The University of Michigan Consumer Sentiment Index shows that U.S. consumer sentiment fell to 57.9 in March, exceeding six points from 64.7 in February.

Emotions fell to lowest levels in 28 months. This is the most sharp drop we have seen since November 2022. The pessimism among consumers is due to a surge in concerns about domestic stags, recessions and worsening due to Trump’s economic policies.

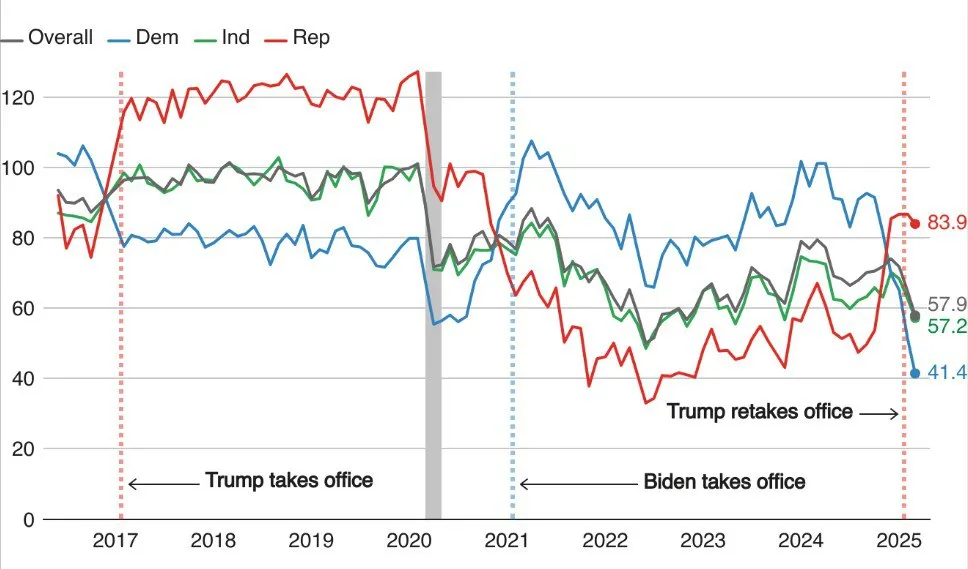

Source: University of Michigan Consumer Survey Consumer Sentiment across all political affiliations as of March 2025

Current consumer sentiment is declining sharply across all ages, genders, education, income, wealth, regional and political affiliations. A Joanne Huss survey of University of Michigan consumers found that consumer sentiment among Republican consumers has dropped to 83.9. Independent and Democrats’ consumer sentiment fell to 57.2 and 41.4 in March, respectively.

The survey shows that the current decline has been ongoing for the third consecutive month, with falls of 22% compared to December 2024. Compared to March 2024, when consumer sentiment was 79.4, the year-on-year decline was over 27%. Other metrics, such as consumer expectations, have also dropped significantly.

The consumer expectations index fell from 64.0 in February to 54.2 in March, showing a 15.3% decline a month ago. Consumer expectations also fell 30% year-on-year, down from 77.4 in March last year. Republican consumer expectations fell 10%, while independents and Democrats fell 12% and 24% respectively. Consumers expect that ongoing policies will affect a variety of economic aspects, including personal income, stock markets, inflation, employment, and business conditions.

