- Bitcoin’s price is aiming for $150,000, so it continues to expand its range before it potentially exceeds $108K.

- A price rise of up to $150,000 will likely raise more institutional funds to drive market growth.

- Bitcoin price transfer continues to determine its long-term growth outlook based on macroeconomic factors and barriers of resistance.

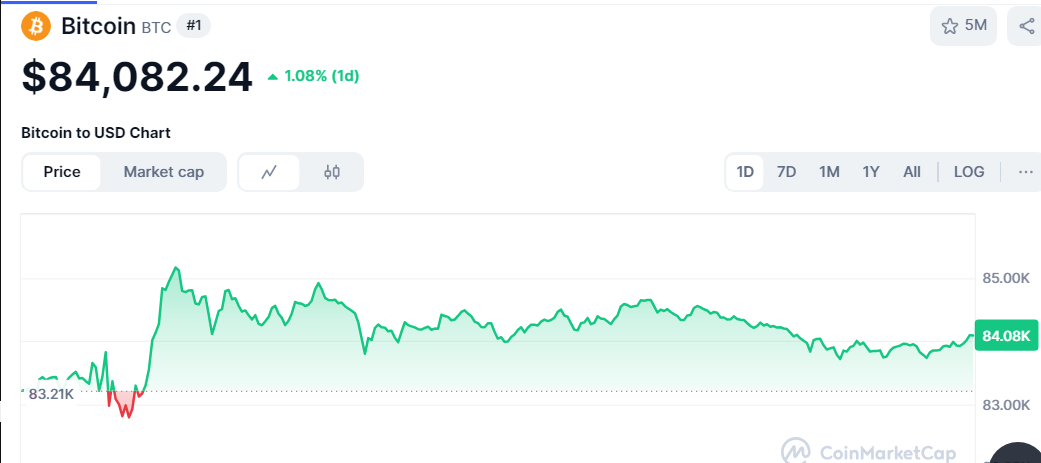

Bitcoin prices are integrated within the expanded wedge pattern, suggesting a potential breakout. Latest market data shows Bitcoin trading at $84,082.24, showing an increase of 1.08% over the last 24 hours. Over the same period, prices fluctuate between $82,705.87 and $85,139.55, with analysts looking closely at resistance and support levels and predicting the next move.

Source: CoinMarketCap

Bitcoin prices show repeated tests on the boundaries of support and resistance while trading boundaries are expanding. If Bitcoin crosses the key resistance zone at $108,000, chart analysis could result in a large price surge.

Market trends and key indicators

According to Cryptogoos, BTC could move over $150,000 due to the spreading wedge of Bitcoin. Recent price activity shows a downward trend that found support around $78,500 before the rebound. Bitcoin is forming a higher and lower value, indicating an increase in buyer confidence. If purchasing pressure continues, breakouts over $108,000 can lead to sustained gatherings.

Bitcoin is expanding! 🚨

The price target is $150,000🚀pic.twitter.com/1crvcyxntf

– Cryptogoos (@crypto_goos) March 15, 2025

However, if you don’t break this level, it could lead to price consolidation or setbacks. BTC’s current trading volume is $277.7 billion, down 4.9%. A surge in trading volume and an increase in bullish momentum could potentially validate the expected price movement.

Surge in institutions and market impact

A rise in Bitcoin to $150,000 will encourage additional institutional capital along with wider market acceptance. Strong price increases, along with Altcoins and Decentralized Financial (DEFI) projects, will affect the entire cryptocurrency market. The crypto industry may witness a significant increase in volatility and increase regulatory attention.

Short-term market corrections can occur if momentum is encountered as prices test support areas. Investors need to track macroeconomic indicators, including inflation, as well as global economic trends affecting monetary policy and the evolution of Bitcoin.

Bitcoin offers a price signal that indicates a potential breakout, as analysts predict the price will reach $150,000. By observing both market indicators and resistance levels, traders can predict important market movements in the future.