Bitcoin, the world’s largest cryptocurrency, is experiencing a downward wave today, trading at $82,400 at the time of writing, down about 4% over the past 24 hours.

A graph showing the movement of BTC prices during the day.

The volatility boost has marked the most significant turbulence since December, when Bitcoin prices skyrocketed due to speculation about Trump’s return to the White House and his custody stance. However, unlike the upward momentum in December last year, Bitcoin prices have been on a downward trend, falling by more than 15% over the past month.

The latest price fluctuations occur when Trump signs an executive order establishing a strategic crypto sanctuary. The order requires full accounting of US government digital asset holdings, including an estimated 200,000 BTC worth around $17 billion. The administration ensures that these assets will not be sold, with Trump’s crypto chief David Sachs likening the reserve to “Digital Fort Knox.”

In addition to the executive order, Trump has held a “crypto summit” with industry leaders, including Coinbase CEO Brian Armstrong and Kraken’s co-Theo Arjun Seti. Despite these moves that show an increase in institutional perception of Bitcoin, the market response is bearish, suggesting that investors have either awaited a backup announcement or have determined that details are inadequate. Trump first came up with the idea of a strategic Bitcoin Reserve last July.

Nick Ruck, director of LVRG Research, said investors are likely “disappointed” that the reserves will be funded by Bitcoin seized through criminal or civil assets, rather than government purchases.

The decline in Bitcoin and increased volatility coincided with broader market sales caused by new tariffs announced by the Trump administration.

In addition to the decline, there was a serious liquidation across the cryptocurrency market. Data shows that the cryptocurrency market has undergone a $423 million liquidation.

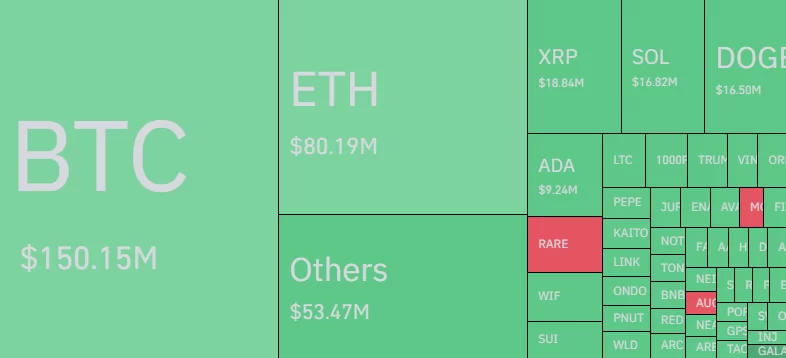

A graph showing the liquidation of cryptocurrency markets over the past 24 hours.

The biggest liquidation was seen in Bitcoin, Ethereum, XRP, Solana and Dogecoin.

*This is not investment advice.