Consumer inflation expectations increase while decreasing

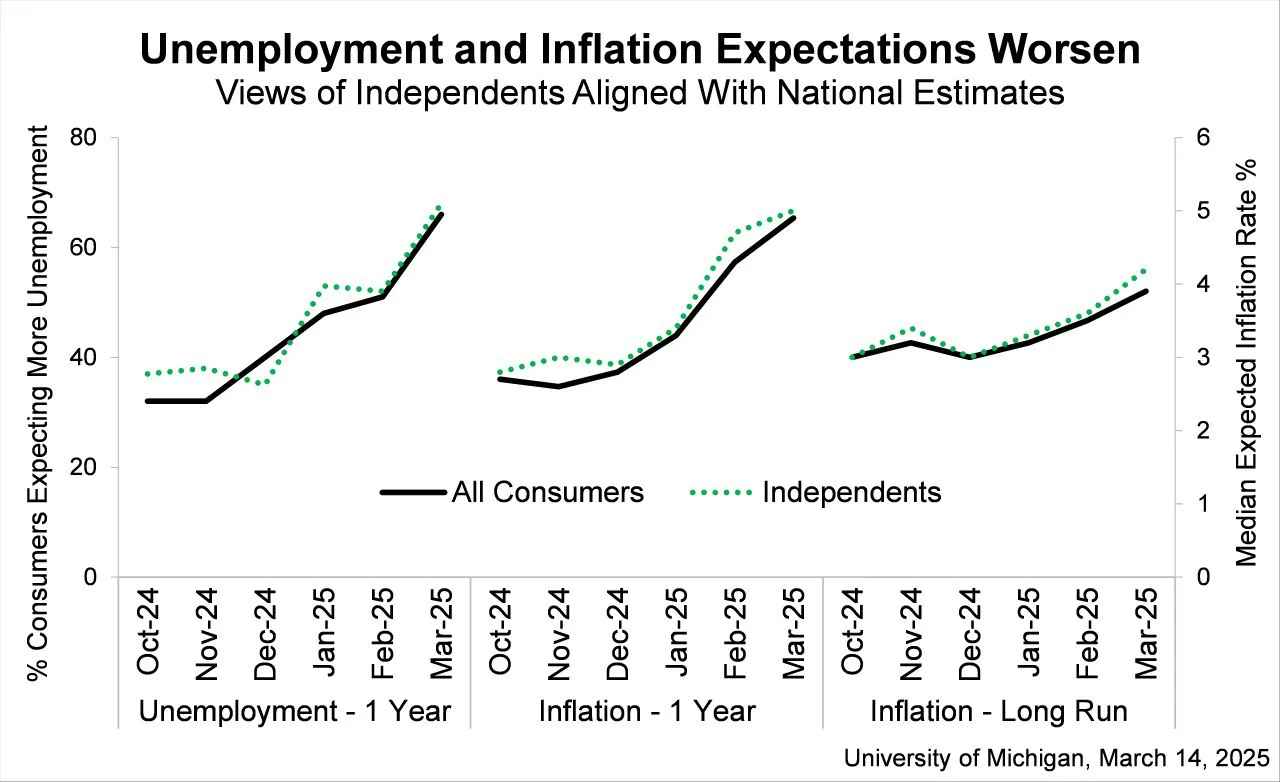

A consumer survey highlighted an increase in inflation expectations over the next year, jumping to 4.9% in March to 4.5% in February. The study outlined that this expectation was the highest read recorded since November 2022, marking a three-month consecutive rise in expectations.

Long-term consumer inflation expectations skyrocketed from 3.5% in February to 3.9% in March. This study confirmed that this value was recorded in the highest month recorded since 1993. All political alliances also expect unemployment to worsen in the coming months, with expectations rising from under 4% to nearly 5%.

Source: University of Michigan Survey on Consumer Inflation and Unemployment Expectations among Consumers in March 2025

US Treasury Secretary Scott Bescent also raised more concerns about the recession after a statement from NBC Meet the Press Sunday Show. Bescent said there is no guarantee that the recession will be avoided. Bescent explained that the government is making a complete reset to prevent future financial crisis, adding that market corrections are normal.

U.S. consumer spending fell 0.2% in January for the first time in almost two years. Monthly consumer spending It was dropped Most products include automobiles, recreational activities, food, drinks, clothing, footwear, and more. Expenses on services increased overall in January, including housing, utilities, financial services, insurance and accommodation. Expenses on products fell by $76.7 billion, but in January expenditures on services increased by $460 billion.

Consumer sentiment in other economies, including China, is on the rise, but the US economy continues to slow. Retail sales in China It’s increased It was about 4.0% in January and February compared to a year ago. Domestic production also surged during the first two months of the year, beating previous expectations.

Trump’s tariffs increase economic health uncertainty

Trump’s unstable tariff policies have sent a great deal of economic uncertainty through the roof and tanking markets. Now that there are fewer visions and apocalypse brands, please. @Reason via https://t.co/rab5iblp6x

– Nick Gillespie (@nickgillespie) March 13, 2025

President Trump’s tariffs continue to raise uncertainties about the US economic health, with the Economic Co-operation and Development Organization (OECD) commenting on the country’s economic slowdown. OECD Quarterly Report prediction Trump’s policies could plunge into the economic health of the United States. The report also pointed to a sharp decline in the US capital market to the revised zone over the past few weeks.

Trump’s tariffs are cited as one of the leading causes of negative health experienced across the US market. The president imposed import taxes on goods from Canada, Mexico, the EU and China, causing a world trade war. Trump also intends to impose a 25% import tax on global metal imports, which he believes should come into effect on April 2nd.

The OECD described tariffs as “a repetitive, non-taxable threat from Trump,” increasing the uncertainty that is induced across businesses around the world. The report argued that uncertainty has become cautious and cautious among businesses, and that investment in US small and medium-sized businesses, which contributes significantly to the health of the US economy, has expressed less optimism.

NFIB Small Business Optimism Index It’s fallen More companies cited worsening profit trends, sales expectations and concerns about economic growth, leading to 100.7 to over 2% in February. Only 12% of businesses are considered favorable time to expand their operations.