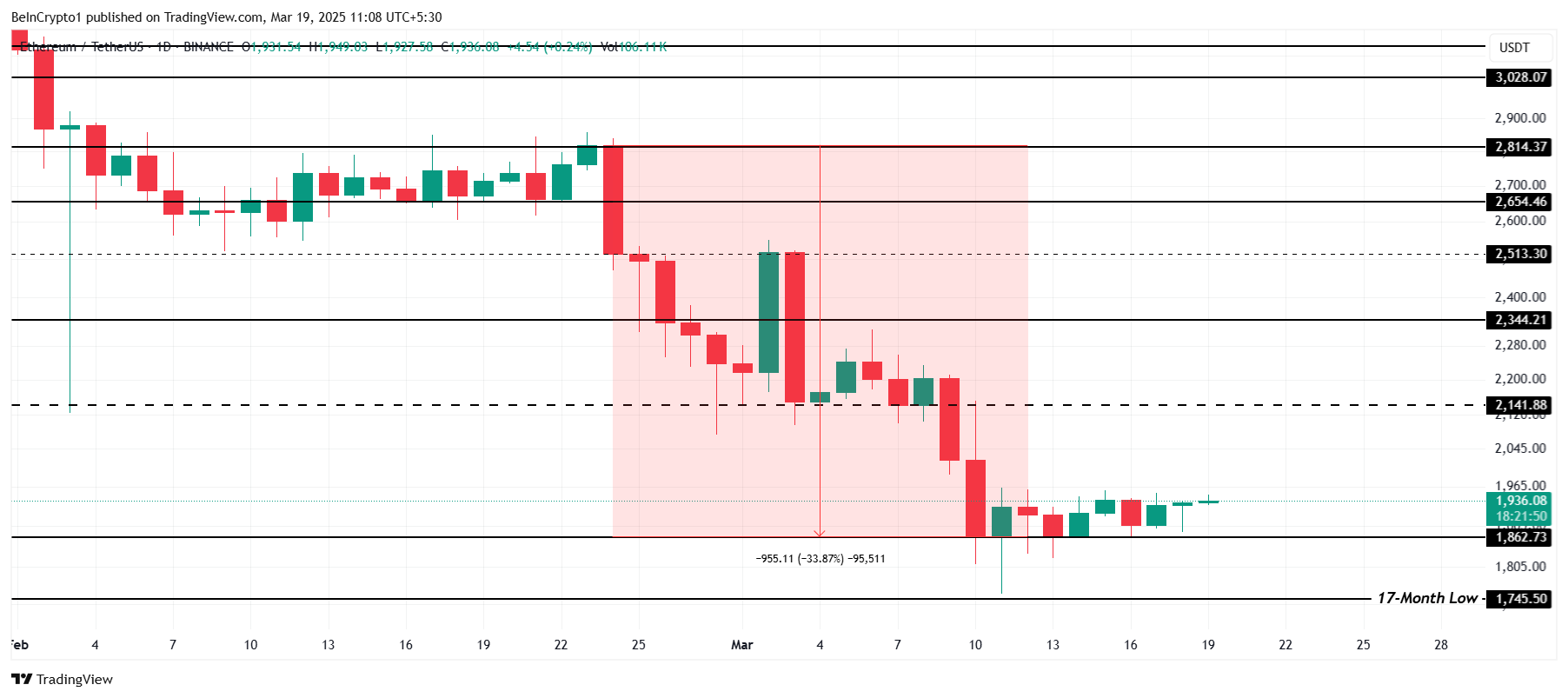

Ethereum has fallen 33% in the past month, with prices falling sharply from the end of February to early March. Currently trading at $1,936, Ethereum is above the $1,862 support level.

However, if the bearish trend continues, Ethereum could break through this support and drop to $1,745. Such a move is a 17-month low, which further tests the market’s confidence.

If Ethereum continues to face sales pressure, it could drop even further, possibly reducing the price to $1,500. The combination of weak ETF influx and bearish technical signals suggests that downward momentum is more likely than a rapid recovery.

Ethereum price analysis. Source: TradingView

However, if Ethereum is taking advantage of future Pectra upgrades, there is still a chance of recovery. If Upgrade Spark renews new interest from institutional investors and increases the inflow of ETFs, Ethereum prices will rise to $2,141, which will help recover some of the losses.