Recent data shows that almost all of the Ethereum ever accumulated by public companies occurred within three months from July to September.

This comes as several crypto executives predict that the price of Ether (ETH) will rise by up to 200% by the end of the year.

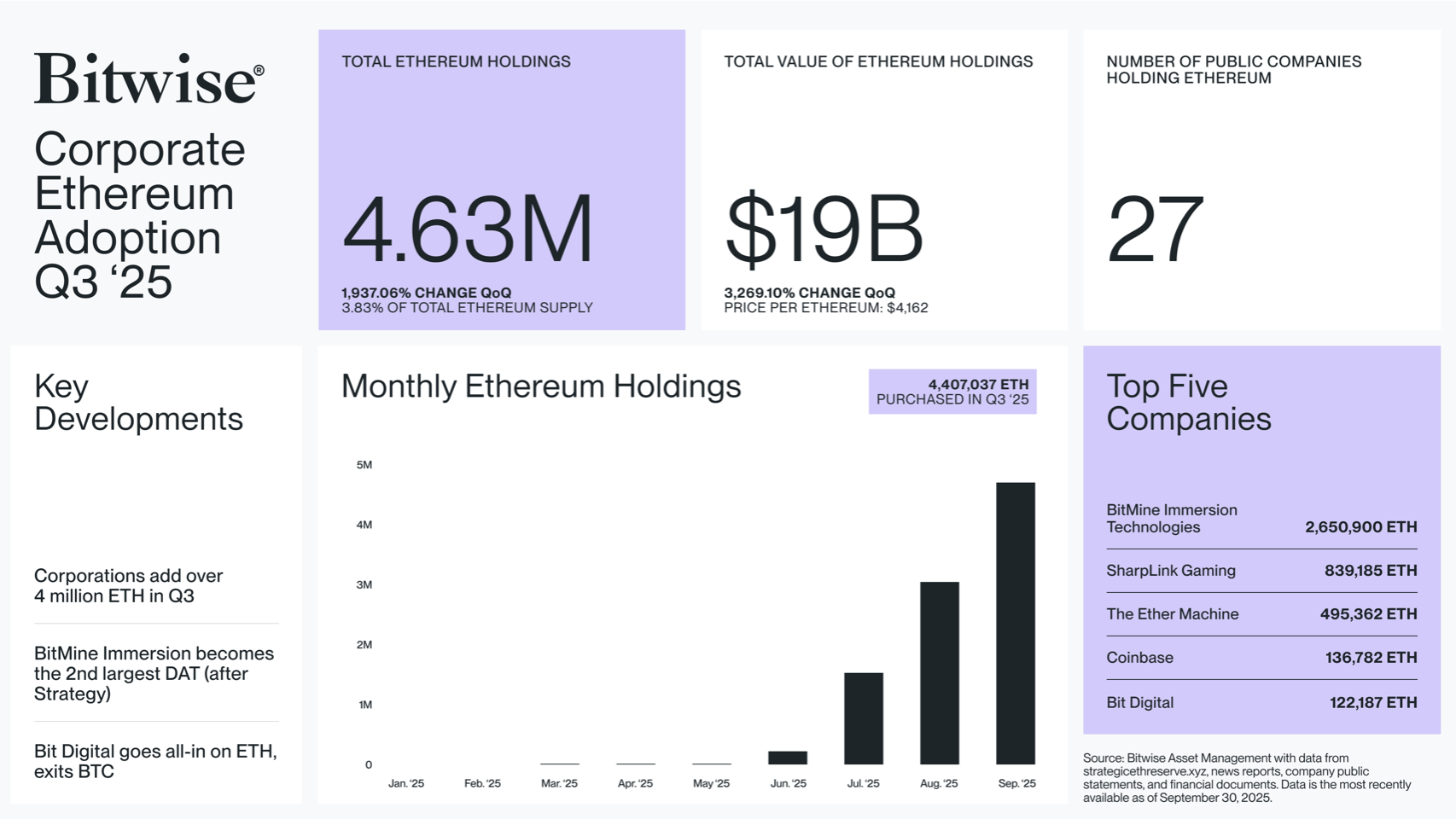

“95% of all ETH held by publicly traded companies was purchased in the past quarter alone,” Bitwise Investments said Wednesday of the $19.13 billion held in treasuries, representing about 4% of the total supply of ether.

Ether Public Treasury added over 4 million ETH tokens in the third quarter alone. sauce: bit by bit

According to Bitwise, of the 4.63 million ETH held on the listed company’s balance sheet as of September 30, approximately 4 million ETH was added in the third quarter.

Will Q4 be profitable for Ether?

The high concentration of ETH buying activity in Q3 has raised questions about what lies in store for Ether in Q4 2025, which is historically Ether’s second-worst performing quarter on average, according to CoinGlass.

Ether (ETH) was trading above $4,300 before Friday’s crypto market-wide selloff, which resulted in more than $19 billion in liquidations across the market. It then fell below the key $4,000 level and remained at $3,980, according to CoinMarketCap.

Ethereum has fallen by 11.65% in the past 30 days. sauce: coin market cap

But the new Treasury story has some analysts predicting a stronger-than-usual finish.

According to StrategicETHReserve, at the time of publication, BitMine Immersion Technologies holds the largest share with approximately 3.03 million ETH, followed by Sharplink Gaming with 840,120 ETH and The Ether Machine with 496,710 ETH.

BitMEX co-founder Arthur Hayes and BitMine chairman Tom Lee both predict ETH will reach $10,000 by the end of the year, with Lee suggesting it could rise to $12,000.

Ether is ‘the best choice for institutions,’ says Sharplink co-CEO

Sharplink Gaming co-CEO Joseph Chalom said on Wednesday that he is “bullish” on Ethereum because it is “the best choice for institutions.”

“It’s decentralized, it’s secure, and the network is continuously growing,” Chalom says.

Chalom told Cointelegraph Magazine that one of Sharplink Gaming’s top priorities is “to raise capital and accumulate as much ETH as possible.”

Analysts also point to catalysts beyond corporate finances, such as steady inflows into U.S. Spot Ether ETFs and a large portion of ETH remaining locked up in staking contracts.

“40% of the total supply is out of circulation. This is the preparation for the Ethereum supercycle,” Marlin the Trader said in an X post on Wednesday.

On Wednesday, MN Trading Capital founder Michael Van de Poppe said, “ETH vs. BTC dollar is just getting started.”

“Just like in 2019, the first upswing has happened,” Van de Poppe said, explaining that there are many more upswings to come and there is no need to understand that they are possible.

“But certainly, it will come,” van de Poppe added.